Answered step by step

Verified Expert Solution

Question

1 Approved Answer

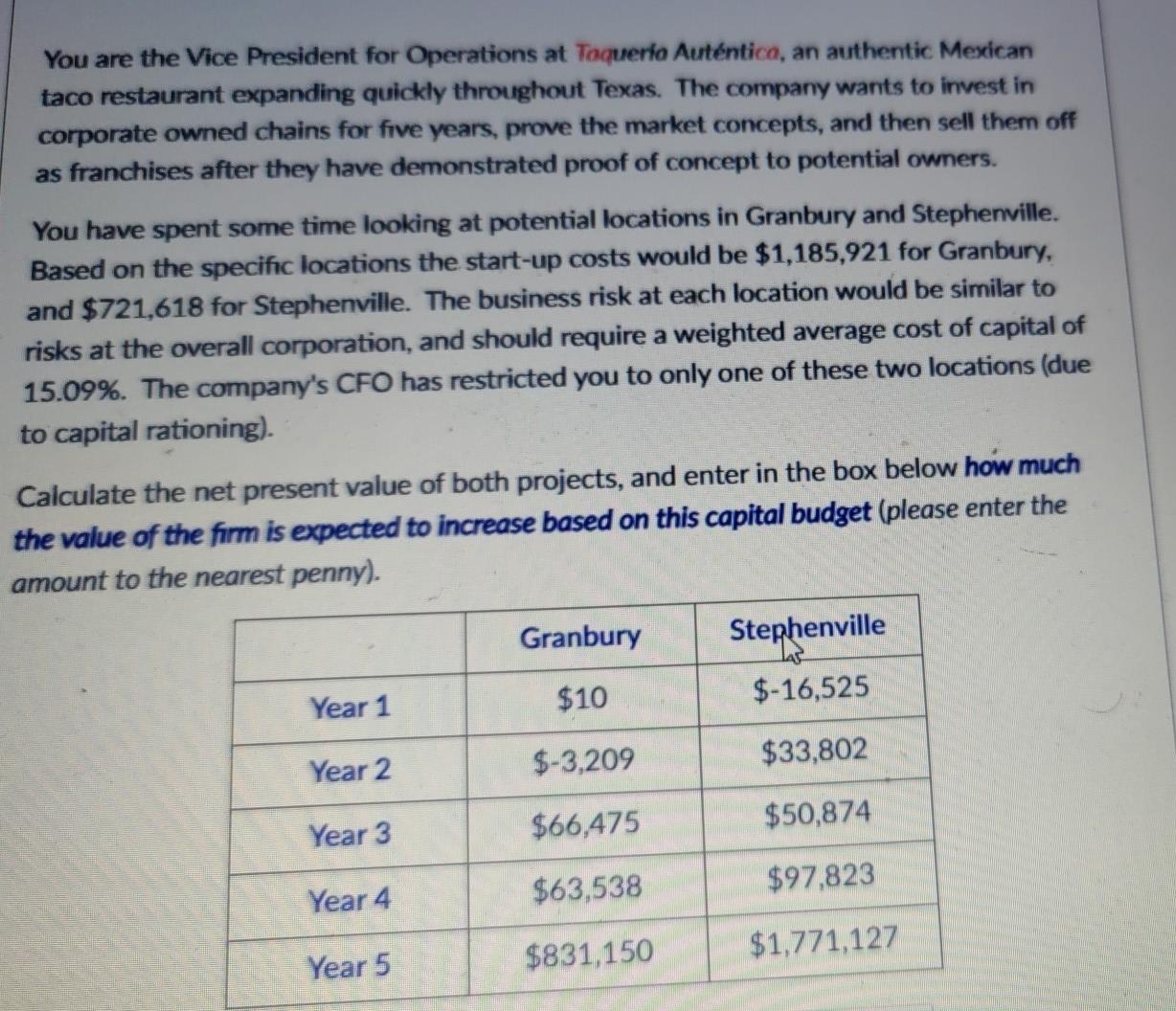

You are the Vice President for Operations at Toqueria Autntica, an authentic Mexican taco restaurant expanding quickly throughout Texas. The company wants to invest in

You are the Vice President for Operations at Toqueria Autntica, an authentic Mexican taco restaurant expanding quickly throughout Texas. The company wants to invest in corporate owned chains for five years, prove the market concepts, and then sell them off as franchises after they have demonstrated proof of concept to potential owners. You have spent some time looking at potential locations in Granbury and Stephenville. Based on the specific locations the start-up costs would be $1,185,921 for Granbury, and $721,618 for Stephenville. The business risk at each location would be similar to risks at the overall corporation, and should require a weighted average cost of capital of 15.09%. The company's CFO has restricted you to only one of these two locations (due to capital rationing). Calculate the net present value of both projects, and enter in the box below how much the value of the firm is expected to increase based on this capital budget (please enter the amount to the nearest penny). Granbury Stephenville $10 $-16,525 Year 1 $-3,209 $33,802 Year 2 Year 3 $50,874 $66,475 Year 4 $63,538 $97,823 $831,150 $1,771,127 Year 5

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started