Question

You are working at the investment bank Gold in Sacks. The table below shows the current STRIPS prices that appear on your computer screen.

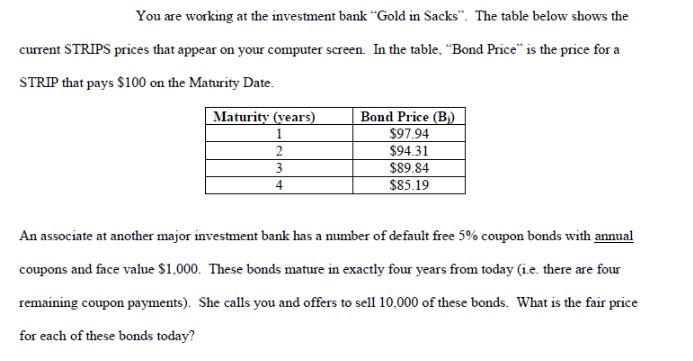

You are working at the investment bank "Gold in Sacks". The table below shows the current STRIPS prices that appear on your computer screen. In the table. "Bond Price" is the price for a STRIP that pays $100 on the Maturity Date. Maturity (years) 1 2 3 4 Bond Price (B) $97.94 $94.31 $89.84 $85.19 An associate at another major investment bank has a number of default free 5% coupon bonds with annual coupons and face value $1,000. These bonds mature in exactly four years from today (i.e. there are four remaining coupon payments). She calls you and offers to sell 10,000 of these bonds. What is the fair price for each of these bonds today?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

SOLUTION 1 The bonds have a face value of 1000 and 4 remaining annual coupon p...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Foundations of Financial Management

Authors: Stanley Block, Geoffrey Hirt, Bartley Danielsen, Doug Short, Michael Perretta

10th Canadian edition

1259261018, 1259261015, 978-1259024979

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App