Answered step by step

Verified Expert Solution

Question

1 Approved Answer

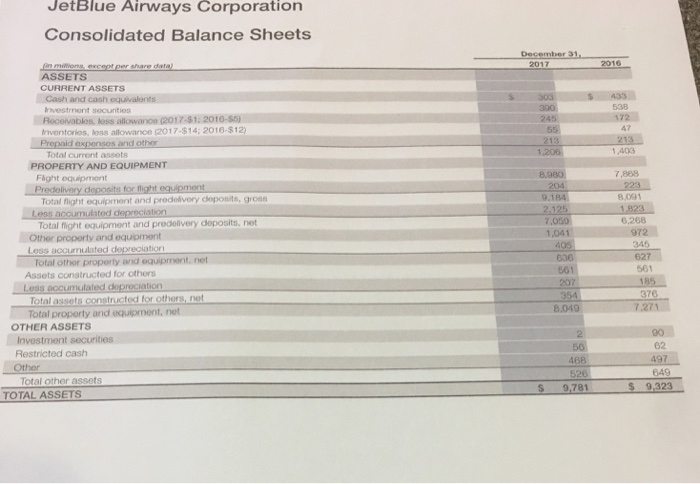

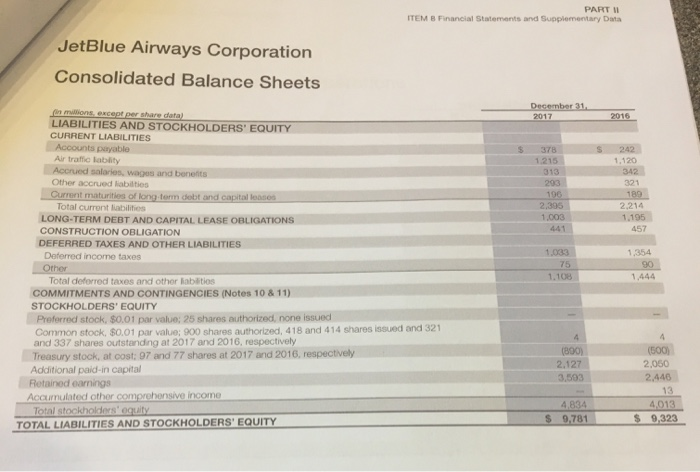

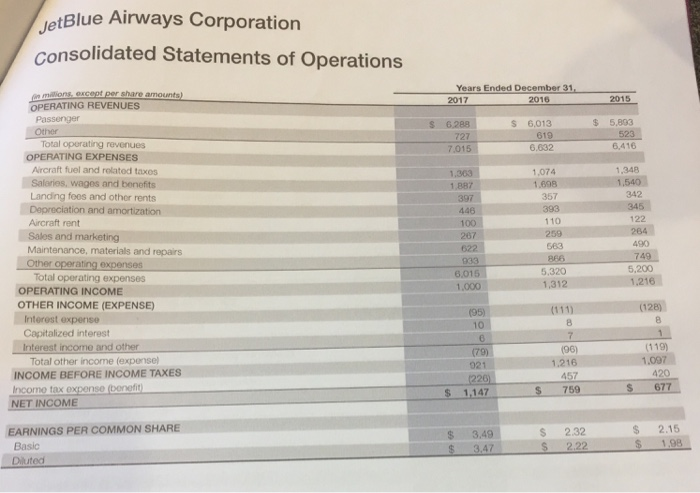

You are to do a Vertical Analysis (on both the Balance Sheet and Income Statement) for EACH of the years presented. You must show your

You are to do a Vertical Analysis (on both the Balance Sheet and Income Statement) for EACH of the years presented. You must show your result as a % (not a decimal number) and round your % results to exactly 2 decimal places (ex: 2.07% ~ not 2% ~ not 2.0734566%).

For these analyses, you are to present the actual tables of your Vertical Analysis. Each of these analyses MUST SHOW: statement titles, the name of every single individual account as shown on the original financial statement, the exact balances as shown on the original financial statements and then the columns for your vertical calculations.

Provide some comments on the results of these studies that may be relevant to your overall recommendation.

the company is Jet Blue

JetBlue Airways Corporation Consolidated Balance Sheets ASSETS CURRENT ASSETs Cash and cash Investment socuritios 538 Recevablos loss allowanoe (2017-$1:2016-s5) 245 47 Inventories, less allowance (2017-$14; 2016-$12) Prepaid exponses and othor 1403 7,868 8.091 Total current assets PROPERTY AND EQUIPMENT 8.980 Flight equipmont 204 .184 Total hight equipment and predolivory dleponits, grons Less accumulated depreciation Total flight equipment and predelivery deposits, net Other property and equipment Less accumulated depreciation ,050 1,041 6,268 972 345 627 Total othor property and equipmont, net Assets conatructed for others Less accumulated depreciation 636 561 561 376 Total assets constructed for others, net 8,049 7.271 Total property and equipmont, net OTHER ASSETS Investment securities Restricted cash Other 62 56 468 526 S 9,781 649 Total other assets TOTAL ASSETS PART I ITEM B Financial Statements and Supplementary Data JetBlue Airways Corporation Consolidated Balance Sheets December 31 n miovns, except per share datal LIABILITIES AND STOCKHOLDERS' EQUITY CURRENT LIABILITIES ts payable 378 Air traffic lablity Accrued salaries, wages and benelits Other accrued iabilties 215 1.120 313 293 321 Current maturities of long terdebt and capital los Total current liabilities LONG-TERM DEBT AND CAPITAL LEASE OBLIGATIONS CONSTRUCTION OBLIGATION 2,395 1,003 2,214 1,195 457 441 DEFERRED TAXES AND OTHER LIABILITIES 033 75 Deferred income taxes 1,354 Other 1.108 1,444 Total deferred taxes and other labilitios COMMITMENTS AND CONTINGENCIES (Notes 10&11) STOCKHOLDERS' EQUITY Preferred stock, $0.01 par value: 25 shares authorized none issued Common stock, $0.01 par value; 900 shares authorized, 418 and 414 shares issued and 321 and 337 shares outstanding at 2017 and 2016, respectively Treasury stock, at cost: 97 and 77 shares at 2017 and 2016, respectively Additional paid-in capital Retained earnings Accumulated other comprehensive income (800) 2.127 3,503 (500) 2,050 2.446 4,834 9,781 stockholders S 9.323 TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY JetBlue Airways Corporation onsolidated Statements of Operations a milions.except per share amounts Years Ended December 31 2017 OPERATING REVENUES Passenger Other $ 5,893 S 6,013 619 6.632 6.288 Total oporating revenues .015 6,416 OPERATING EXPENSES ircraft fuel and relatod taxes Saleries, wages and benofits Landing fees and other rents Depreciation and Aircraft rent Sales and marketing Maintenance, materials and repairs Other operating expenses 1,348 1.540 342 345 1,074 1,887 397 1.698 357 393 122 259 583 267 490 5,200 1.216 5,320 Total operating expenses OPERATING INCOME OTHER INCOME (EXPENSE 1,000 (128) (95) 10 nterest expense Capitalized interest terest income and other (119) (96) 457 $ 759 Total other income (expensel INCOME BEFORE INCOME TAXES 021 420 677 S 1,147 S NET INCOME $ 3,492.32 S 2.22 $ 2.15 1,98 EARNINGS PER COMMON SHARE Basic Diuted Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started