Answered step by step

Verified Expert Solution

Question

1 Approved Answer

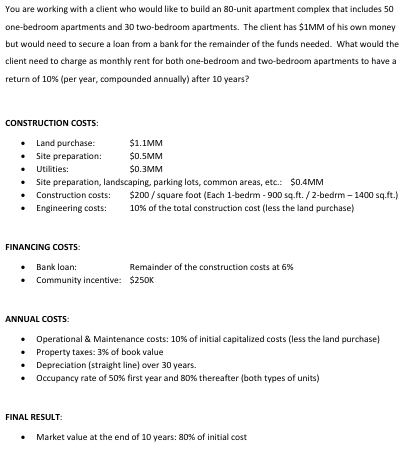

You are working with a client who would like to build an 8 0 - unit apartment complex that includes 5 0 one - bedroom

You are working with a client who would like to build an unit apartment complex that includes onebedroom apartments and twobedroom apartments. The client has $ mathrmMM of his own money but would need to secure a loan from a bank for the remainder of the funds needed. What would the client need to charge as monthly rent for both onebedroom and twobedroom apartments to have a return of per year, compounded annually after years?

CONSTRUCTION COSTS:

Land purchase:

$MM

Site preparation:

$ mathrmMM

Utilities:

$ mathrmMM

Site preparation, landscaping, parking lots, common areas, etc.: $ mathrmMM

Construction costs: $ square foot Each bedrm sqftbedrm mathrmsqmathrmft

Engineering costs: of the total construction cost less the land purchase

FINANCING COSTS:

Bank loan:

Remainder of the construction costs at

Community incentive: $ mathrm~K

ANNUAL COSTS:

Operational & Maintenance costs: of initial capitalized costs less the land purchase

Property taxes: of book value

Depreciation straight line over years.

Occupancy rate of first year and thereafter both types of units

FINAL RESULT:

Market value at the end of years: of initial cost

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started