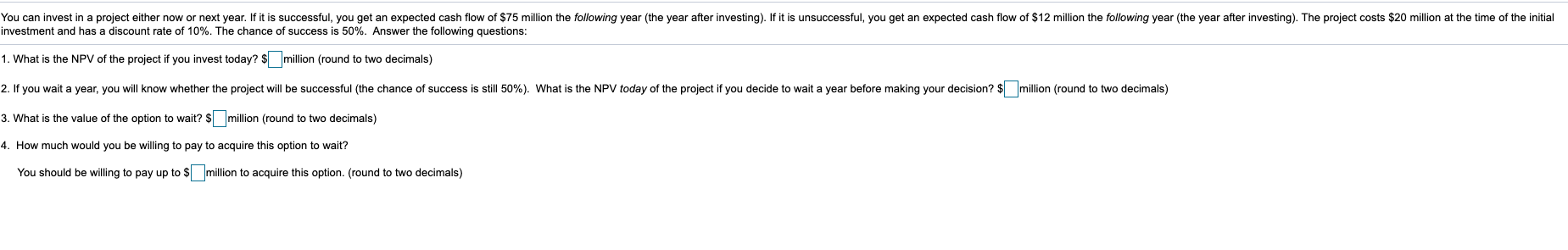

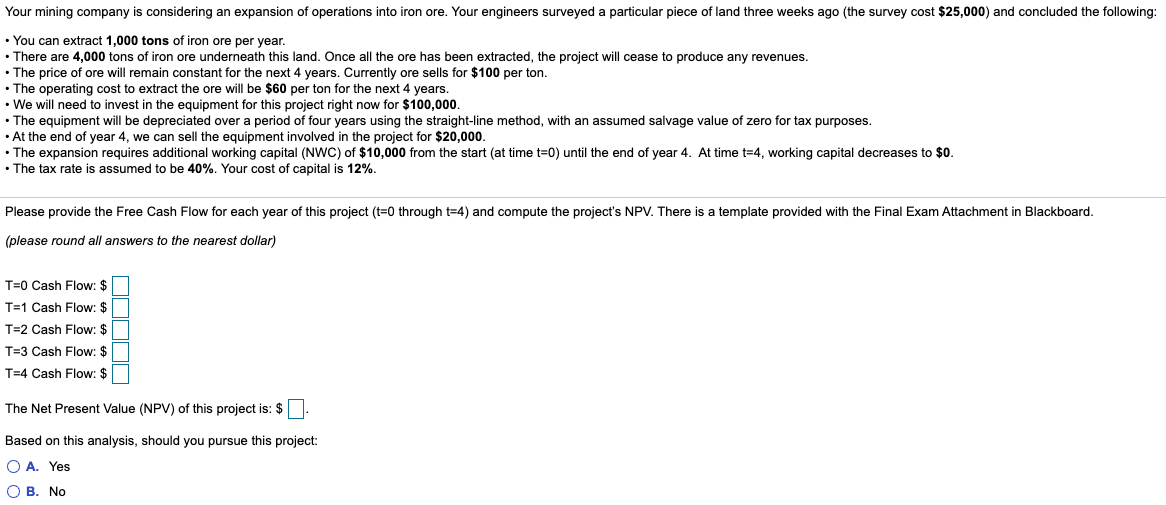

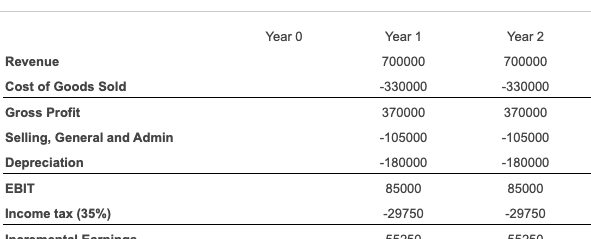

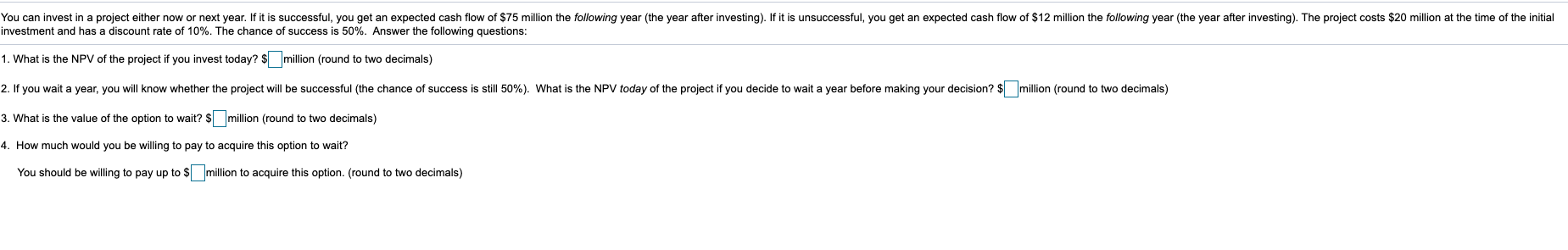

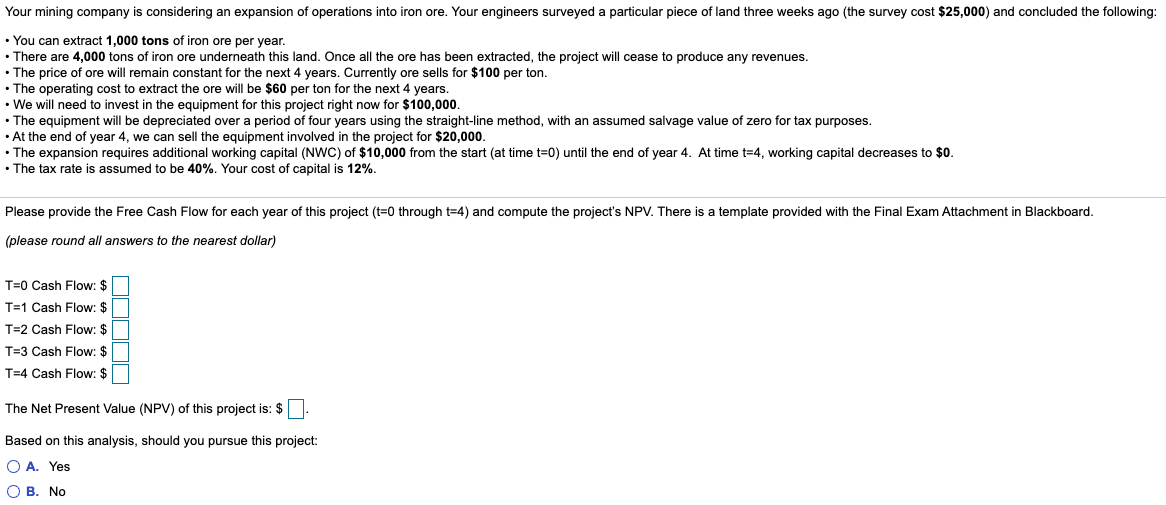

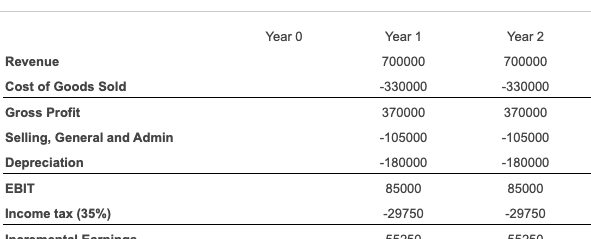

You can invest in a project either now or next year. If it is successful, you get an expected cash flow of $75 million the following year (the year after investing). If it is unsuccessful, you get an expected cash flow of $12 million the following year (the year after investing). The project costs $20 million at the time of the initial investment and has a discount rate of 10%. The chance of success is 50%. Answer the following questions: 1. What is the NPV of the project if you invest today? $_million (round to two decimals) 2. If you wait a year, you will know whether the project will be successful (the chance of success is still 50%). What is the NPV today of the project if you decide to wait a year before making your decision? $ million (round to two decimals) 3. What is the value of the option to wait? $ million (round to two decimals) 4. How much would you be willing to pay to acquire this option to wait? You should be willing to pay up to 8 million to acquire this option. (round to two decimals) * Your mining company is considering an expansion of operations into iron ore. Your engineers surveyed a particular piece of land three weeks ago (the survey cost $25,000) and concluded the following: You can extract 1,000 tons of iron ore per year. There are 4,000 tons of iron ore underneath this land. Once all the ore has been extracted, the project will cease to produce any revenues. The price of ore will remain constant for the next 4 years. Currently ore sells for $100 per ton. The operating cost to extract the ore will be $60 per ton for the next 4 years. . We will need to invest in the equipment for this project right now for $100,000. The equipment will be depreciated over a period of four years using the straight-line method, with an assumed salvage value of zero for tax purposes. At the end of year 4, we can sell the equipment involved in the project for $20,000. The expansion requires additional working capital (NWC) of $10,000 from the start (at time t=0) until the end of year 4. At time t=4, working