Question

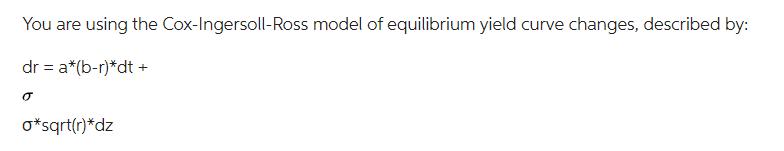

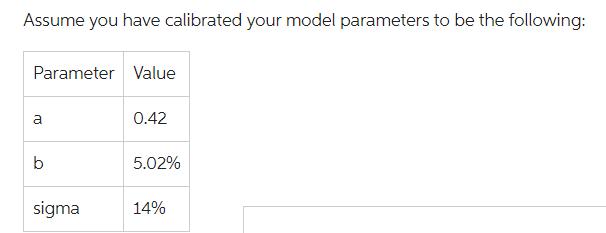

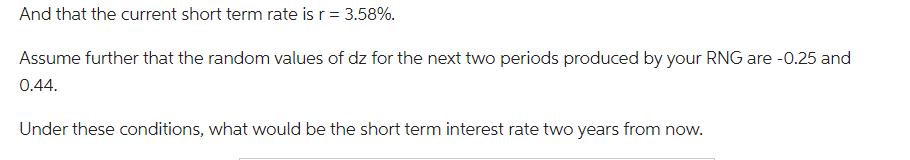

You are using the Cox-Ingersoll-Ross model of equilibrium yield curve changes, described by: dr = a*(b-r)*dt + o*sqrt(r)*dz Assume you have calibrated your model

You are using the Cox-Ingersoll-Ross model of equilibrium yield curve changes, described by: dr = a*(b-r)*dt + o*sqrt(r)*dz Assume you have calibrated your model parameters to be the following: Parameter Value a b sigma 0.42 5.02% 14% And that the current short term rate is r = 3.58%. Assume further that the random values of dz for the next two periods produced by your RNG are -0.25 and 0.44. Under these conditions, what would be the short term interest rate two years from now.

Step by Step Solution

3.55 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

The CoxIngersollRoss CIR model is a onefactor shortrate model used to describe the evolution of interest rates The models differential equation can be ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Applied Corporate Finance

Authors: Aswath Damodaran

4th edition

978-1-118-9185, 9781118918562, 1118808932, 1118918568, 978-1118808931

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App