Answered step by step

Verified Expert Solution

Question

1 Approved Answer

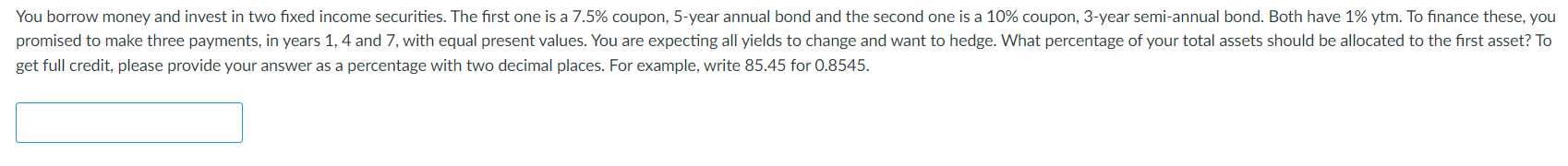

You borrow money and invest in two fixed income securities . The first one is a 7 . 5 % coupon, 5 - year annual

You borrow money and invest in two fixed income securities The first one is a coupon, year annual bond and the second one is a coupon, year semiannual bond. Both have ytm To finance these, you

promised to make three payments, in years and with equal present values. You are expecting all yields to change and want to hedge. What percentage of your total assets should be allocated to the first asset? To

get full credit, please provide your answer as a percentage with two decimal places. For example, write for

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started