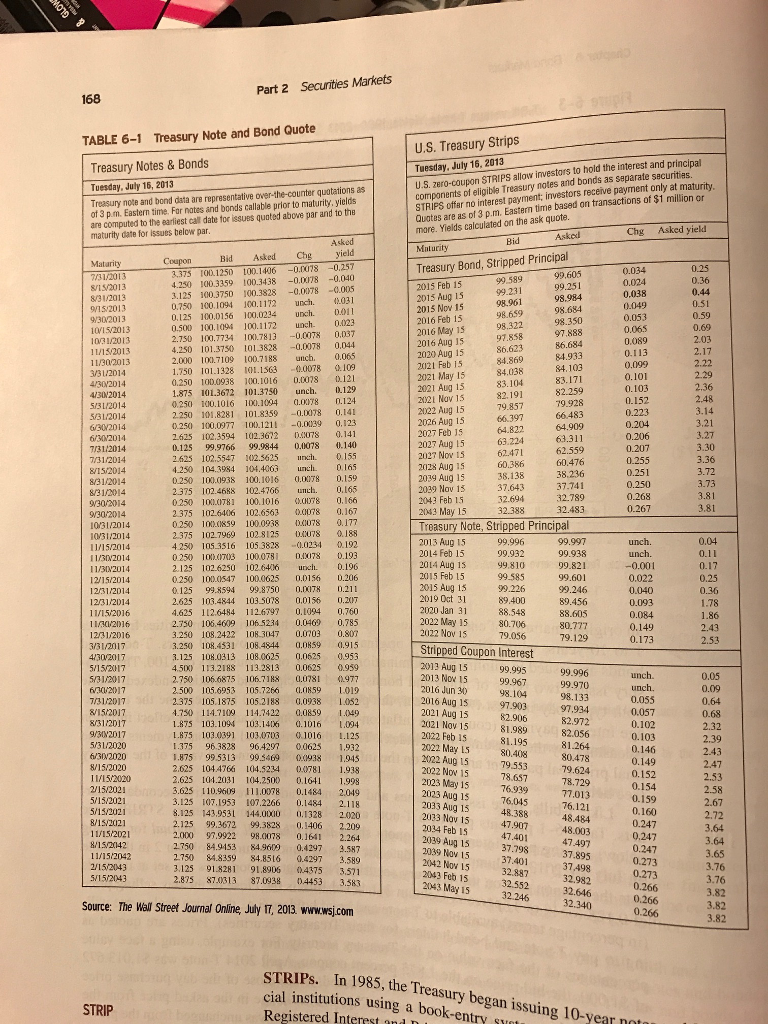

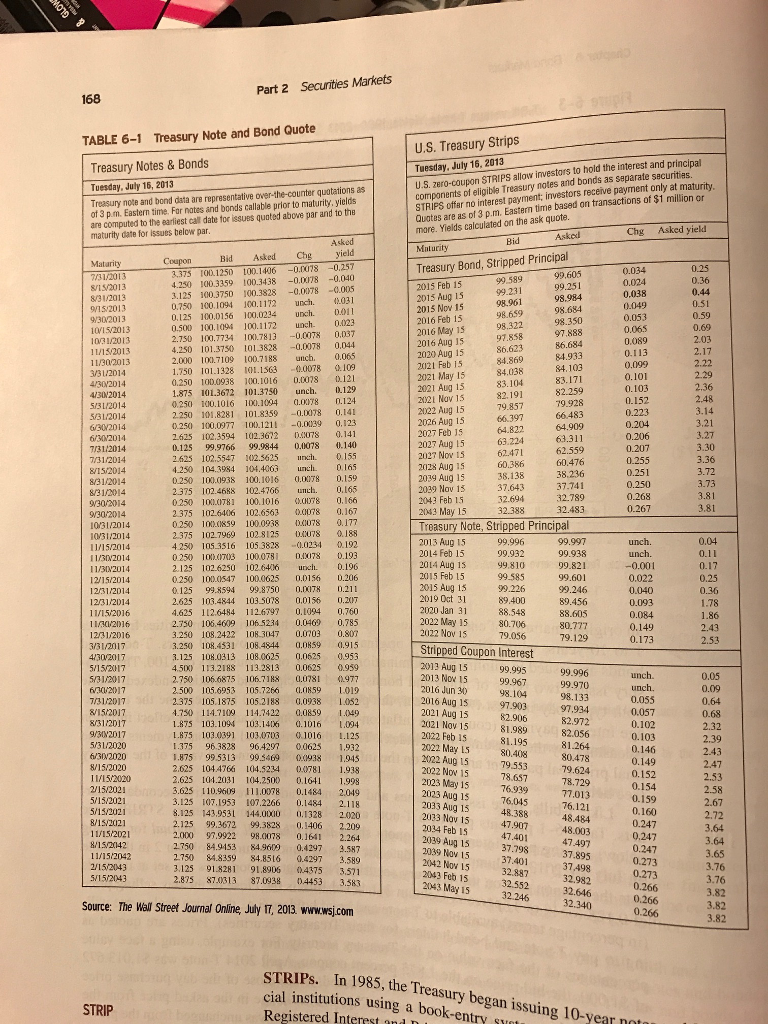

Refer to the T-note and T-bond quotes in Table 61. a. What is the asking price on the 1.750 percent May 2023 T-bond if the face value of the bond is $10,000? b. What is the bid price on the 0.375 percent May 2016 T-note if the face value of the bond is $10,000?

