Answered step by step

Verified Expert Solution

Question

1 Approved Answer

you can exclude the part that looks crossed out. the question is complete. please do what you can QUESTION ONE Mercy and Ben were partners

you can exclude the part that looks crossed out.

the question is complete. please do what you can

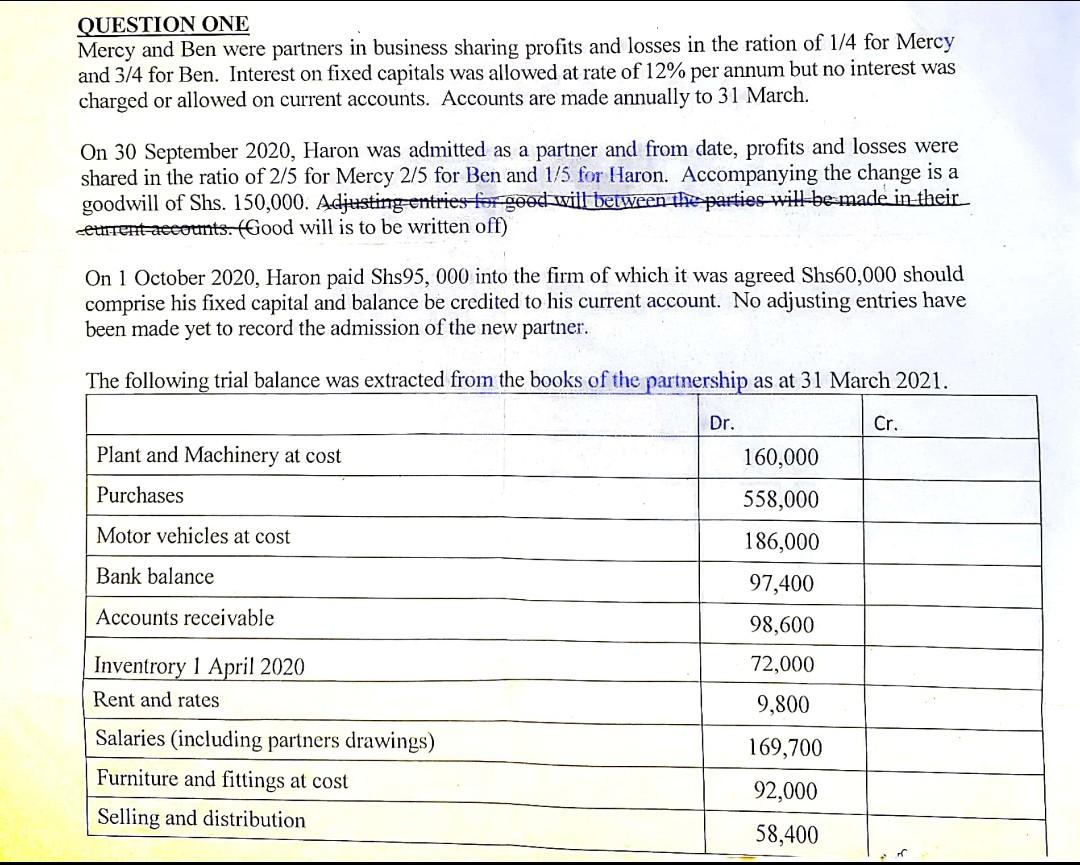

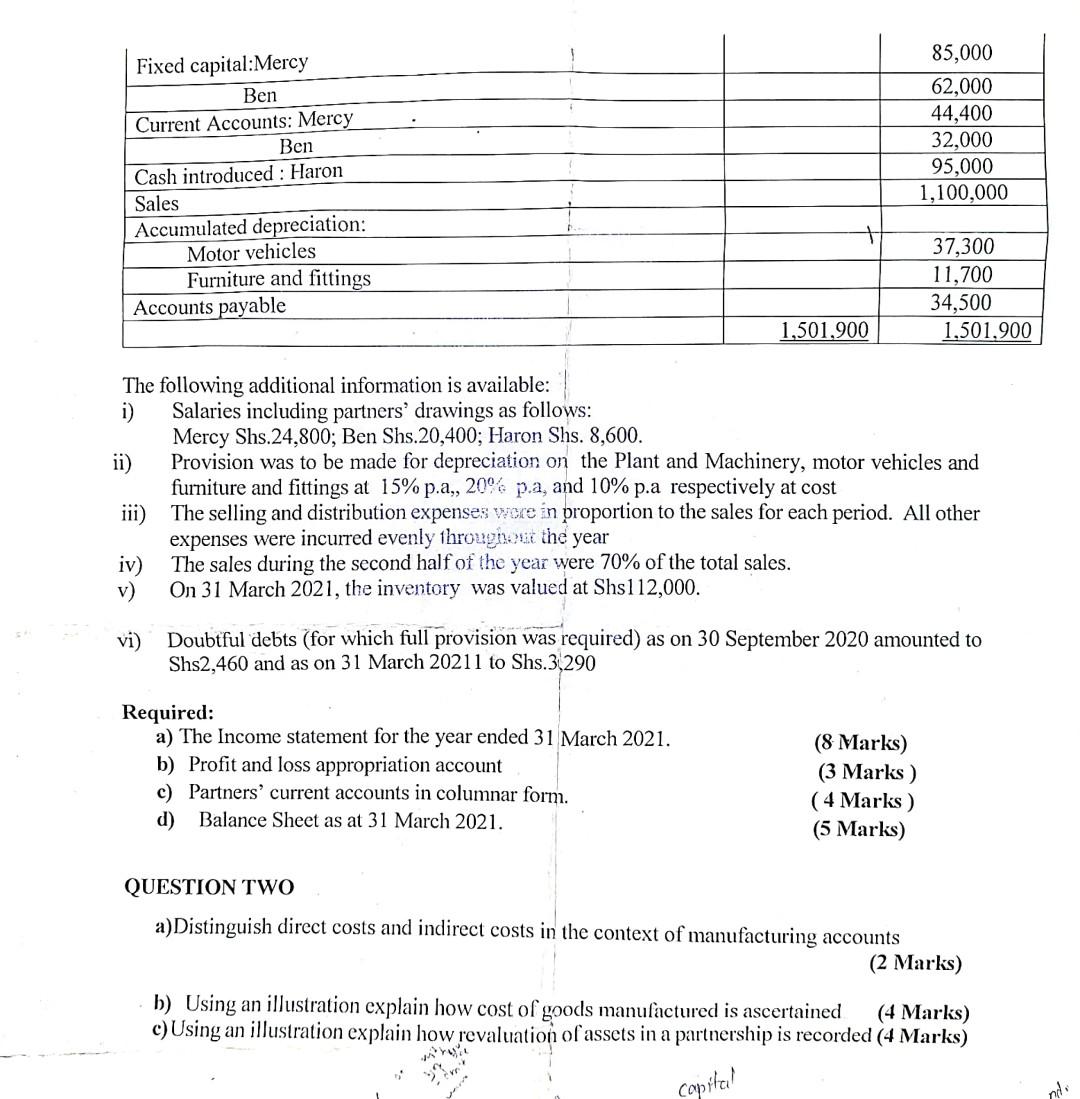

QUESTION ONE Mercy and Ben were partners in business sharing profits and losses in the ration of 1/4 for Mercy and 3/4 for Ben. Interest on fixed capitals was allowed at rate of 12% per annum but no interest was charged or allowed on current accounts. Accounts are made annually to 31 March. On 30 September 2020, Haron was admitted as a partner and from date, profits and losses were shared in the ratio of 2/5 for Mercy 2/5 for Ben and 1/5 for Haron. Accompanying the change is a goodwill of Shs. 150,000 . Adjusting entries will bewween the paties bill made in their On 1 October 2020, Haron paid Shs 95,000 into the firm of which it was agreed Shs60,000 should comprise his fixed capital and balance be credited to his current account. No adjusting entries have been made yet to record the admission of the new partner. The following additional information is available: i) Salaries including partners' drawings as follows: Mercy Shs.24,800; Ben Shs.20,400; Haron Shs. 8,600. ii) Provision was to be made for depreciation on the Plant and Machinery, motor vehicles and furniture and fittings at 15% p.a,, 20% p.a, and 10% p.a respectively at cost iii) The selling and distribution expenses were in proportion to the sales for each period. All other expenses were incurred evenly throughest the year iv) The sales during the second half of the year were 70% of the total sales. v) On 31 March 2021, the inventory was valued at Shs112,000. vi) Doubtful debts (for which full provision was required) as on 30 September 2020 amounted to Shs2,460 and as on 31 March 20211 to Shs.3,290 Required: a) The Income statement for the year ended 31 March 2021. (8 Marks) b) Profit and loss appropriation account (3 Marks) c) Partners' current accounts in columnar form. ( 4 Marks) d) Balance Sheet as at 31 March 2021. (5 Marks) QUESTION TWO a)Distinguish direct costs and indirect costs in the context of manufacturing accounts (2 Marks) b) Using an