Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You became aware of the following information regarding your audit client, Ducks Limited, a retailer of cleaning supplies and a company listed on the

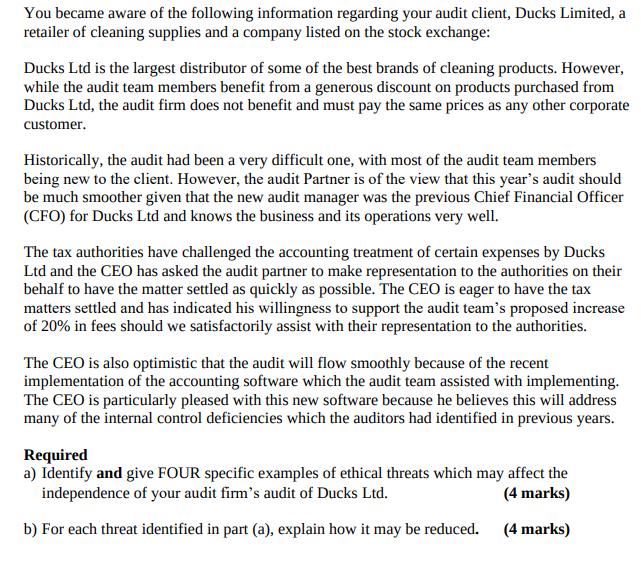

You became aware of the following information regarding your audit client, Ducks Limited, a retailer of cleaning supplies and a company listed on the stock exchange: Ducks Ltd is the largest distributor of some of the best brands of cleaning products. However, while the audit team members benefit from a generous discount on products purchased from Ducks Ltd, the audit firm does not benefit and must pay the same prices as any other corporate customer. Historically, the audit had been a very difficult one, with most of the audit team members being new to the client. However, the audit Partner is of the view that this year's audit should be much smoother given that the new audit manager was the previous Chief Financial Officer (CFO) for Ducks Ltd and knows the business and its operations very well. The tax authorities have challenged the accounting treatment of certain expenses by Ducks Ltd and the CEO has asked the audit partner to make representation to the authorities on their behalf to have the matter settled as quickly as possible. The CEO is eager to have the tax matters settled and has indicated his willingness to support the audit team's proposed increase of 20% in fees should we satisfactorily assist with their representation to the authorities. The CEO is also optimistic that the audit will flow smoothly because of the recent implementation of the accounting software which the audit team assisted with implementing. The CEO is particularly pleased with this new software because he believes this will address many of the internal control deficiencies which the auditors had identified in previous years. Required a) Identify and give FOUR specific examples of ethical threats which may affect the independence of your audit firm's audit of Ducks Ltd. (4 marks) b) For each threat identified in part (a), explain how it may be reduced. (4 marks)

Step by Step Solution

★★★★★

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

a Four Specific Examples of Ethical Threats SelfInterest Threat Example The audit team members benefiting from a generous discount on products purchas...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started