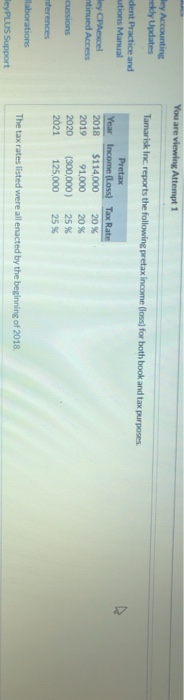

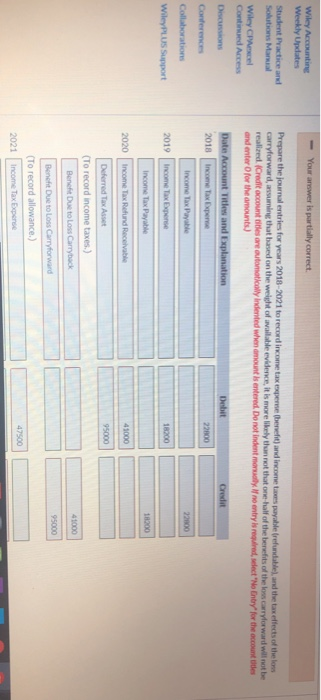

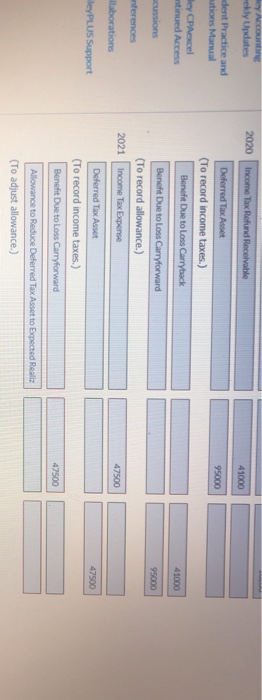

You are viewing Attempt 1 Bey Accounting ekly Updates Tamarisk Inc. reports the following pretax income (loss) for both book and tax purposes dent Practice and utions Manual ley CPAexcel ntinued Access Pretax Year Income (Loss) Tax Rate 2018 $114,000 20% 2019 91,000 20% 2020 (300,000) 25% 2021 125,000 25 % cussions nferences laborations The tax rates listed were all enacted by the beginning of 2018 LeyPLUS Support Your answer is partially correct. Wiley Accounting Weekly Updates Student Practice and Solutions Manual Prepare the journal entries for years 2018-2021 to record income tax per benefit and incom e s payable refundable and the taxeffects of the los carryforward, assuming that based on the weight of available evidence, it is more likely than not that one half of the benefits of the low carryforward will not be realized Cred account oes or cowyIndented when amount is entered. Do not indentmen t no entry ogrod, select No Entry for the accounts and enter for the amounts.) Wiley CPA cel Continued Access Date Account Titles and Explanation Discussions Debit 2018 Income Tax Experne 22800 Collaborations Income Tax Payable 22000 Wiley Support 2019 Income Tax Expense 18200 Income Tax Payable 2020 41000 Income Tax Refund Receivable Deferred Tax Asset (To record income taxes.) Benefit Due to Loss Carryback Benefit Due to Loss Carryforward (To record allowance.) 2021 Income Tax Expense y Accounting ekly Updates 2020 Income Tax Refund Receivable 41000 dent Practice and utions Manual Deferred Tax Asset 95000 ley CP excel ntinued Access (To record income taxes.) Benefit Due to Loss Carryback 41000 Ussions 95000 Benefit Due to Loss Carryforward (To record allowance.) 2021 Income Tax Expense nferences laborations 47500 leyPLUS Support 47500 Deferred Tax Asset (To record income taxes.) Benefit Due to Loss Carryforward 47500 Allowance to Reduce Deferred Tax Asset to Expected Realiz (To adjust allowance.) ons Support b) The parts of this question must be completed in order. This part will be available when you complete the part above. (c) The parts of this question must be completed in order. This part will be available when you complete the part above