Answered step by step

Verified Expert Solution

Question

1 Approved Answer

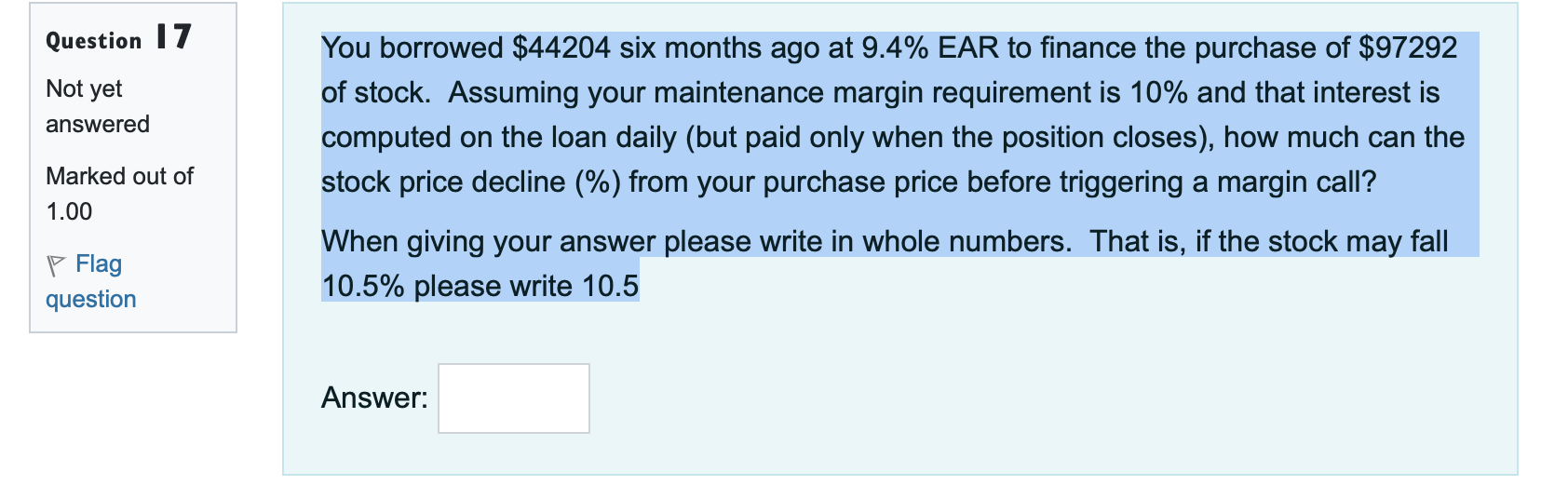

You borrowed $ 4 4 2 0 4 six months ago at 9 . 4 % EAR to finance the purchase of $ 9 7

You borrowed $ six months ago at EAR to finance the purchase of $

of stock. Assuming your maintenance margin requirement is and that interest is

computed on the loan daily but paid only when the position closes how much can the

stock price decline from your purchase price before triggering a margin call?

When giving your answer please write in whole numbers. That is if the stock may fall

please write

Answer:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started