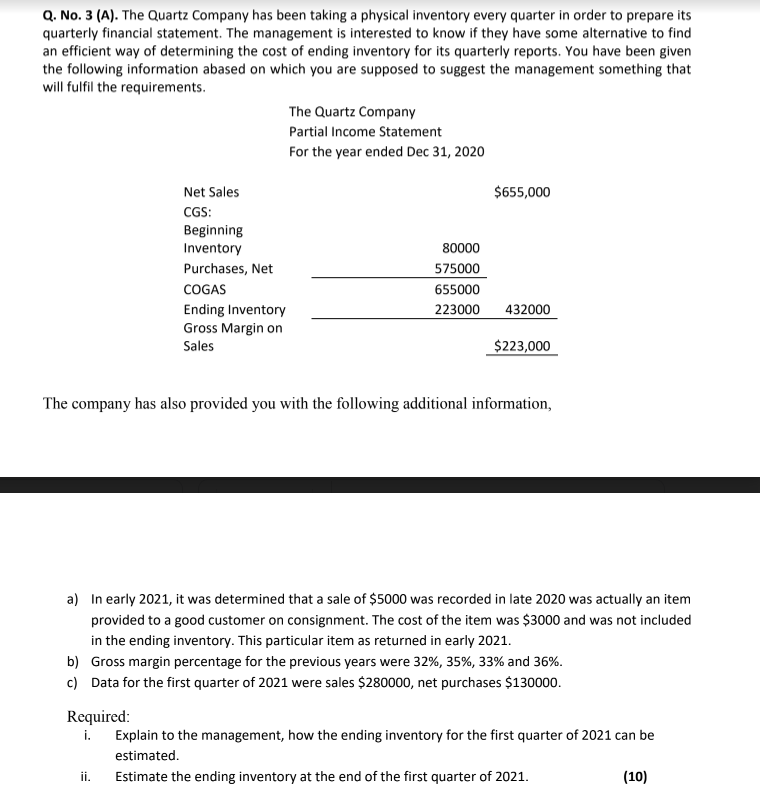

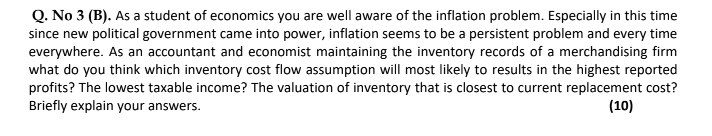

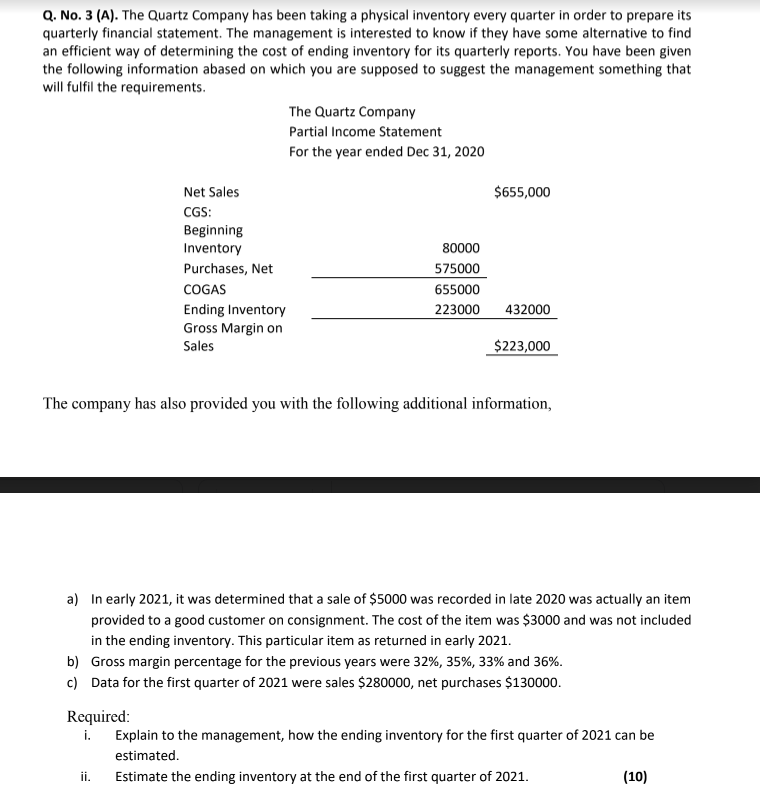

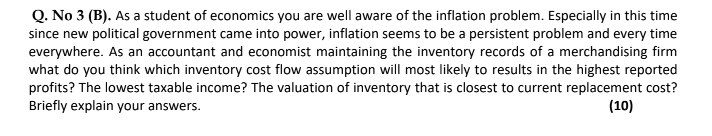

Q. No. 3 (A). The Quartz Company has been taking a physical inventory every quarter in order to prepare its quarterly financial statement. The management is interested to know if they have some alternative to find an efficient way of determining the cost of ending inventory for its quarterly reports. You have been given the following information abased on which you are supposed to suggest the management something that will fulfil the requirements. The Quartz Company Partial Income Statement For the year ended Dec 31, 2020 $655,000 Net Sales CGS: Beginning Inventory Purchases, Net COGAS Ending Inventory Gross Margin on Sales 80000 575000 655000 223000 432000 $223,000 The company has also provided you with the following additional information, a) In early 2021, it was determined that a sale of $5000 was recorded in late 2020 was actually an item provided to a good customer on consignment. The cost of the item was $3000 and was not included in the ending inventory. This particular item as returned in early 2021. b) Gross margin percentage for the previous years were 32%, 35%, 33% and 36%. c) Data for the first quarter of 2021 were sales $280000, net purchases $130000. Required: i. Explain to the management, how the ending inventory for the first quarter of 2021 can be estimated ii. Estimate the ending inventory at the end of the first quarter of 2021. (10) Q. No 3 (B). As a student of economics you are well aware of the inflation problem. Especially in this time since new political government came into power, inflation seems to be a persistent problem and every time everywhere. As an accountant and economist maintaining the inventory records of a merchandising firm what do you think which inventory cost flow assumption will most likely to results in the highest reported profits? The lowest taxable income? The valuation of