illustration explain how cost of goods manufactured is ascertained (4 Marks) c) Using an illustration explain how revaluation of assets in a partnership is recorded (4 Marks) QUESTION ONE Mercy and Ben were partners in business sharing profits and losses in the ration of 1/4 for Mercy and 3/4 for Ben. Interest on fixed capitals was allowed at rate of 12% per annum but no interest was charged or allowed on current accounts. Accounts are made annually to 31 March. On 30 September 2020, Haron was admitted as a partner and from date, profits and losses were shared in the ratio of 2/5 for Mercy 2/5 for Ben and 1/5 for Haron. Accompanying the change is a goodwill of Shs. 150,000 . Adjusting entries will bewween the paties bill made in their On 1 October 2020, Haron paid Shs 95,000 into the firm of which it was agreed Shs60,000 should comprise his fixed capital and balance be credited to his current account. No adjusting entries have been made yet to record the admission of the new partner. The following additional information is available: i) Salaries including partners' drawings as follows: Mercy Shs.24,800; Ben Shs.20,400; Haron Shs. 8,600. ii) Provision was to be made for depreciation on the Plant and Machinery, motor vehicles and furniture and fittings at 15% p.a,, 20% p.a, and 10% p.a respectively at cost iii) The selling and distribution expenses were in proportion to the sales for each period. All other expenses were incurred evenly throughest the year iv) The sales during the second half of the year were 70% of the total sales. v) On 31 March 2021, the inventory was valued at Shs112,000. vi) Doubtful debts (for which full provision was required) as on 30 September 2020 amounted to Shs2,460 and as on 31 March 20211 to Shs.3,290 Required: a) The Income statement for the year ended 31 March 2021. (8 Marks) b) Profit and loss appropriation account (3 Marks) c) Partners' current accounts in columnar form. ( 4 Marks) d) Balance Sheet as at 31 March 2021. (5 Marks) QUESTION TWO a)Distinguish direct costs and indirect costs in the context of manufacturing accounts (2 Marks) b) Using an illustration explain how cost of goods manufactured is ascertained (4 Marks) c) Using an illustration explain how revaluation of assets in a partnership is recorded (4 Marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started