Answered step by step

Verified Expert Solution

Question

1 Approved Answer

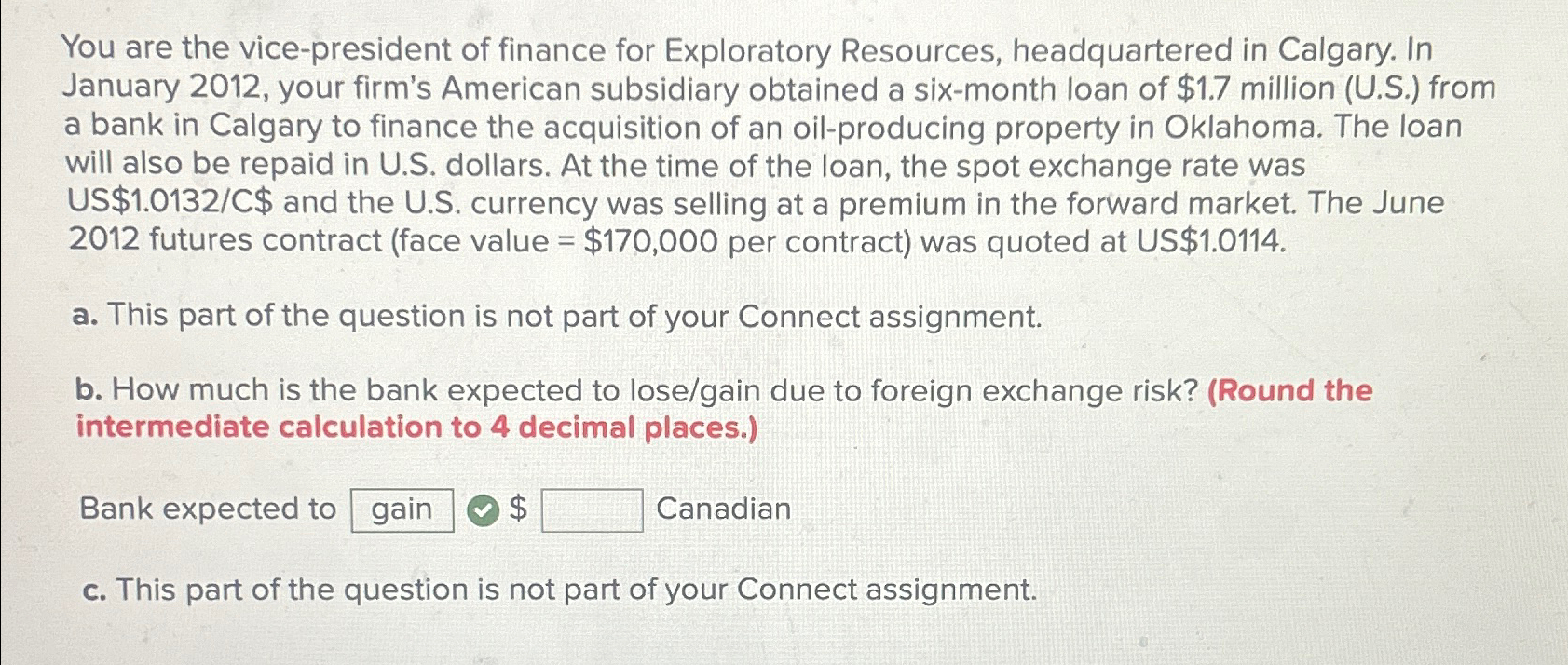

You are the vice - president of finance for Exploratory Resources, headquartered in Calgary. In January 2 0 1 2 , your firm's American subsidiary

You are the vicepresident of finance for Exploratory Resources, headquartered in Calgary. In January your firm's American subsidiary obtained a sixmonth loan of $ million US from a bank in Calgary to finance the acquisition of an oilproducing property in Oklahoma. The loan will also be repaid in US dollars. At the time of the loan, the spot exchange rate was US $$ and the US currency was selling at a premium in the forward market. The June futures contract face value $ per contract was quoted at US $

a This part of the question is not part of your Connect assignment.

b How much is the bank expected to losegain due to foreign exchange risk? Round the intermediate calculation to decimal places.

Bank expected to

$

Canadian

c This part of the question is not part of your Connect assignment.N

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started