MOTO & Part 2 Securities Markets 168 TABLE 6-1 Treasury Note and Bond Quote U.S. Treasury Strips Tuesday, July 16, 2013 U.S. zero-coupon STRIPS allow investors to hold the interest and principal components of eligible Treasury notes and bonds as separate securities STRIPS offer no interest payment; investors receive payment only at maturity Quotes are as of 3p.m. Eastern time based on transactions of $1 million or more. Yields calculated on the ask quote. Chg Asked yield Bid 0.034 0.024 0.038 0.049 0.053 0.065 0.089 0.113 0.099 0.101 0.103 0.152 0.223 0.204 0.206 0.207 0.255 0.251 0.250 0.268 0.267 0.25 0.36 0.44 0.51 0.59 0.69 2.03 2.17 2.22 2.29 2.36 2.48 3.14 3.21 3.27 3.30 3.36 3.72 3.73 3.81 3.81 Treasury Notes & Bonds Tuesday, July 16, 2013 Treasury note and bond data are representative over-the-counter quotations as of 3p.m. Eastern time. For notes and bonds callable prior to maturity. yields are computed to the earliest call date for issues quoted above par and to the maturity date for issues below par Asked Coupon Bid Asked Chg Maturity yield 33375 100.1406 100 1250 -0.0078 7/31/2013 -0.257 4.250 100.3359 SI5/2013 -0.0078 100.3438 -0.040 100 3828 3.125 100.3750 -0.0078 -0.005 8/31/2013 unch. 0.750 100.1094 100.1172 0031 9/15/2013 100,0294 0.125 100,0156 unch D011 9/30/2013 100.1172 0.500 100.1004 unch. DA123 10/15/2013 10/31/2013 2.750 100.7734 10.7813 -0.0078 0.037 4.250 11/15/2013 101.3750) 101.3828 -0.0078 0.044 11/30/2013 2.000 100.7109100.7188 unch 0,065 3/31/2014 1.750 101.1328 L.1563 0.0078 109 4/30/2014 0.250 100.0938 (0.1016 0.0078 0.121 4/30/2014 1.875 101.3672 101.3750 unch 5/31/2014 0.250 1010 1016 10.1004 (1.06178 0.124 5/31/2014 2.250 101.8281 101.8359 -0.0078 0.141 6/30/2014 0.250 100.0977 100.1211 -0.0039 0.123 6/3/2014 2.625 102.3594 102.3612 0.0078 0.141 7/31/2014 0.125 09.9766 99.9844 0.0078 0.140 7/31/2014 2.625 102.5547 102.5625 unch 0.155 8/15/2014 4.250 104.3084 104.4063 unch 0165 8/31/2014 0.250 10.01938 100.1016 (1,0078 0.159 8/31/2014 2.375 102.46% 102.4766 unch 0.165 9/30/2014 0.250) 10DCIT81100.1016 ( 078 0.166 9/30/2014 2.375 102.640/6 102.6563 0.0078 0.167 10/31/2014 0.250 100.(1859 100.0938 0.0078 0.177 10/31/2014 2.375 102 7969 1028125 DAX078 0.188 11/15/2014 4.251) 1053516 105 3828 0.0234 0.192 11/30/2014 0.250) 100X703 100 0781D X078 0.193 11/ 2014 2.125 102.6250 102.6406 unch 0.196 12/15/2014 0.250 100.