Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are trying to value CVS Corporation, a leading chain of drugstores. You have estimated the free cash flows to equity for the firm

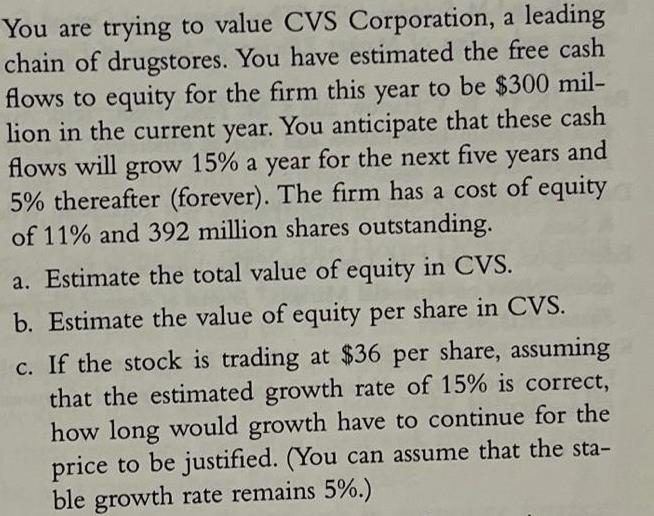

You are trying to value CVS Corporation, a leading chain of drugstores. You have estimated the free cash flows to equity for the firm this year to be $300 mil- lion in the current year. You anticipate that these cash flows will grow 15% a year for the next five years and 5% thereafter (forever). The firm has a cost of equity of 11% and 392 million shares outstanding. a. Estimate the total value of equity in CVS. b. Estimate the value of equity per share in CVS. c. If the stock is trading at $36 per share, assuming that the estimated growth rate of 15% is correct, how long would growth have to continue for the price to be justified. (You can assume that the sta- ble growth rate remains 5%.)

Step by Step Solution

★★★★★

3.39 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Free Cashflow to Equity 300 Million Growth for first 5 years 15 Stable growth after 5 years 5 Cost of Equity 11 Shares outstanding 392 Million a With ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started