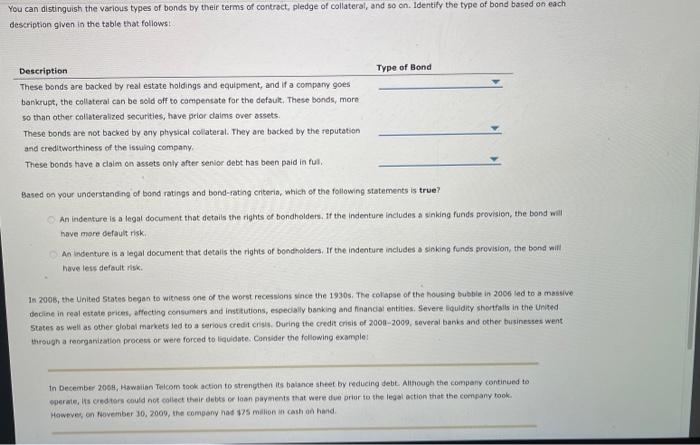

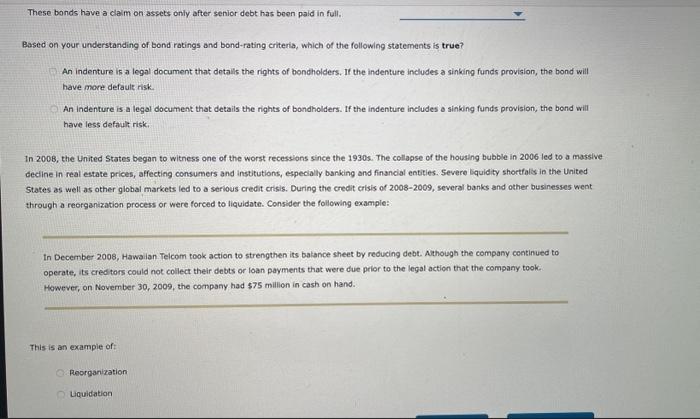

You can distinguish the various types of bonds by their terms of contract, pledge of collateral, and so on. Identify the type of bond based on each description given in the table that follows! Based on your uncerstanding of bond ratings and bond-rating criteris, which or the following statements is true? An indeature is a legat document that detais the rights of bondholders, if the indenture includes a siking funds provision, the bond wall hove mare default risk: An indenture is a legal document that detalis the rights of bondmolsers. If the indenture includes a sinking funds provision, the bond will have les defaut risk. In 2008 , the United States began to witness gee of the worst recessions since the 19305. The colapse of the housing fubble in 2006 led to a massive. docine in real estath prices, affecting consumars and insteutions, especilly banking and financal entities. Severe liquidity shortsails in the United States as well as other global markets led to a tenous credit crisis. Ouring the credit crisis of 2000-2009, several banis and other businesses went tarough a roomanization procest or were forced to liquidate. Consider the following example: In December 2008, Hawaian Telcom took action to strengthen its baiance sheet by reducing debt. Allnough the company continued to werate. Ifs credtars could not coliect thair debts or laan payments that were dve prior to the legal action that the company took. Howeve, on thovember 30,7009 , the comeeny nad 125 milion in cash an hand. An indenture is a legal document that detalis the rights of bondholders. If the indenture includes a sinking funds provision, the bond will have more defaute risk. An indenture is a legal document that details the rights of bondholders. If the indenture includes a sinking funds provision, the bond will have less default riski. In 2008, the United States began to witness one of the worst recesslons since the 1930 s. The collapse of the housing bubble in 2006 led to a massive decine in real estate prices, affecting consumers and institutions, especially barking and financial entities. Severe liquidity shortfalis in the United States as well as other giobal markets led to a serious credit crisis. During the credit crisis of 2008-2009, several banks and other businesses weot. through a reorganizatien process or were forced to liquidate. Consider the following example: In December 2008, Hawailan. Telcom took action to strengthen its balance sheet by reducing debt. Athough the company continued to operate, is credi tors could not collect their debts or loan payments that were due prior to the legal action that the company took. However, on November 30,2009 , the company had $75 million in cash on hand. This is an exampie of: Reorganization Lquidation