(1547 100.0625 0.0156 0.206 12/31/2014 0.125 99.8594 99.8750 DIXITX 1.211 12/31/2014 2.625 103.4844 103 5078 0.0156 0.2X 11/15/2016 4.625 112.6484 112.6797 0.1094 0.760 11 /2016 2.750 106.4009 106.5234 0.0469 0.785 1231/2016 3.250 108.2422 TON 3047 0,0203 0.807 3/31/2017 3.250) 108.4531 1084844 0859 0.915 4/30/2017 3.125 108.0313 108.0625 0.0625 0.953 5/15/2017 4.500) 113.2188 113.2813 0.0625 0.959 5/31/2017 2.750) 106.6875 106.7118 0,0781 977 6/31/2007 2.500 105.6953 105.7266 (1.0859 1.019 7/31/2017 2.375 105 1875 105 2188 0,0938 LOS2 8/15/2017 4.750 114.7109 114.7422 0.0859 149 8/31/2017 1875 103 104 103 141X10.1016 094 9/302017 1.875 103.0391 103.003 0.1016 1.125 5/31/2020 1.375 96.3828 964297 0.0625 1.932 6/30/2020 1.875 99 5313 99 3469 1928 1.045 8/15/2020 2.625 1044764 104.5244 0.0781 1.038 11/15/2020 2.625 104.2031 104.2500 0.1641 1.998 2/15/2021 3.625 10.2609 111.0078 0.1484 2.049 5/15/2021 3.125 07.1953 107.2266 0.1484 2118 5/15/2021 8.125 143.0531 144,00XID 0,1328 10/20 8/15/2021 2.125 99,3672 99.3828 0,1406 2.209 11/15/2021 2.000 97.992298.0078 0.1641 2.264 8/15/20142 2.750 849453 84.9609 0.4297 3.587 11/15/2042 2.750) 84.8359 84.8516 0.4297 3.589 2/15/20043 3.125 91.8281 91.8906 0.4375 3.571 5/15/2043 2.835 87.0313 87,0938 0.4453 3.583 Asked Molucity Treasury Bond, Stripped Principal 99,605 99.589 2015 Feb 15 99.231 99.251 2015 Aug 15 98.961 98.984 2015 Nov 15 98.6.99 98.684 2016 Feb 15 08 322 98.350 2016 May 15 07.858 97.888 2016 Aug 15 86.684 86,623 2020 Aug 15 84.933 84.869 2021 Feb 15 84.103 84.038 2021 May 15 83.171 83.104 2021 Aug 15 82.259 82.191 2121 Nov 15 79.928 79.857 2022 Aug 15 66.483 66.397 2026 Aug 15 64.909 64.822 2027 Feb 15 63.311 63.224 2027 Aug 15 2027 Nov 15 62.471 62.559 2128 Aug 15 60.386 60.476 2039 Aug is 38.138 38.236 2099 Noy 15 37.643 37.741 2043 Feb 15 32.694 32.789 2013 May 15 32.388 32.483 Treasury Note, Stripped Principal 2013 Aug 15 99.996 99.997 2014 Feb 15 99.932 99.938 2014 Aug 15 49 810 99.821 2015 Feb 15 99.585 99.601 2015 Aug 13 99.226 99.246 2019 Oct 31 89.400 89.456 2020 Jan 31 88.548 88.605 2022 May 15 80.706 80.777 2012 Noy IS 79.056 79.129 Stripped Coupon Interest 2013 Aug 15 99.995 99.996 2013 Nov 15 99.967 99.970 2016 Jun 30 98.104 2016 Aug 15 98.133 97.903 2021 Aug 15 97.934 82.906 82.972 81.989 2022 Feb 15 82.056 81.195 2022 May Is 81.264 80.408 80.478 79.553 79.624 78.657 78.729 76.939 2023 Aug 13 77.013 76,045 76.121 48 388 48.484 48.003 37.798 47.497 37.401 37.895 32.887 37.498 32.982 32.552 32.646 32.340 unch. unch. -0.001 0.022 0.040 0.093 0.084 0.149 0.173 0.04 0.11 0.17 0.25 0.36 1.78 1.86 2.43 2.53 0.05 0.09 0.64 0.68 2.32 2021 Nov 15 2.39 2.43 2.47 2022 Aug 15 2022 Nov 15 2023 May 15 2.53 unch unch. 0.055 0.057 0.102 0.103 0.146 0.149 0.152 0.154 0.159 0.160 0.247 0.247 0.247 0.273 0.273 0.266 0.266 0.266 2.58 47.907 47.401 2033 Aug 15 2003 Nov 15 2034 Feb Is 2039 Aug 15 3039 Nov 15 2042 Nov 15 2043 Feb 15 2043 May 15 2.67 2.72 3.64 3.64 3.65 3.76 3.76 3.82 3.82 3.82 32.246 Source: The Wall Street Journal Online, July 17, 2013. www.wsj.com STRIPs. In 1985, the Tre cial institutions using a Registered Interest and n IPs. In 1985, the Treasury began issuing 10-year not Litutions using a book-entry sy STRIP