Answered step by step

Verified Expert Solution

Question

1 Approved Answer

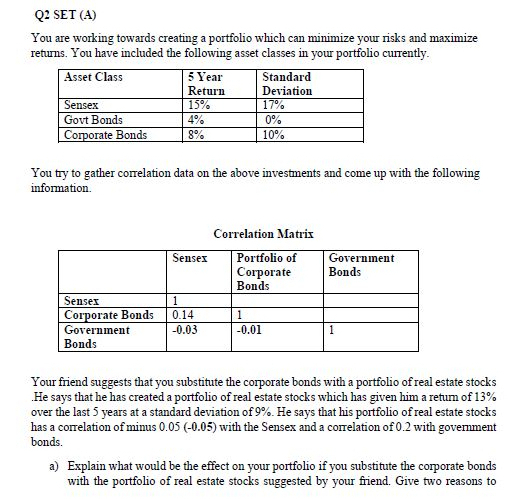

You are working towards creating a portfolio which can minimize your risks and maximize returns. You have included the following asset classes in your portfolio

You are working towards creating a portfolio which can minimize your risks and maximize returns. You have included the following asset classes in your portfolio currently. Your friend suggests that you substitute the corporate bonds with a portfolio of real estate stocks

He says that he has created a portfolio of real estate stocks which has given him a retum of

over the last years at a standard deviation of He says that his portfolio of real estate stocks

has a correlation of minus with the Sensex and a correlation of with government

bonds.

a Explain what would be the effect on your portfolio if you substitute the corporate bonds

with the portfolio of real estate stocks suggested by your friend. Give two reasons to

explain any change you would expect. Note: You do not have to compute expected risk

and return.

b Your understanding of capital market theory causes you to doubt the validity of the data

provided by your friend on his real estate portfolio. Justify your skepticism.

Your friend also suggests that you add shares of a fast growing FMCG company

FastFood Itd in your portfolio. He says this company has generated a positive alpha this

year based on capm He says that such a company is bound to have high a PE Ratio

which makes it a good buy.

c What is PE Ratio?

d Do you agree with your friend? WhyWhy not?

Marks:

Asset Class

Year Return

Standard Deviation

Sensex

Govt Bonds

Corporate Bonds

You try to gather correlation data on the above investments and come up with the following information.

Correlation Matrix

Sensex

Portfolio of Corporate Bonds

Government Bonds

Sensex

Corporate Bonds

Government Bonds

Your friend suggests that you substitute the corporate bonds with a portfolio of real estate stocks He says that he has created a portfolio of real estate stocks which has given him a return of over the last years at a standard deviation of He says that his portfolio of real estate stocks has a correlation of minus with the Sensex and a correlation of with government bonds.

a Explain what would be the effect on your portfolio if you substitute the corporate bonds with the portfolio of real estate stocks suggested by your friend. Give two reasons to

explain any change you would expect. Note: You do not have to compute expected risk and return.

b Your understanding of capital market theory causes you to doubt the validity of the data provided by your friend on his real estate portfolio. Justify your skepticism.

Your friend also suggests that you add shares of a fast growing FMCG companyFastFood Ltd in your portfolio. He says this company has generated a positive alpha this year based on capmHe says that such a company is bound to have high a PE Ratio which makes it a good buy.

c What is PE Ratio?

d Do you agree with your friend? WhyWhy noQ SET A

You are working towards creating a portfolio which can minimize your risks and maximize

returns. You have included the following asset classes in your portfolio currently.

You try to gather correlation data on the above investments and come up with the following

information.

Correlation Matrix

Your friend suggests that you substitute the corporate bonds with a portfolio of real estate stocks

He says that he has created a portfolio of real estate stocks which has given him a retum of

over the last years at a standard deviation of He says that his portfolio of real estate stocks

has a correlation of minus with the Sensex and a correlation of with government

bonds.

a Explain what would be the effect on your portfolio if you substitute the corporate bonds

with the portfolio of real estate stocks suggested by your friend. Give two reasons to

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started