inventory that is closest to current replacement cost? Briefly explain your answers. (10) Q. No. 3 (A). The Quartz Company has been taking a physical inventory every quarter in order to prepare its quarterly financial statement. The management is interested to know if they have some alternative to find an efficient way of determining the cost of ending inventory for its quarterly reports. You have been given the following information abased on which you are supposed to suggest the management something that will fulfil the requirements. The Quartz Company Partial Income Statement For the year ended Dec 31, 2020 $655,000 Net Sales CGS: Beginning Inventory Purchases, Net COGAS Ending Inventory Gross Margin on Sales 80000 575000 655000 223000 432000 $223,000 The company has also provided you with the following additional information, a) In early 2021, it was determined that a sale of $5000 was recorded in late 2020 was actually an item provided to a good customer on consignment. The cost of the item was $3000 and was not included in the ending inventory. This particular item as returned in early 2021. b) Gross margin percentage for the previous years were 32%, 35%, 33% and 36%. c) Data for the first quarter of 2021 were sales $280000, net purchases $130000. Required: i. Explain to the management, how the ending inventory for the first quarter of 2021 can be estimated ii. Estimate the ending inventory at the end of the first quarter of 2021. (10) Q. No 3 (B). As a student of economics you are well aware of the inflation problem. Especially in this time since new political government came into power, inflation seems to be a persistent problem and every time everywhere. As an accountant and economist maintaining the inventory records of a merchandising firm what do you think which inventory cost flow assumption will most likely to results in the highest reported profits? The lowest taxable income? The valuation of inventory that is closest to current replacement cost? Briefly explain your answers