MOTO & Part 2 Securities Markets 168 TABLE 6-1 Treasury Note and Bond Quote U.S. Treasury Strips Tuesday, July 16, 2013 U.S. zero-coupon STRIPS allow investors to hold the interest and principal components of eligible Treasury notes and bonds as separate securities STRIPS offer no interest payment; investors receive payment only at maturity Quotes are as of 3p.m. Eastern time based on transactions of $1 million or more. Yields calculated on the ask quote. Chg Asked yield Bid 0.034 0.024 0.038 0.049 0.053 0.065 0.089 0.113 0.099 0.101 0.103 0.152 0.223 0.204 0.206 0.207 0.255 0.251 0.250 0.268 0.267 0.25 0.36 0.44 0.51 0.59 0.69 2.03 2.17 2.22 2.29 2.36 2.48 3.14 3.21 3.27 3.30 3.36 3.72 3.73 3.81 3.81 Treasury Notes & Bonds Tuesday, July 16, 2013 Treasury note and bond data are representative over-the-counter quotations as of 3p.m. Eastern time. For notes and bonds callable prior to maturity. yields are computed to the earliest call date for issues quoted above par and to the maturity date for issues below par Asked Coupon Bid Asked Chg Maturity yield 33375 100.1406 100 1250 -0.0078 7/31/2013 -0.257 4.250 100.3359 SI5/2013 -0.0078 100.3438 -0.040 100 3828 3.125 100.3750 -0.0078 -0.005 8/31/2013 unch. 0.750 100.1094 100.1172 0031 9/15/2013 100,0294 0.125 100,0156 unch D011 9/30/2013 100.1172 0.500 100.1004 unch. DA123 10/15/2013 10/31/2013 2.750 100.7734 10.7813 -0.0078 0.037 4.250 11/15/2013 101.3750) 101.3828 -0.0078 0.044 11/30/2013 2.000 100.7109100.7188 unch 0,065 3/31/2014 1.750 101.1328 L.1563 0.0078 109 4/30/2014 0.250 100.0938 (0.1016 0.0078 0.121 4/30/2014 1.875 101.3672 101.3750 unch 5/31/2014 0.250 1010 1016 10.1004 (1.06178 0.124 5/31/2014 2.250 101.8281 101.8359 -0.0078 0.141 6/30/2014 0.250 100.0977 100.1211 -0.0039 0.123 6/3/2014 2.625 102.3594 102.3612 0.0078 0.141 7/31/2014 0.125 09.9766 99.9844 0.0078 0.140 7/31/2014 2.625 102.5547 102.5625 unch 0.155 8/15/2014 4.250 104.3084 104.4063 unch 0165 8/31/2014 0.250 10.01938 100.1016 (1,0078 0.159 8/31/2014 2.375 102.46% 102.4766 unch 0.165 9/30/2014 0.250) 10DCIT81100.1016 ( 078 0.166 9/30/2014 2.375 102.640/6 102.6563 0.0078 0.167 10/31/2014 0.250 100.(1859 100.0938 0.0078 0.177 10/31/2014 2.375 102 7969 1028125 DAX078 0.188 11/15/2014 4.251) 1053516 105 3828 0.0234 0.192 11/30/2014 0.250) 100X703 100 0781D X078 0.193 11/ 2014 2.125 102.6250 102.6406 unch 0.196 12/15/2014 0.250 100.