Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You believe that a risk-free arbitrage opportunity exists whereby you can borrow $10,000 in Canadian dollars, invest the funds in Switzerland (in CHF) and then

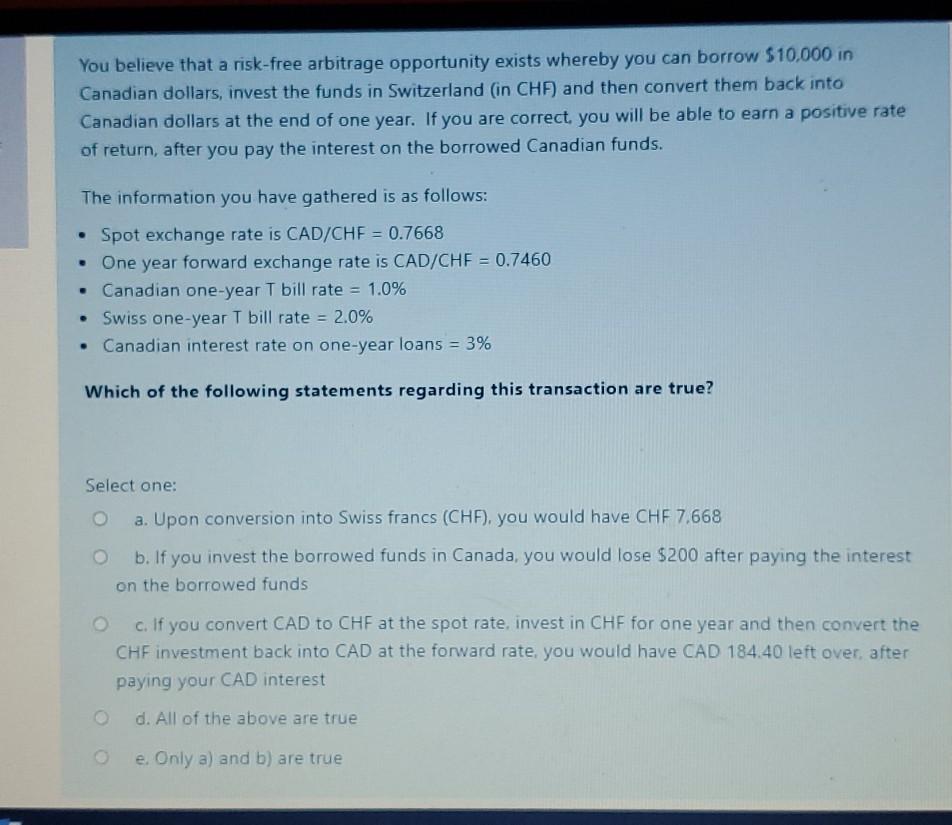

You believe that a risk-free arbitrage opportunity exists whereby you can borrow $10,000 in Canadian dollars, invest the funds in Switzerland (in CHF) and then convert them back into Canadian dollars at the end of one year. If you are correct you will be able to earn a positive rate of return, after you pay the interest on the borrowed Canadian funds. The information you have gathered is as follows: Spot exchange rate is CAD/CHF = 0.7668 One year forward exchange rate is CAD/CHF = 0.7460 Canadian one-year T bill rate = 1.0% Swiss one-year T bill rate = 2.0% Canadian interest rate on one-year loans = 3% Which of the following statements regarding this transaction are true? Select one: a. Upon conversion into Swiss francs (CHF), you would have CHF 7.668 b. If you invest the borrowed funds in Canada, you would lose $200 after paying the interest on the borrowed funds c. If you convert CAD to CHF at the spot rate, invest in CHF for one year and then convert the CHF investment back into CAD at the forward rate, you would have CAD 184.40 left over after paying your CAD interest d. All of the above are true e. Only a) and b) are true

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started