Answered step by step

Verified Expert Solution

Question

1 Approved Answer

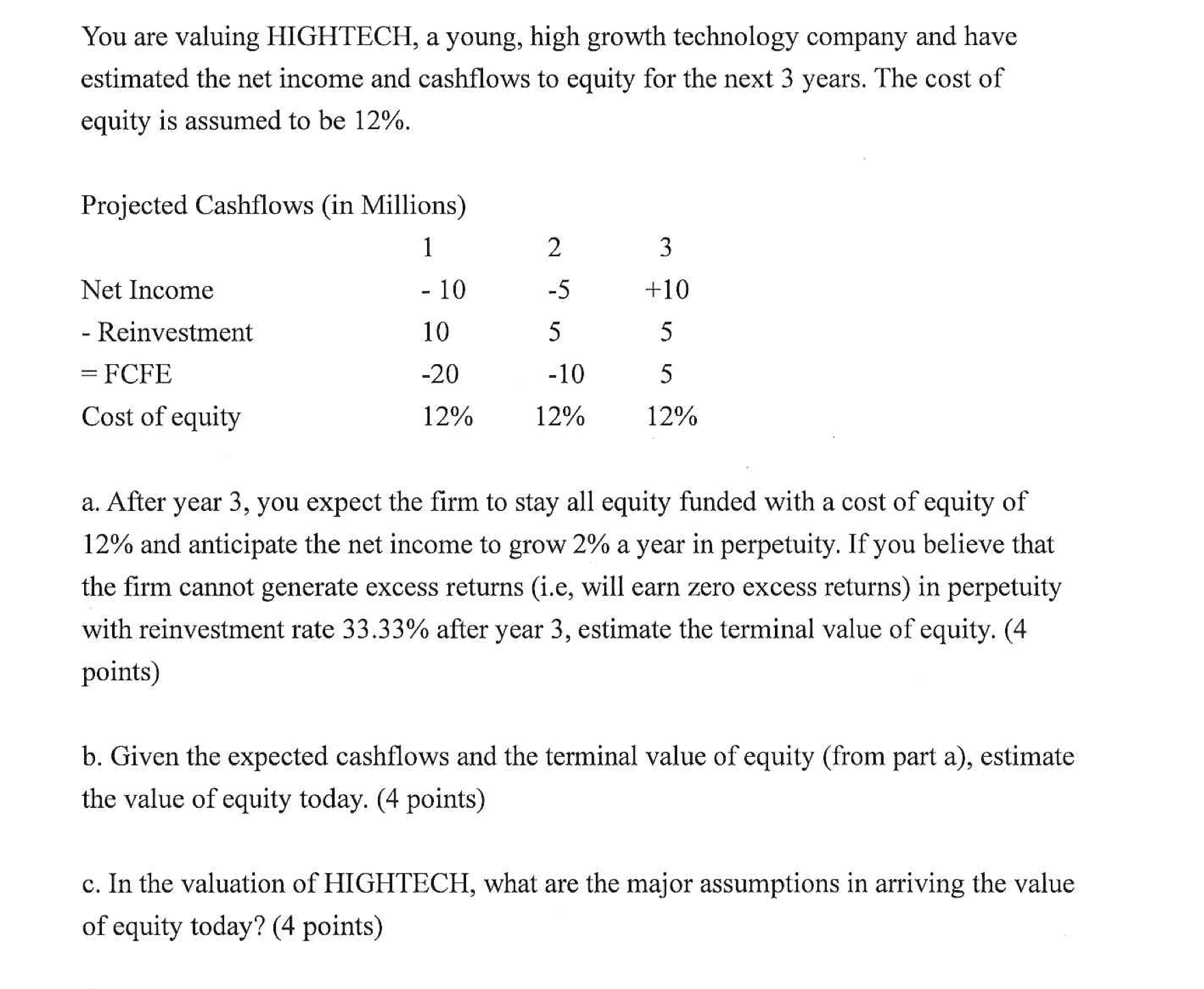

You are valuing HIGHTECH, a young, high growth technology company and have estimated the net income and cashflows to equity for the next 3 years.

You are valuing HIGHTECH, a young, high growth technology company and have estimated the net income and cashflows to equity for the next years. The cost of equity is assumed to be a After year you expect the firm to stay all equity funded with a cost of equity of and anticipate the net income to grow a year in perpetuity. If you believe that the firm cannot generate excess returns ie will earn zero excess returns in perpetuity with reinvestment rate after year estimate the terminal value of equity. points b Given the expected cashflows and the terminal value of equity from part a estimate the value of equity today. points c In the valuation of HIGHTECH, what are the major assumptions in arriving the value of equity today? points Answer the questions please

You are valuing HIGHTECH, a young, high growth technology company and have

estimated the net income and cashflows to equity for the next years. The cost of

equity is assumed to be

a After year you expect the firm to stay all equity funded with a cost of equity of

and anticipate the net income to grow a year in perpetuity. If you believe that

the firm cannot generate excess returns ie will earn zero excess returns in perpetuity

with reinvestment rate after year estimate the terminal value of equity.

points

b Given the expected cashflows and the terminal value of equity from part a estimate

the value of equity today. points

c In the valuation of HIGHTECH, what are the major assumptions in arriving the value

of equity today? points

Answer the questions please

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started