(1547 100.0625 0.0156 0.206 12/31/2014 0.125 99.8594 99.8750 DIXITX 1.211 12/31/2014 2.625 103.4844 103 5078 0.0156 0.2X 11/15/2016 4.625 112.6484 112.6797 0.1094 0.760 11 /2016 2.750 106.4009 106.5234 0.0469 0.785 1231/2016 3.250 108.2422 TON 3047 0,0203 0.807 3/31/2017 3.250) 108.4531 1084844 0859 0.915 4/30/2017 3.125 108.0313 108.0625 0.0625 0.953 5/15/2017 4.500) 113.2188 113.2813 0.0625 0.959 5/31/2017 2.750) 106.6875 106.7118 0,0781 977 6/31/2007 2.500 105.6953 105.7266 (1.0859 1.019 7/31/2017 2.375 105 1875 105 2188 0,0938 LOS2 8/15/2017 4.750 114.7109 114.7422 0.0859 149 8/31/2017 1875 103 104 103 141X10.1016 094 9/302017 1.875 103.0391 103.003 0.1016 1.125 5/31/2020 1.375 96.3828 964297 0.0625 1.932 6/30/2020 1.875 99 5313 99 3469 1928 1.045 8/15/2020 2.625 1044764 104.5244 0.0781 1.038 11/15/2020 2.625 104.2031 104.2500 0.1641 1.998 2/15/2021 3.625 10.2609 111.0078 0.1484 2.049 5/15/2021 3.125 07.1953 107.2266 0.1484 2118 5/15/2021 8.125 143.0531 144,00XID 0,1328 10/20 8/15/2021 2.125 99,3672 99.3828 0,1406 2.209 11/15/2021 2.000 97.992298.0078 0.1641 2.264 8/15/20142 2.750 849453 84.9609 0.4297 3.587 11/15/2042 2.750) 84.8359 84.8516 0.4297 3.589 2/15/20043 3.125 91.8281 91.8906 0.4375 3.571 5/15/2043 2.835 87.0313 87,0938 0.4453 3.583 Asked Molucity Treasury Bond, Stripped Principal 99,605 99.589 2015 Feb 15 99.231 99.251 2015 Aug 15 98.961 98.984 2015 Nov 15 98.6.99 98.684 2016 Feb 15 08 322 98.350 2016 May 15 07.858 97.888 2016 Aug 15 86.684 86,623 2020 Aug 15 84.933 84.869 2021 Feb 15 84.103 84.038 2021 May 15 83.171 83.104 2021 Aug 15 82.259 82.191 2121 Nov 15 79.928 79.857 2022 Aug 15 66.483 66.397 2026 Aug 15 64.909 64.822 2027 Feb 15 63.311 63.224 2027 Aug 15 2027 Nov 15 62.471 62.559 2128 Aug 15 60.386 60.476 2039 Aug is 38.138 38.236 2099 Noy 15 37.643 37.741 2043 Feb 15 32.694 32.789 2013 May 15 32.388 32.483 Treasury Note, Stripped Principal 2013 Aug 15 99.996 99.997 2014 Feb 15 99.932 99.938 2014 Aug 15 49 810 99.821 2015 Feb 15 99.585 99.601 2015 Aug 13 99.226 99.246 2019 Oct 31 89.400 89.456 2020 Jan 31 88.548 88.605 2022 May 15 80.706 80.777 2012 Noy IS 79.056 79.129 Stripped Coupon Interest 2013 Aug 15 99.995 99.996 2013 Nov 15 99.967 99.970 2016 Jun 30 98.104 2016 Aug 15 98.133 97.903 2021 Aug 15 97.934 82.906 82.972 81.989 2022 Feb 15 82.056 81.195 2022 May Is 81.264 80.408 80.478 79.553 79.624 78.657 78.729 76.939 2023 Aug 13 77.013 76,045 76.121 48 388 48.484 48.003 37.798 47.497 37.401 37.895 32.887 37.498 32.982 32.552 32.646 32.340 unch. unch. -0.001 0.022 0.040 0.093 0.084 0.149 0.173 0.04 0.11 0.17 0.25 0.36 1.78 1.86 2.43 2.53 0.05 0.09 0.64 0.68 2.32 2021 Nov 15 2.39 2.43 2.47 2022 Aug 15 2022 Nov 15 2023 May 15 2.53 unch unch. 0.055 0.057 0.102 0.103 0.146 0.149 0.152 0.154 0.159 0.160 0.247 0.247 0.247 0.273 0.273 0.266 0.266 0.266 2.58 47.907 47.401 2033 Aug 15 2003 Nov 15 2034 Feb Is 2039 Aug 15 3039 Nov 15 2042 Nov 15 2043 Feb 15 2043 May 15 2.67 2.72 3.64 3.64 3.65 3.76 3.76 3.82 3.82 3.82 32.246 Source: The Wall Street Journal Online, July 17, 2013. www.wsj.com STRIPs. In 1985, the Tre cial institutions using a Registered Interest and n IPs. In 1985, the Treasury began issuing 10-year not Litutions using a book-entry sy STRIP