capital decreases to $0. The tax rate is assumed to be 40%. Your cost of capital is 12%. . Please provide the Free Cash Flow for each year of this project (t=0 through t=4) and compute the project's NPV. There is a template provided with the Final Exam Attachment in Blackboard. (please round all answers to the nearest dollar) T=0 Cash Flow: $ T=1 Cash Flow: $ T=2 Cash Flow: $ T=3 Cash Flow: $ T=4 Cash Flow: $ The Net Present Value (NPV) of this project is: $ 1. Based on this analysis, should you pursue this project: O A. Yes OB. No Year 0 Year 2 700000 Revenue Cost of Goods Sold Gross Profit Selling, General and Admin Depreciation EBIT Income tax (35%) Year 1 700000 -330000 370000 -105000 -180000 -330000 370000 -105000 -180000 85000 85000 -29750 -29750 55250 En -105000 -105000 -105000 Selling, General and Admin Depreciation -180000 -180000 - 180000 EBIT 85000 85000 85000 Income tax (35%) -29750 -29750 -29750 Incremental Earnings 55250 55250 55250 -600,000 Capital Purchaes Change to NWC -12,000 -12,000 -12,000 Cromwell Industries is considering a new project which will have costs, revenues, etc. as shown by the data above. If the cost of capital is 7.6%, what is the net present value (NPV) of this project? O A. - $37,633 OB. $45,995 O C. - $39,723 OD. $41,814 You can invest in a project either now or next year. If it is successful, you get an expected cash flow of $75 million the following year (the year after investing). If it is unsuccessful, you get an expected cash flow of $12 million the following year (the year after investing). The project costs $20 million at the time of the initial investment and has a discount rate of 10%. The chance of success is 50%. Answer the following questions: 1. What is the NPV of the project if you invest today? $_million (round to two decimals) 2. If you wait a year, you will know whether the project will be successful (the chance of success is still 50%). What is the NPV today of the project if you decide to wait a year before making your decision? $ million (round to two decimals) 3. What is the value of the option to wait? $ million (round to two decimals) 4. How much would you be willing to pay to acquire this option to wait? You should be willing to pay up to 8 million to acquire this option. (round to two decimals) * Your