Question

You are trying to estimate the equity beta of a private firm that manufactures musical instruments by using a sample of comparable firms. You have

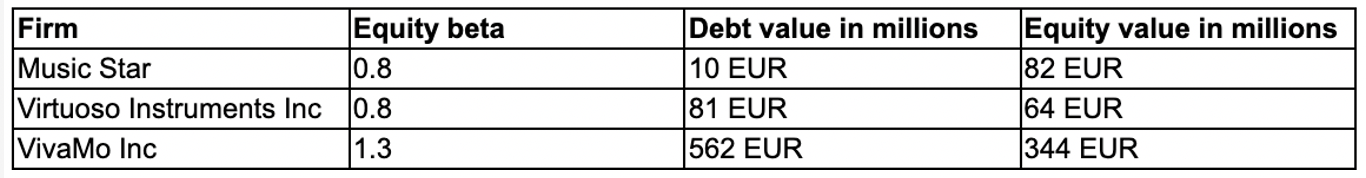

You are trying to estimate the equity beta of a private firm that manufactures musical instruments by using a sample of comparable firms. You have managed to obtain equity betas, debt values, and equity values for publicly traded firms that also manufacture musical instruments:

The private firm has a debt-to-equity ratio of 123%. The private firm and the publicly traded firms are not subject to corporate tax because they benefit from a special tax break for musical instrument manufacturers. You can assume that the debt betas of the private firm and all the comparable firms are zero. The equity beta of the private firm is:

Answer: 1.1594 0.001

Can someone explain the process to get the answer?

Firm Equity beta Music Star 0.8 Virtuoso Instruments Inc 0.8 VivaMo Inc 1.3 Debt value in millions 10 EUR 81 EUR 562 EUR Equity value in millions 82 EUR 64 EUR 344 EURStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started