Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You bought 1 share of stock for $44.46 three months ago, just received a dividend of $2.61 per share, and can sell the stock for

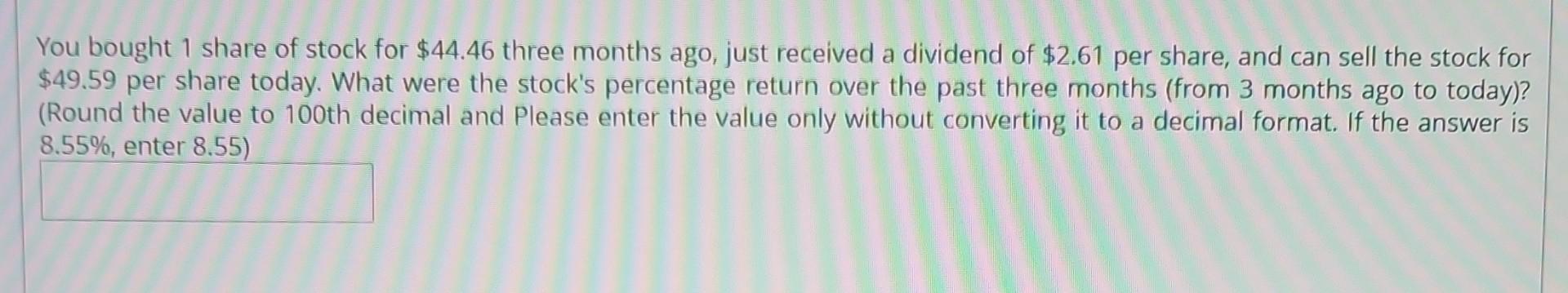

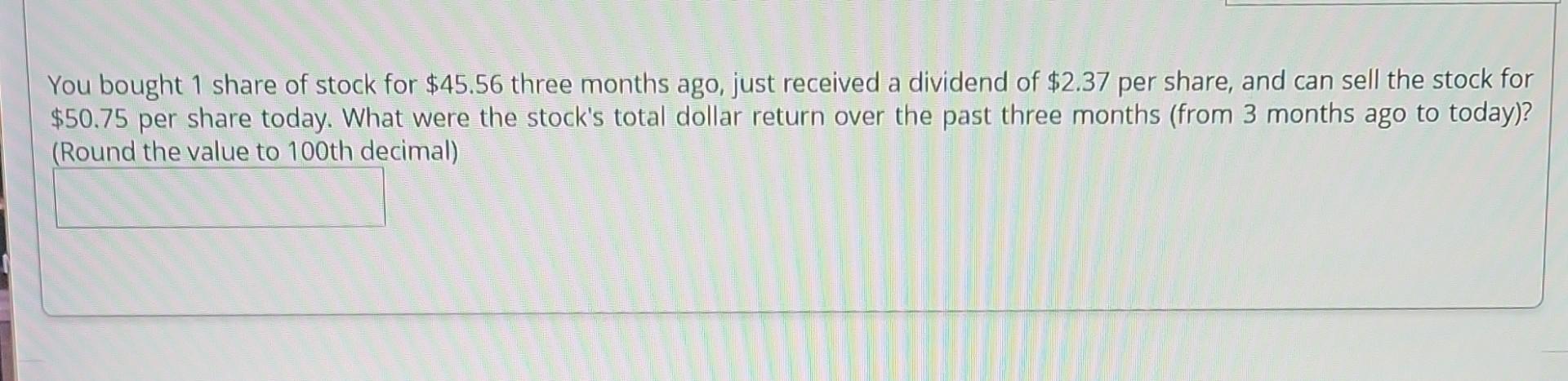

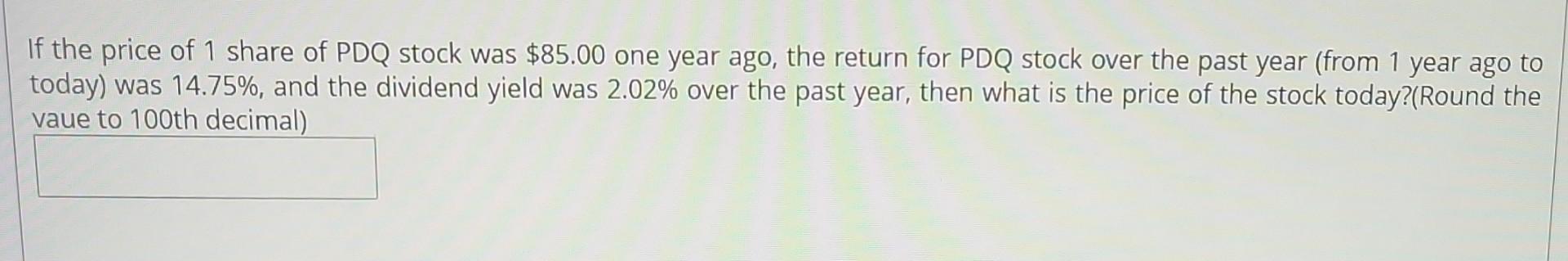

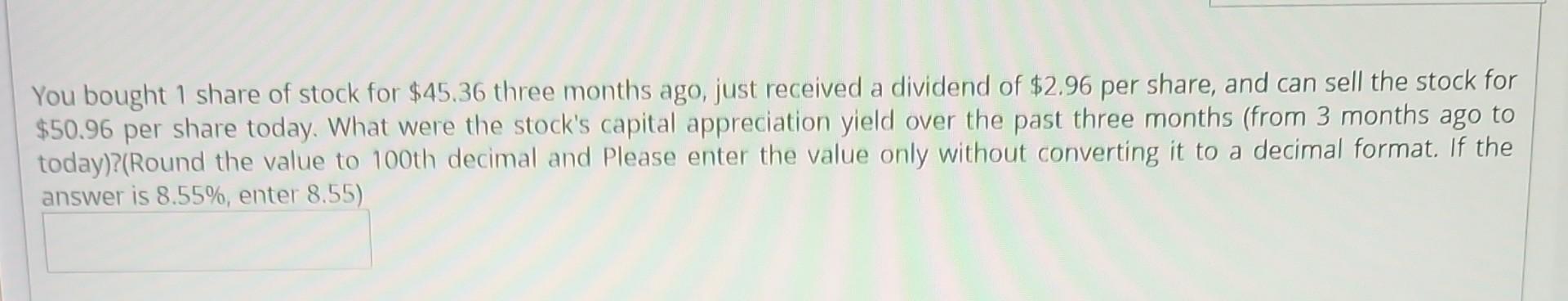

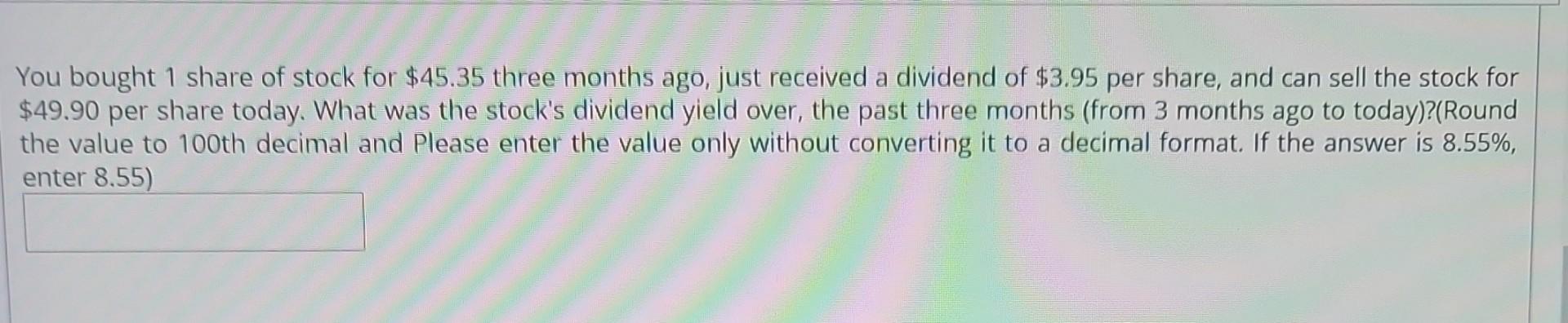

You bought 1 share of stock for $44.46 three months ago, just received a dividend of $2.61 per share, and can sell the stock for $49.59 per share today. What were the stock's percentage return over the past three months (from 3 months ago to today)? (Round the value to 100th decimal and Please enter the value only without converting it to a decimal format. If the answer is 8.55%, enter 8.55 ) You bought 1 share of stock for $45.56 three months ago, just received a dividend of $2.37 per share, and can sell the stock for $50.75 per share today. What were the stock's total dollar return over the past three months (from 3 months ago to today)? (Round the value to 100 th decimal) If the price of 1 share of PDQ stock was $85.00 one year ago, the return for PDQ stock over the past year (from 1 year ago to today) was 14.75%, and the dividend yield was 2.02% over the past year, then what is the price of the stock today?(Round the vaue to 100th decimal) You bought 1 share of stock for $45.36 three months ago, just received a dividend of $2.96 per share, and can sell the stock for $50.96 per share today. What were the stock's capital appreciation yield over the past three months (from 3 months ago to today)?(Round the value to 100 th decimal and Please enter the value only without converting it to a decimal format. If the answer is 8.55%. enter 8.55 ) You bought 1 share of stock for $45.35 three months ago, just received a dividend of $3.95 per share, and can sell the stock for $49.90 per share today. What was the stock's dividend yield over, the past three months (from 3 months ago to today)?(Round the value to 100th decimal and Please enter the value only without converting it to a decimal format. If the answer is 8.55%, enter 8.55)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started