mining company is considering an expansion of operations into iron ore. Your engineers surveyed a particular piece of land three weeks ago (the survey cost $25,000) and concluded the following: You can extract 1,000 tons of iron ore per year. There are 4,000 tons of iron ore underneath this land. Once all the ore has been extracted, the project will cease to produce any revenues. The price of ore will remain constant for the next 4 years. Currently ore sells for $100 per ton. The operating cost to extract the ore will be $60 per ton for the next 4 years. . We will need to invest in the equipment for this project right now for $100,000. The equipment will be depreciated over a period of four years using the straight-line method, with an assumed salvage value of zero for tax purposes. At the end of year 4, we can sell the equipment involved in the project for $20,000. The expansion requires additional working capital (NWC) of $10,000 from the start (at time t=0) until the end of year 4. At time t=4, working capital decreases to $0. The tax rate is assumed to be 40%. Your cost of capital is 12%. . Please provide the Free Cash Flow for each year of this project (t=0 through t=4) and compute the project's NPV. There is a template provided with the Final Exam Attachment in Blackboard. (please round all answers to the nearest dollar) T=0 Cash Flow: $ T=1 Cash Flow: $ T=2 Cash Flow: $ T=3 Cash Flow: $ T=4 Cash Flow: $ The Net Present Value (NPV) of this project is: $ 1. Based on this analysis, should you pursue this project: O A. Yes OB. No Year 0 Year 2 700000 Revenue Cost of Goods Sold Gross Profit Selling, General and Admin Depreciation EBIT Income tax (35%) Year 1 700000 -330000 370000 -105000 -180000 -330000 370000 -105000 -180000 85000 85000 -29750 -29750 55250 En -105000 -105000 -105000 Selling, General and Admin Depreciation -180000 -180000 - 180000 EBIT 85000 85000 85000 Income tax (35%) -29750 -29750 -29750 Incremental Earnings 55250 55250 55250 -600,000 Capital Purchaes Change to NWC -12,000 -12,000 -12,000 Cromwell Industries is considering a new project which will have costs, revenues, etc. as shown by the data above. If the cost of capital is 7.6%, what is the net present value (NPV) of this project? O A. - $37,633 OB. $45,995 O C. - $39,723 OD. $41,814