Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are your Great Auntie Millies favourite niece. Uncle Frank recently died and she has asked you to help with her financial affairs. She recently

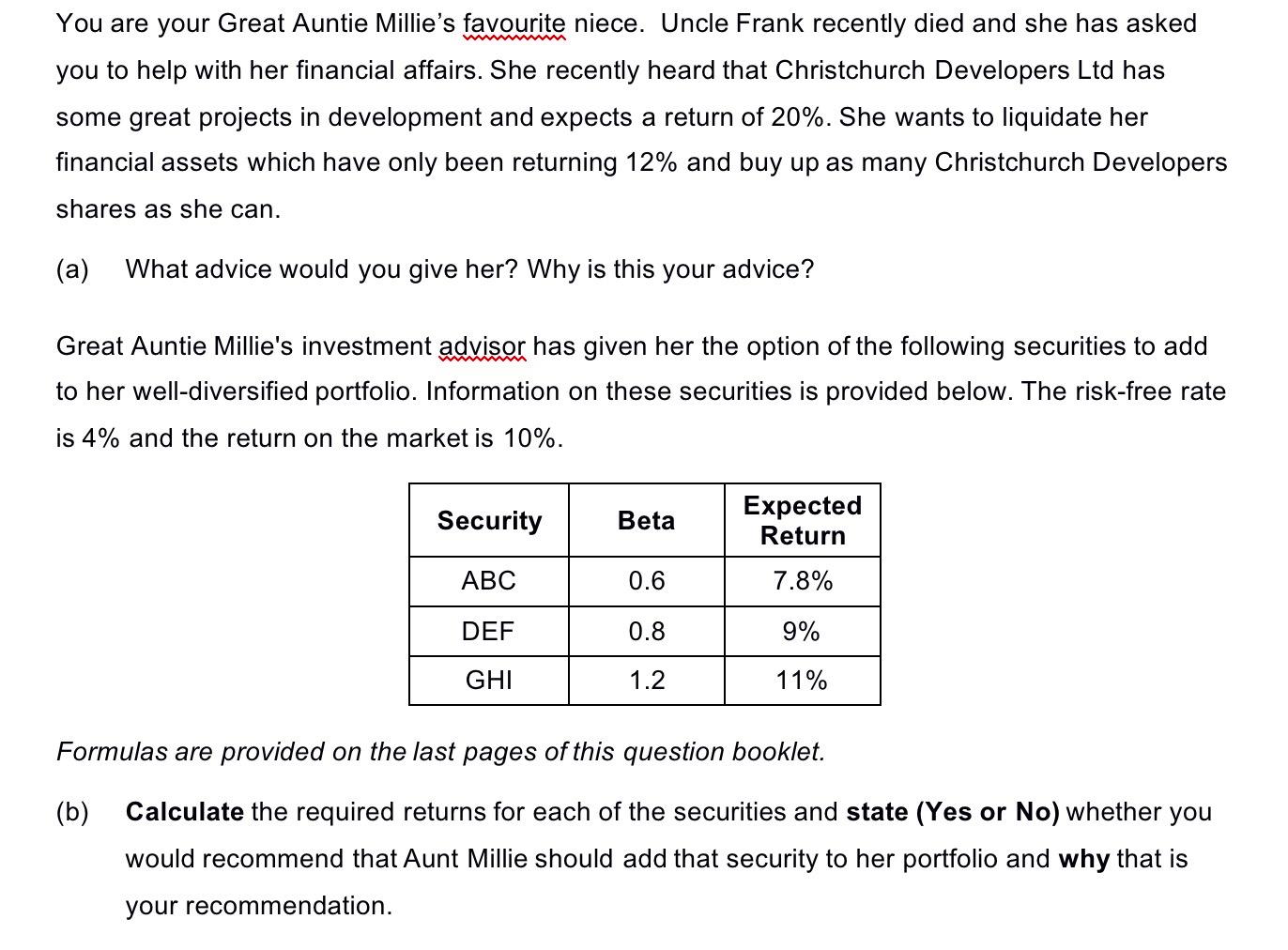

You are your Great Auntie Millies favourite niece. Uncle Frank recently died and she has asked you to help with her financial affairs. She recently heard that Christchurch Developers Ltd has some great projects in development and expects a return of 20%. She wants to liquidate her financial assets which have only been returning 12% and buy up as many Christchurch Developers shares as she can.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started