Answered step by step

Verified Expert Solution

Question

1 Approved Answer

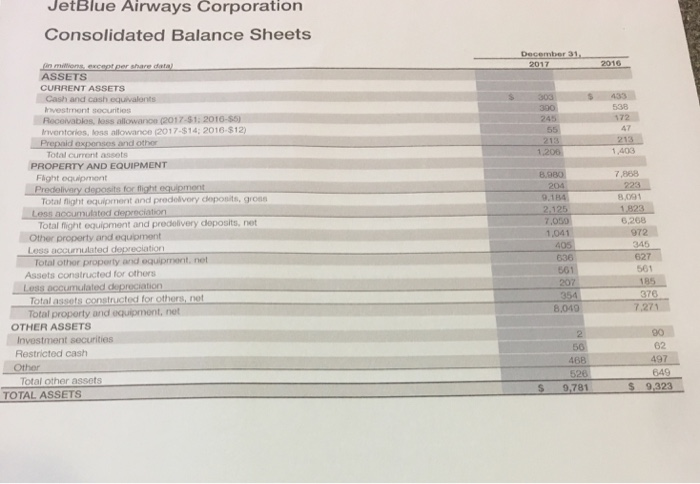

You are to do a full Horizontal Analysis (on the Balance Sheet and on the Income Statement) for the years presented using the oldest year

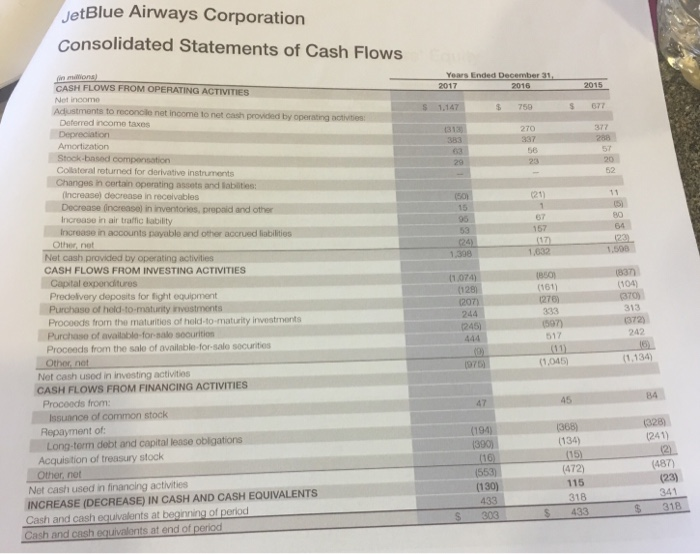

You are to do a full Horizontal Analysis (on the Balance Sheet and on the Income Statement) for the years presented using the oldest year as your base year and rolling forward that base year to most recent year. In other words, for the Balance Sheet which contains 2 years of data, you compare the oldest year to the most recent year. Easy. But for the Income Statement, there should be 3 years

disregard the horizontal analysis.

NOTE: You are not to comment AT ALL on ANY of the details within the Cash Flow from Operating Activities section. Id like you to include a comment on the grand total Cash Flow from Operating Activities as one of your 7-10 comments (that would be appreciated) but No Remarks At All on the details within that section.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started