Question

You buy a car for $15,000. You cannot afford to pay cash so you shop around for the best finance terms you can find and

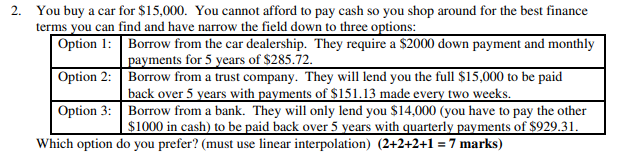

You buy a car for $15,000. You cannot afford to pay cash so you shop around for the best finance terms you can find and have narrow the field down to three options: Option 1: Borrow from the car dealership. They require a $2000 down payment and monthly payments for 5 years of $285.72. Option 2: Borrow from a trust company. They will lend you the full $15,000 to be paid back over 5 years with payments of $151.13 made every two weeks. Option 3: Borrow from a bank. They will only lend you $14,000 (you have to pay the other $1000 in cash) to be paid back over 5 years with quarterly payments of $929.31. Which option do you prefer? (must use linear interpolation) (2+2+2+1 = 7 marks)

You buy a car for $15,000. You cannot afford to pay cash so you shop around for the best finance terms you can find and have narrow the field down to three options: Option 1: Borrow from the car dealership. They require a $2000 down payment and monthly payments for 5 years of $285.72. Option 2: Borrow from a trust company. They will lend you the full $15,000 to be paid back over 5 years with payments of $151.13 made every two weeks. Option 3: Borrow from a bank. They will only lend you $14,000 (you have to pay the other $1000 in cash) to be paid back over 5 years with quarterly payments of $929.31. Which option do you prefer? (must use linear interpolation) (2+2+2+1 = 7 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started