Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are trying to value Brisk Transport Inc., and have collected the following information: - Brisk Transport has earnings per share currently of $2.50

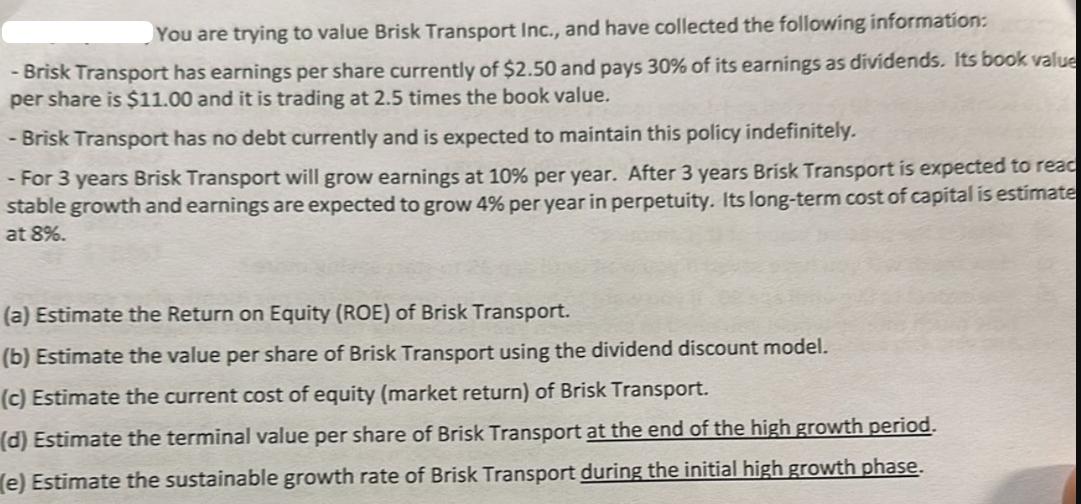

You are trying to value Brisk Transport Inc., and have collected the following information: - Brisk Transport has earnings per share currently of $2.50 and pays 30% of its earnings as dividends. Its book value per share is $11.00 and it is trading at 2.5 times the book value. - Brisk Transport has no debt currently and is expected to maintain this policy indefinitely. - For 3 years Brisk Transport will grow earnings at 10% per year. After 3 years Brisk Transport is expected to read stable growth and earnings are expected to grow 4% per year in perpetuity. Its long-term cost of capital is estimate at 8%. (a) Estimate the Return on Equity (ROE) of Brisk Transport. (b) Estimate the value per share of Brisk Transport using the dividend discount model. (c) Estimate the current cost of equity (market return) of Brisk Transport. (d) Estimate the terminal value per share of Brisk Transport at the end of the high growth period. (e) Estimate the sustainable growth rate of Brisk Transport during the initial high growth phase.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The image contains a question with several parts that relate to valuing Brisk Transport Inc by analyzing its financial information Ill go through each part step by step a Estimate the Return on Equity ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started