Question

You are trying to value the equity of x company which produces durable goods. In 2022, the firm had net income of 600 Million TL,

You are trying to value the equity of x company which produces durable goods. In 2022, the firm had net income of 600 Million TL, 300 Million TL of capital expenditures, 140 Million TL of depreciation. x also increased its non-cash working capital by 70 million TL, and its debt by 60 million TL in 2022. The book value of equity of x was 1,500 million TL in the 2022 Balance Sheet and its cost of equity is 15%.

a) Calculate the equity reinvestment rate, ROE and expected growth rate for x under these conditions. Assume that portion of debt used to finance reinvestment is being held constant.

b) This growth rate in NI is expected to last for 5 years and then slow down to 6% forever. The ROE will be 24% after 5 years. Estimate value of equity today using the FCFE. 2022 2023 2024 2025 2026 2027 2028 2029

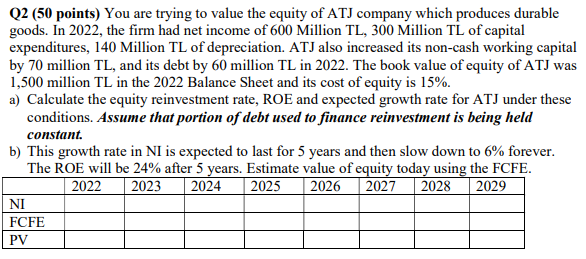

Q2 (50 points) You are trying to value the equity of ATJ company which produces durable goods. In 2022, the firm had net income of 600 Million TL, 300 Million TL of capital expenditures, 140 Million TL of depreciation. ATJ also increased its non-cash working capital by 70 million TL, and its debt by 60 million TL in 2022 . The book value of equity of ATJ was 1,500 million TL in the 2022 Balance Sheet and its cost of equity is 15%. a) Calculate the equity reinvestment rate, ROE and expected growth rate for ATJ under these conditions. Assume that portion of debt used to finance reinvestment is being held constant. b) This growth rate in NI is expected to last for 5 years and then slow down to 6% forever. The ROE will be 24% after 5 years. Estimate value of equity today using the FCFE

Q2 (50 points) You are trying to value the equity of ATJ company which produces durable goods. In 2022, the firm had net income of 600 Million TL, 300 Million TL of capital expenditures, 140 Million TL of depreciation. ATJ also increased its non-cash working capital by 70 million TL, and its debt by 60 million TL in 2022 . The book value of equity of ATJ was 1,500 million TL in the 2022 Balance Sheet and its cost of equity is 15%. a) Calculate the equity reinvestment rate, ROE and expected growth rate for ATJ under these conditions. Assume that portion of debt used to finance reinvestment is being held constant. b) This growth rate in NI is expected to last for 5 years and then slow down to 6% forever. The ROE will be 24% after 5 years. Estimate value of equity today using the FCFE Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started