Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are working for First Boston, a well-known investment bank, and are trying to value the equity of Twitter as part of a potential takeover

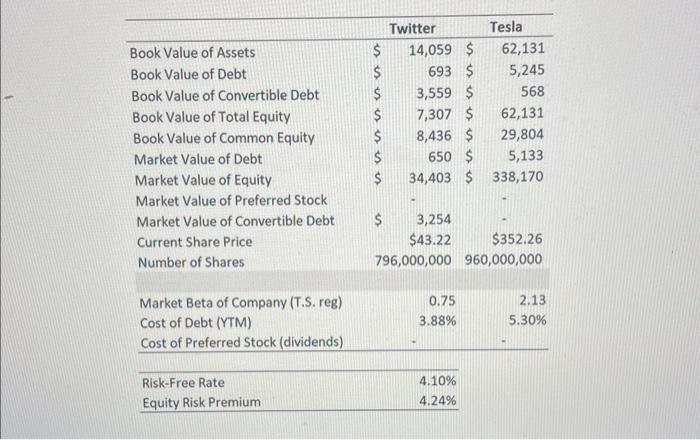

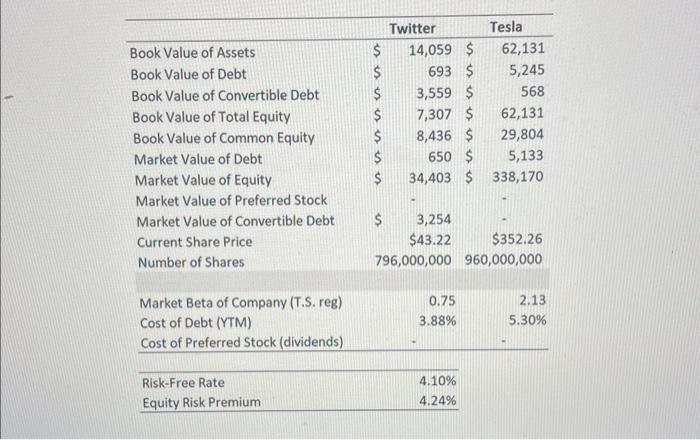

You are working for First Boston, a well-known investment bank, and are trying to value the equity of Twitter as part of a potential takeover deal for Mr. Elon Musk, the CEO of Tesla. Mr. Musk has told you that he wants to own the entire company so that he can take Twitter private. To own the company, he needs to purchase 100% of Twitters equity. Its your teams job to determine the true value of Twitters equity so that Mr. Musk doesnt overpay. The other analysts on the team have already performed some calculations which they have given you in the table below. Using this information, calculate the appropriate discount rate that you should use to value the equity of Twitter so that Mr. Musk doesnt overpay. (Hint: valuing the equity of a company is different from valuing the entire company).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started