Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are valuing Harley using its fiscal 2018 10-K as your final year of historical data. You are in the expansion/adjustment stages, where you are

You are valuing Harley using its fiscal 2018 10-K as your final year of historical data. You are in the expansion/adjustment stages, where you are using information fromthe Notes to Consolidated Financial Statements. Assume that Harley faces a 21% marginal corporate tax rate, and the applicable discount rate for operating leases is 3%.

By how much will the adjustments for operating leases increase assets (over and above those originally reported on the balance sheet) as of December 31, 2018, after applying the mid-year adjustment factor?

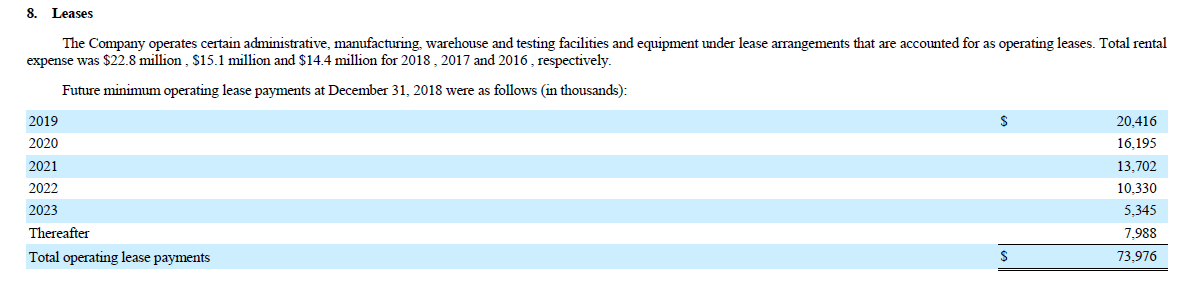

The Company operates certain administrative, manufacturing, warehouse and testing facilities and equipment under lease arrangements that are accounted for as operating leases. Total rental expense was \$22.8 million, \$15.1 million and \$14.4 million for 2018, 2017 and 2016, respectively. Future minimum operating lease payments at December 31,2018 were as follows (in thousands)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started