Answered step by step

Verified Expert Solution

Question

1 Approved Answer

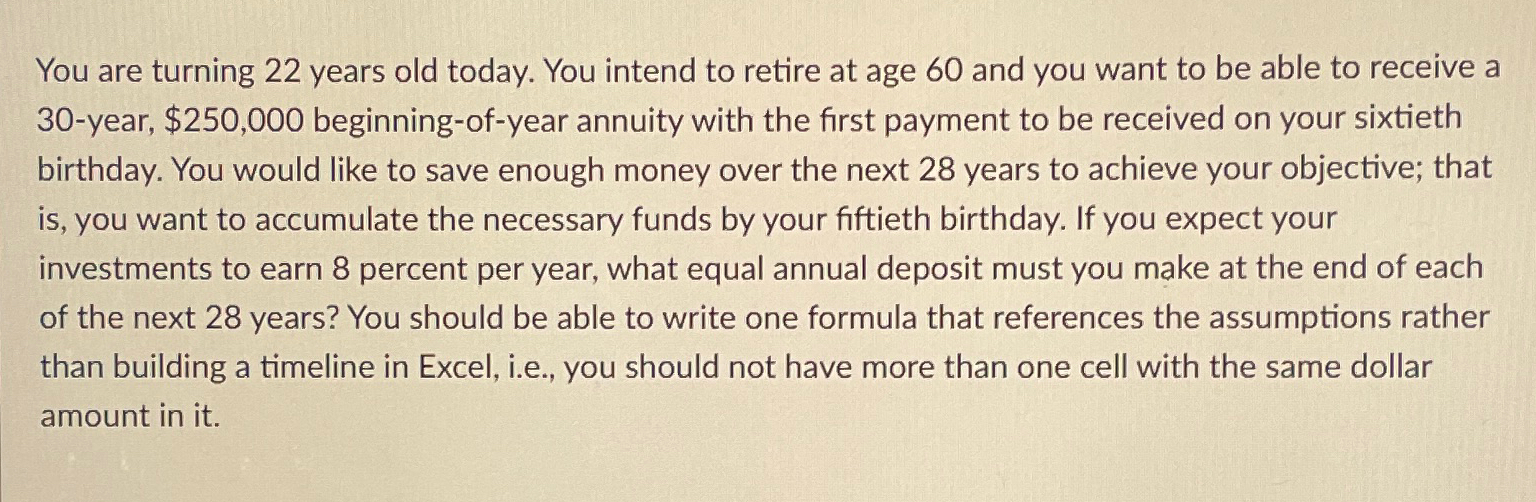

You are turning 2 2 years old today. You intend to retire at age 6 0 and you want to be able to receive a

You are turning years old today. You intend to retire at age and you want to be able to receive a year, $ beginningofyear annuity with the first payment to be received on your sixtieth birthday. You would like to save enough money over the next years to achieve your objective; that is you want to accumulate the necessary funds by your fiftieth birthday. If you expect your investments to earn percent per year, what equal annual deposit must you make at the end of each of the next years? You should be able to write one formula that references the assumptions rather than building a timeline in Excel, ie you should not have more than one cell with the same dollar amount in it

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started