Answered step by step

Verified Expert Solution

Question

1 Approved Answer

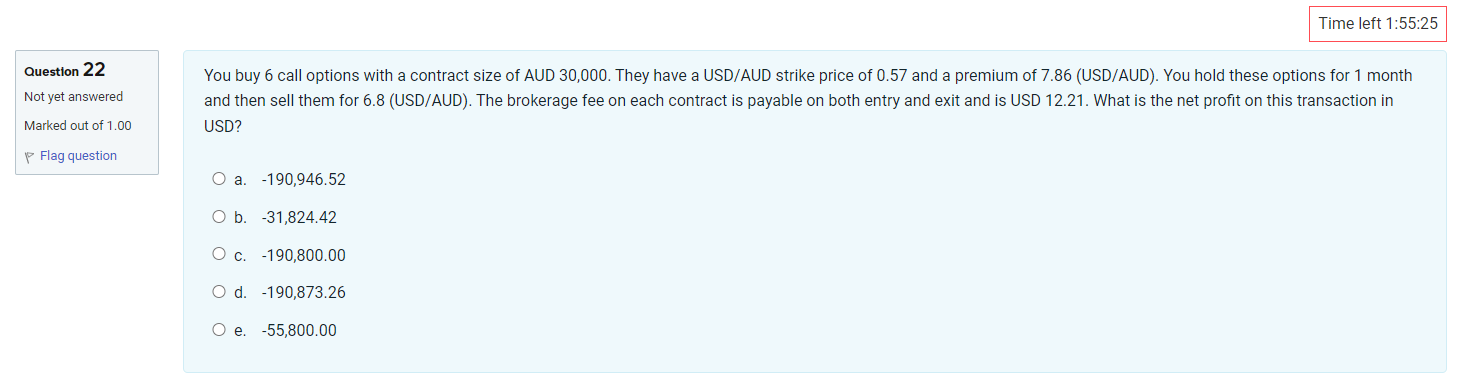

You buy 6 call options with a contract size of AUD 30,000. They have a USD/AUD strike price of 0.57 and a premium of 7.86

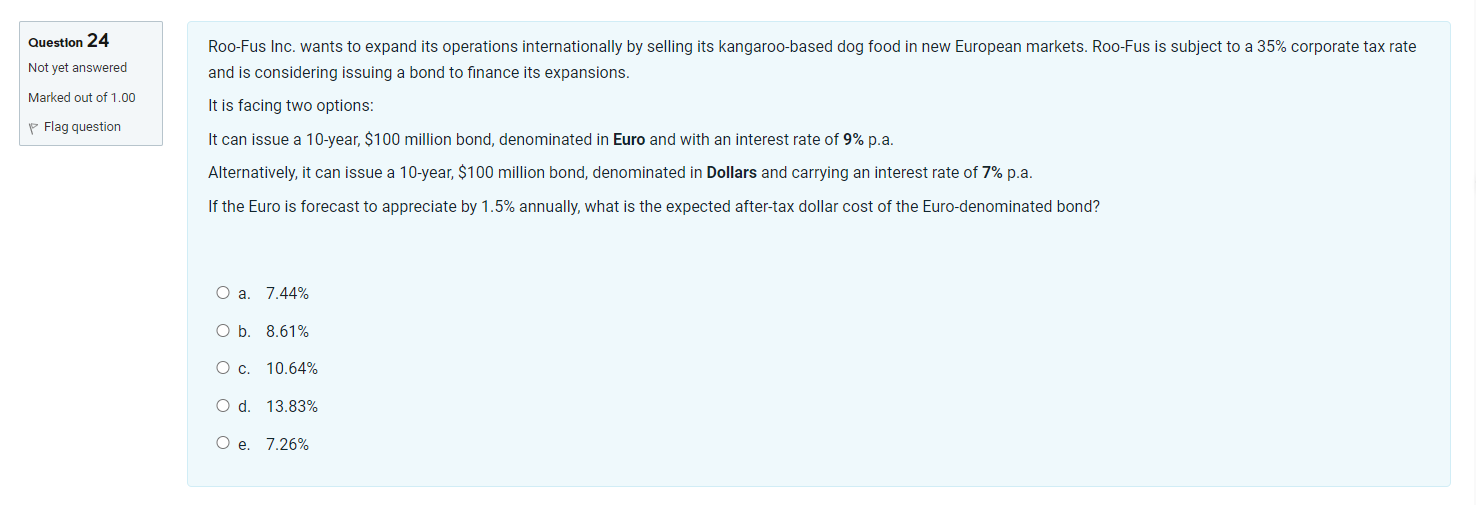

You buy 6 call options with a contract size of AUD 30,000. They have a USD/AUD strike price of 0.57 and a premium of 7.86 (USD/AUD). You hold these options for 1 month and then sell them for 6.8 (USD/AUD). The brokerage fee on each contract is payable on both entry and exit and is USD 12.21. What is the net profit on this transaction in USD? a. \\( -190,946.52 \\) b. \\( -31,824.42 \\) c. \\( -190,800.00 \\) d. \\( -190,873.26 \\) e. \\( -55,800.00 \\) Roo-Fus Inc. wants to expand its operations internationally by selling its kangaroo-based dog food in new European markets. Roo-Fus is subject to a \35 corporate tax rate and is considering issuing a bond to finance its expansions. It is facing two options: It can issue a 10 -year, \\( \\$ 100 \\) million bond, denominated in Euro and with an interest rate of \\( \\mathbf{9 \\%} \\) p.a. Alternatively, it can issue a 10 -year, \\$100 million bond, denominated in Dollars and carrying an interest rate of 7\\% p.a. If the Euro is forecast to appreciate by \1.5 annually, what is the expected after-tax dollar cost of the Euro-denominated bond? a. \7.44 b. \8.61 c. \10.64 d. \13.83 e. \7.26

You buy 6 call options with a contract size of AUD 30,000. They have a USD/AUD strike price of 0.57 and a premium of 7.86 (USD/AUD). You hold these options for 1 month and then sell them for 6.8 (USD/AUD). The brokerage fee on each contract is payable on both entry and exit and is USD 12.21. What is the net profit on this transaction in USD? a. \\( -190,946.52 \\) b. \\( -31,824.42 \\) c. \\( -190,800.00 \\) d. \\( -190,873.26 \\) e. \\( -55,800.00 \\) Roo-Fus Inc. wants to expand its operations internationally by selling its kangaroo-based dog food in new European markets. Roo-Fus is subject to a \35 corporate tax rate and is considering issuing a bond to finance its expansions. It is facing two options: It can issue a 10 -year, \\( \\$ 100 \\) million bond, denominated in Euro and with an interest rate of \\( \\mathbf{9 \\%} \\) p.a. Alternatively, it can issue a 10 -year, \\$100 million bond, denominated in Dollars and carrying an interest rate of 7\\% p.a. If the Euro is forecast to appreciate by \1.5 annually, what is the expected after-tax dollar cost of the Euro-denominated bond? a. \7.44 b. \8.61 c. \10.64 d. \13.83 e. \7.26 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started