Answered step by step

Verified Expert Solution

Question

1 Approved Answer

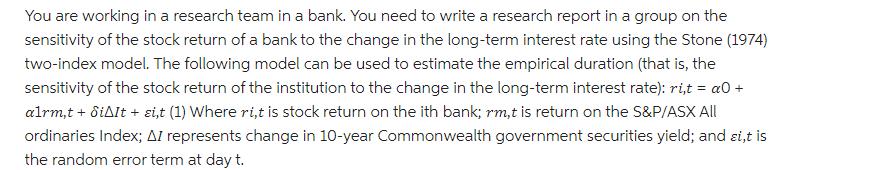

You are working in a research team in a bank. You need to write a research report in a group on the sensitivity of

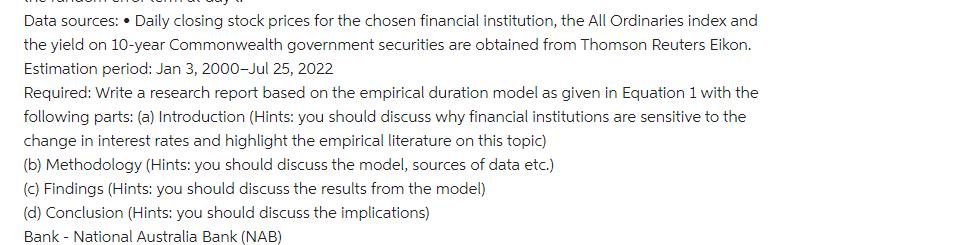

You are working in a research team in a bank. You need to write a research report in a group on the sensitivity of the stock return of a bank to the change in the long-term interest rate using the Stone (1974) two-index model. The following model can be used to estimate the empirical duration (that is, the sensitivity of the stock return of the institution to the change in the long-term interest rate): ri,t = a0 + alrm,t + diAlt + i,t (1) Where ri,t is stock return on the ith bank; rm,t is return on the S&P/ASX All ordinaries Index; AI represents change in 10-year Commonwealth government securities yield; and i,t is the random error term at day t. Data sources: Daily closing stock prices for the chosen financial institution, the All Ordinaries index and the yield on 10-year Commonwealth government securities are obtained from Thomson Reuters Eikon. Estimation period: Jan 3, 2000-Jul 25, 2022 Required: Write a research report based on the empirical duration model as given in Equation 1 with the following parts: (a) Introduction (Hints: you should discuss why financial institutions are sensitive to the change in interest rates and highlight the empirical literature on this topic) (b) Methodology (Hints: you should discuss the model, sources of data etc.) (c) Findings (Hints: you should discuss the results from the model) (d) Conclusion (Hints: you should discuss the implications) Bank - National Australia Bank (NAB)

Step by Step Solution

★★★★★

3.49 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

A Introduction The purpose of this report is to investigate the sensitivity of stock return of Natio...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started