Question

You are trying to estimate a price per share on an initial public offering of a company involved in environmental waste disposal. The company has

You are trying to estimate a price per share on an initial public offering of a company involved in environmental waste disposal.

The company has a book value per share of $20 and earned $3.50 per share in the most recent time period.

While it does not pay dividends, the capital expenditures per share were $2.50 higher than depreciation per share in the most recent period, and the firm uses no debt financing.

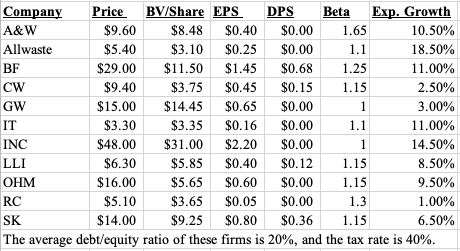

Analysts project that earnings for the company will grow 25% a year for the next five years. You have data on other companies in the environment waste disposal business:

a. Estimate the average price/book value ratio for these comparable firms. Would you use this average P/BV ratio to price the initial public offering?

b. What subjective adjustments would you make to the price/book value ratio for this firm& why?

On all three counts, a higher price/book value ratio should be used for this company.

(PLEASE EXPLAIN EVERY STEP IN DETAIL ON HOW TO SOLVE, THANK YOU IN ADVANCE)

1.1 Company Price BV/Share EPS DPS Beta Exp. Growth A&W $9.60 $8.48 $0.40 $0.00 1.65 10.50% Allwaste $5.40 $3.10 $0.25 $0.00 18.50% BF $29.00 $11.50 $1.45 $0.68 1.25 11.00% CW $9.40 $3.75 $0.45 $0.15 1.15 2.50% GW $15.00 $14.45 $0.65 $0.00 3.00% IT $3.30 $3.35 $0.16 $0.00 1.1 11.00% INC $48.00 $31.00 $2.20 $0.00 14.50% LLI $6.30 $5.85 $0.40 $0.12 1.15 8.50% OHM $16.00 $5.65 $0.60 $0.00 1.15 9.50% $5.10 $3.65 $0.05 $0.00 1.3 1.00% $14.00 $9.25 $0.80 $0.36 1.15 6.50% The average debt/equity ratio of these firms is 20%, and the tax rate is 40%. RC SK 1.1 Company Price BV/Share EPS DPS Beta Exp. Growth A&W $9.60 $8.48 $0.40 $0.00 1.65 10.50% Allwaste $5.40 $3.10 $0.25 $0.00 18.50% BF $29.00 $11.50 $1.45 $0.68 1.25 11.00% CW $9.40 $3.75 $0.45 $0.15 1.15 2.50% GW $15.00 $14.45 $0.65 $0.00 3.00% IT $3.30 $3.35 $0.16 $0.00 1.1 11.00% INC $48.00 $31.00 $2.20 $0.00 14.50% LLI $6.30 $5.85 $0.40 $0.12 1.15 8.50% OHM $16.00 $5.65 $0.60 $0.00 1.15 9.50% $5.10 $3.65 $0.05 $0.00 1.3 1.00% $14.00 $9.25 $0.80 $0.36 1.15 6.50% The average debt/equity ratio of these firms is 20%, and the tax rate is 40%. RC SKStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started