Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You buy your first home after graduating college in the year 2020, the price is $210,000. With a 5% down payment, the bank offers you

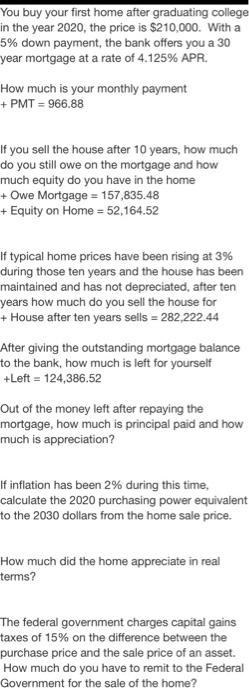

You buy your first home after graduating college in the year 2020, the price is $210,000. With a 5% down payment, the bank offers you a 30 year mortgage at a rate of 4.125% APR.

Out of the money left after repaying the mortgage, how much is principal paid and how much is appreciation?

If inflation has been 2% during this time, calculate the 2020 purchasing power equivalent to the 2030 dollars from the home sale price. (2pts)

How much did the home appreciate in real terms? (2pt)

The federal government charges capital gains taxes of 15% on the difference between the purchase price and the sale price of an asset. How much do you have to remit to the Federal Government for the sale of the home? (1pt)

What is your effective capital gains tax rate for this transaction when you consider inflation and only include real appreciation and not nominal appreciation? (1pt)

Do you find the amount of capital gains tax you have to pay to be fair given the appreciation in real terms vs nominal terms and the rate of inflation over the ten years? Defend your answer. (4pts)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started