Question

You are trying to decide how to hedge euro 5,000,000 accounts payable due in one year. Current interest rates and exchange rates are: Spot rate:

You are trying to decide how to hedge euro 5,000,000 accounts payable due in one year. Current interest rates and exchange rates are:

Spot rate: $1.21/ euro

1-year forward rate: $1.18/ euro

1-year interest rates:

interest rate: 2.20% per annum

$ interest rate: 2.00% per annum

Call option: $1.20 strike, premium $0.025/

Put option: $1.20 strike, premium $0.0125/

Note: Please answer the short questions in addition to completing the table.

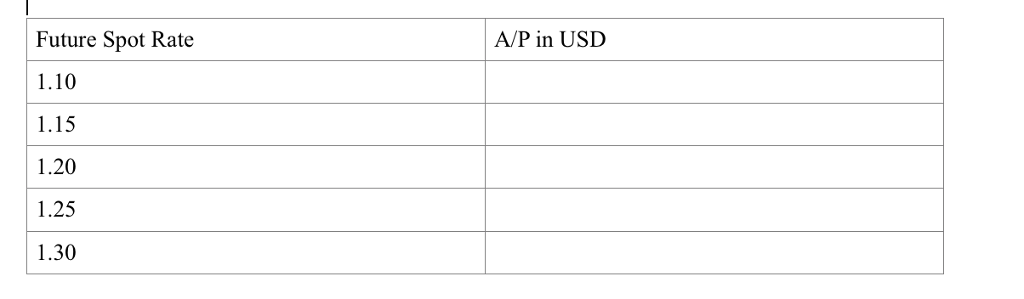

If you are unhedged, what is your A/P payment in USD given different future spot rates? Complete the table below. In general, what is the accounts payable in dollars if unhedged.

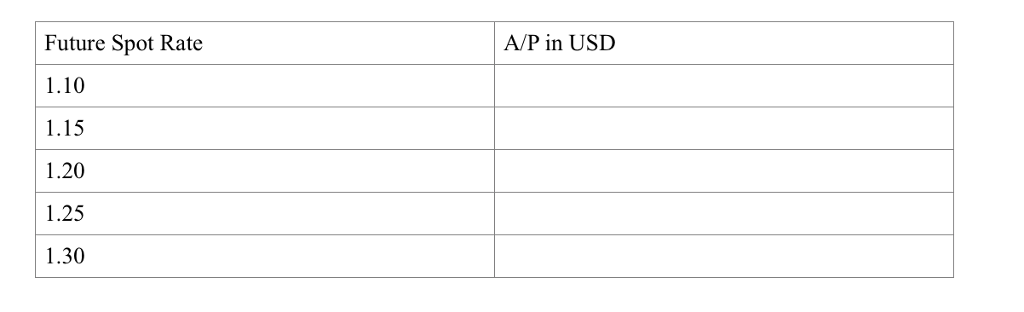

How to hedge in the forward market? If you use forward to hedge, what is your A/P payment in USD given different future spot rates? Complete the table below. In general, what is the value of the payable in one year if you use a forward hedge?

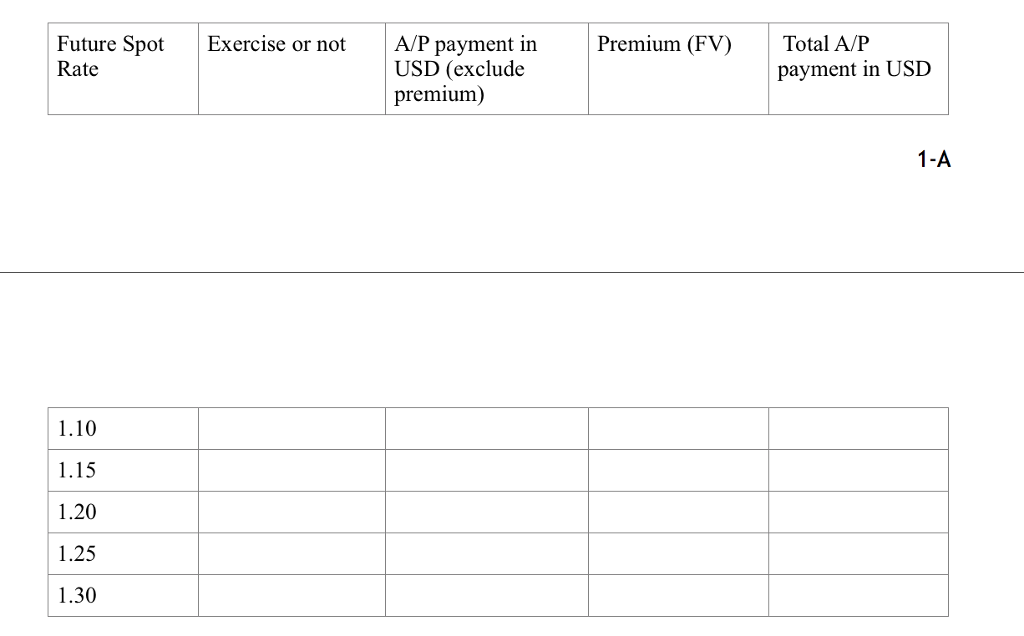

How to hedge in the option market? If you use option to hedge, what is your A/P payment in USD given different future spot rates? Complete the table below.

What is the maximum payment in USD?

How to hedge in the money market? Calculate the value of the payable if you use a money market hedge?

Draw the graph for all four strategies.

Calculate the breakeven exchange rate (against the forward) for the appropriate option contract.

If you believe the spot rate in one year will actually be $1.17/euro which strategy would you recommend?

If you believe the spot rate in one year will actually be $1.14/euro which strategy would you recommend?

Future Spot Rate 1.10 1.15 1.20 1.25 1.30 A/P in USDStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started