Answered step by step

Verified Expert Solution

Question

1 Approved Answer

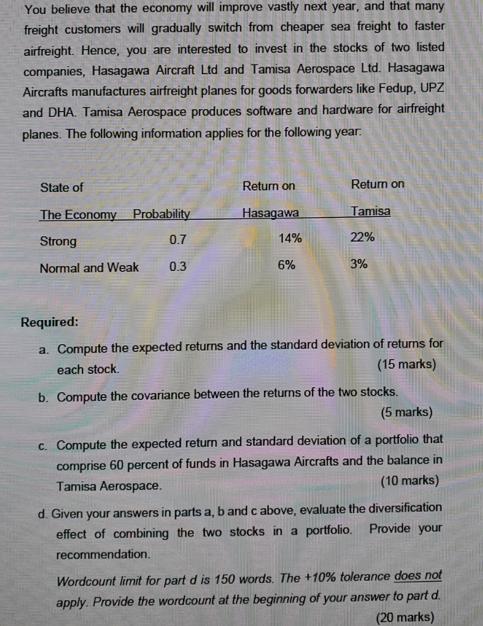

You believe that the economy will improve vastly next year, and that many freight customers will gradually switch from cheaper sea freight to faster

You believe that the economy will improve vastly next year, and that many freight customers will gradually switch from cheaper sea freight to faster airfreight. Hence, you are interested to invest in the stocks of two listed companies, Hasagawa Aircraft Ltd and Tamisa Aerospace Ltd. Hasagawa Aircrafts manufactures airfreight planes for goods forwarders like Fedup, UPZ and DHA. Tamisa Aerospace produces software and hardware for airfreight planes. The following information applies for the following year. State of The Economy Probability Strong Normal and Weak 0.7 0.3 Return on Hasagawa 14% 6% Return on Tamisa 22% 3% Required: a. Compute the expected returns and the standard deviation of returns for each stock. (15 marks) b. Compute the covariance between the returns of the two stocks. (5 marks) c. Compute the expected return and standard deviation of a portfolio that comprise 60 percent of funds in Hasagawa Aircrafts and the balance in Tamisa Aerospace. (10 marks) d. Given your answers in parts a, b and c above, evaluate the diversification effect of combining the two stocks in a portfolio. Provide your recommendation. Wordcount limit for part d is 150 words. The +10% tolerance does not apply. Provide the wordcount at the beginning of your answer to part d. (20 marks)

Step by Step Solution

★★★★★

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

a To compute the expected return ER for each stock we multiply each possible return by its probability and then sum the products The standard deviation is a measure of the volatility of the returns wh...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started