Question

You are trying to estimate the share price for MidStream Inc. You have forecasted the following information about earnings and payouts to shareholders for the

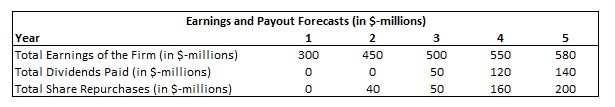

You are trying to estimate the share price for MidStream Inc. You have forecasted the following information about earnings and payouts to shareholders for the next five years (see table below). In addition, you know that after year 5 the company will maintain a constant payout rate of 60% in perpetuity. The companys equity cost of capital ( ) is 12%, its return on new investment is 13%, and it currently has 100 million shares outstanding. Based on the information provided, what is a good estimate for the firm's share price?

Select the best one.

A. 110.85

B. 3,459

C. 14.20

D. 34.59

E. $67.53

\begin{tabular}{|lccccc|} \hline \multicolumn{7}{|c|}{ Earnings and Payout Forecasts (in \$-millions) } \\ Year & 1 & 2 & 3 & 4 & 5 \\ \hline Total Earnings of the Firm (in \$-millions) & 300 & 450 & 500 & 550 & 580 \\ Total Dividends Paid (in S-millions) & 0 & 0 & 50 & 120 & 140 \\ Total Share Repurchases (in \$-millions) & 0 & 40 & 50 & 160 & 200 \\ \hline \end{tabular} \begin{tabular}{|lccccc|} \hline \multicolumn{7}{|c|}{ Earnings and Payout Forecasts (in \$-millions) } \\ Year & 1 & 2 & 3 & 4 & 5 \\ \hline Total Earnings of the Firm (in \$-millions) & 300 & 450 & 500 & 550 & 580 \\ Total Dividends Paid (in S-millions) & 0 & 0 & 50 & 120 & 140 \\ Total Share Repurchases (in \$-millions) & 0 & 40 & 50 & 160 & 200 \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started