Answered step by step

Verified Expert Solution

Question

1 Approved Answer

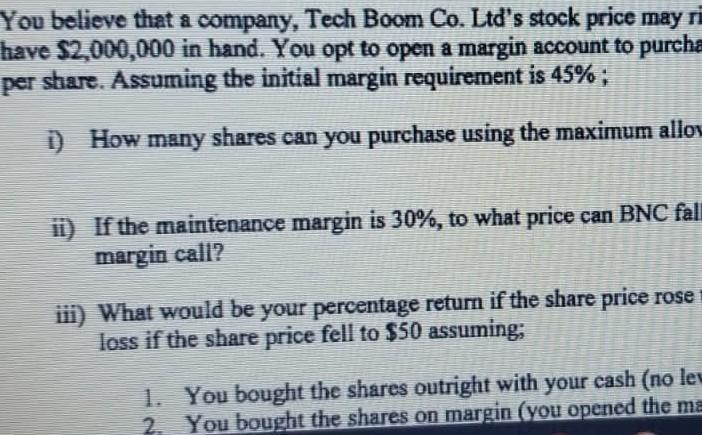

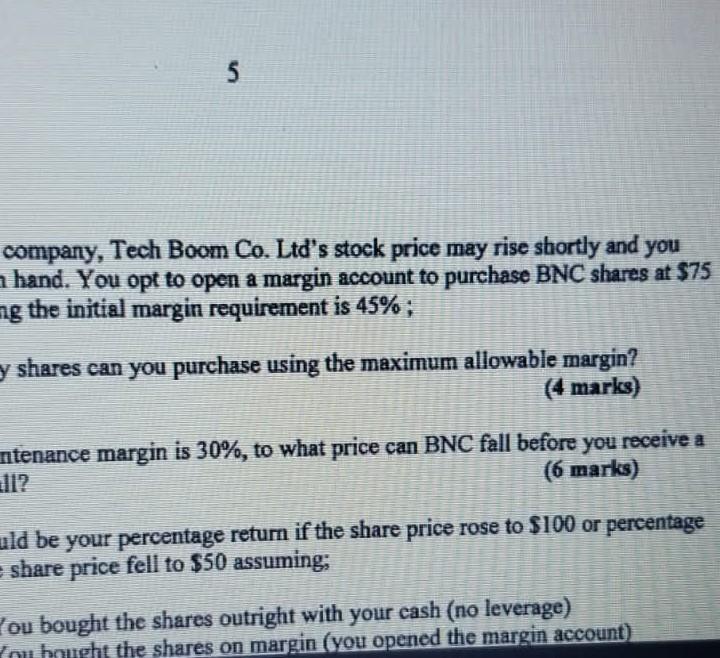

You believe that a company, Tech Boom Co. Ltd's stock price may ri have $2,000,000 in hand. You opt to open a margin account to

You believe that a company, Tech Boom Co. Ltd's stock price may ri have $2,000,000 in hand. You opt to open a margin account to purcha per share. Assuming the initial margin requirement is 45%; 1. How many shares can you purchase using the maximum allow ii) If the maintenance margin is 30%, to what price can BNC fall margin call? ii) What would be your percentage return if the share price rose loss if the share price fell to $50 assuming; 1. You bought the shares outright with your cash (no le 2. You bought the shares on margin (you opened the ma 5 company, Tech Boom Co. Ltd's stock price may rise shortly and you a hand. You opt to open a margin account to purchase BNC shares at $75 ng the initial margin requirement is 45%; y shares can you purchase using the maximum allowable margin? (4 marks) ntenance margin is 30%, to what price can BNC fall before you receive a 11? (6 marks) uld be your percentage return if the share price rose to $100 or percentage share price fell to $50 assuming: Pou bought the shares outright with your cash (no leverage) I'm bought the shares on margin (you opened the margin account)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started