Question

You are working as a Trainee Accountant (1 st year) at Jacobs Inc and have been assigned to the audit of Orange (Pty) Ltd (Orange).

You are working as a Trainee Accountant (1st year) at Jacobs Inc and have been assigned to the audit of Orange (Pty) Ltd (Orange). You are one of five individuals on the audit team at Orange. The Audit Senior presented you with the following information about Orange.

Background Information of Orange

Orange was established in 1983 in South Africa. The core of Oranges business is to develop and build construction sites. Their Head quarte's (Head Office) is situated in Durban.

Orange employs 16 850 employees and has an August financial year-end.

Assets and liabilities are valued using the cost-price model.

While conducting risk assessment procedures, the following were noted:

- Included in the non-current liabilities are fixed-term borrowings, which are approaching maturity without prospects of repayment.

- Orange places excessive reliance on borrowings and facilities to finance long-term assets.

- There were certain senior management that were removed in the current year, but Orange managed to fill the senior management positions.

- In the current year, Orange built a site in the East Coast region where one of the workers had an accident and, on the way to the hospital passed on. This news quickly went to the media which resulted in a bad perception by the public of Orange.

- The above incident also caused negative publicity due to the photos and posts on social media.

- The family of the worker who had an accident took legal action and at year-end, there was still a pending lawsuit against Orange.

- Orange is in arrears on a few years of dividend payments but is committed to paying dividends for the foreseeable future.

- Orange is in the process of extending the entitys overdraft facility.

- The accounts receivable regressed and are currently at five months even though Oranges policy is 60 days.

- Oranges accounts payable have increased in the current financial year. The Chief Financial Officer (CFO) negotiated with Oranges top two largest suppliers, which represent 45% of the total of the accounts payable, to extend the payment term from 30 to 60 days.

While you were finalizing the audit, the Financial Manager of Orange informed you that the entity had been awarded a contract to construct a building in Umhlanga for which they have submitted a tender. The Financial Manager felt that this would assure the future of Orange. They applied to the bank to assist with financing the project. For this project, Orange will need additional engineers and installers for project-specific requirements.

REQUIRED:

1.1 Discuss the appropriateness of the going concern assumption for the financial statements of Orange (Pty) Ltd for the financial year ending 31 August 2023.

Structure your answer as follow:

- Negative aspects that increase the going concern risk (14 marks)

- Positive aspects that decrease the going concern risk (4 marks)

1.2 Briefly state the enquiries you would make with the Financial Manager at Orange (Pty) Ltd to determine whether the awarding of the Umhlanga contract would have any effect on your going concern evaluation. (7 marks)

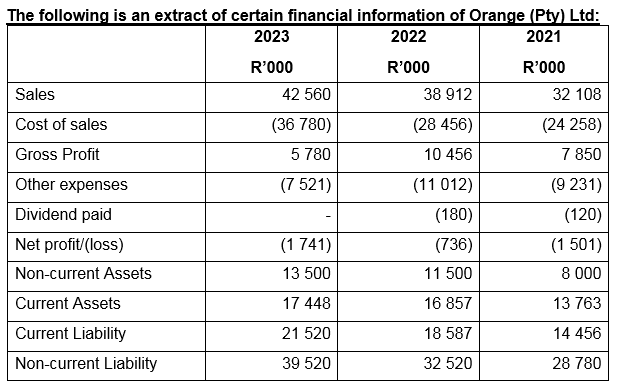

The following is an extract of certain financial information of Orange (Pty) Ltd: \begin{tabular}{|l|r|r|r|} \hline & \multicolumn{1}{|c|}{2023R000} & \multicolumn{1}{c|}{2022R000} & \multicolumn{1}{c|}{\begin{tabular}{c} \multicolumn{1}{c|}{ R'000 } \\ R'0 \end{tabular}} \\ \hline Sales & 42560 & 38912 & 32108 \\ \hline Cost of sales & (36780) & (28456) & (24258) \\ \hline Gross Profit & 5780 & 10456 & 7850 \\ \hline Other expenses & (7521) & (11012) & (9231) \\ \hline Dividend paid & - & (180) & (120) \\ \hline Net profit/(loss) & (1741) & (736) & (1501) \\ \hline Non-current Assets & 13500 & 11500 & 8000 \\ \hline Current Assets & 17448 & 16857 & 13763 \\ \hline Current Liability & 21520 & 18587 & 14456 \\ \hline Non-current Liability & 39520 & 32520 & 28780 \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started