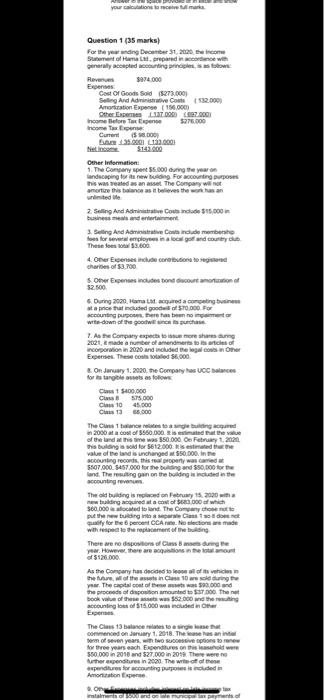

you can make Question 1 (35 marks) For the ending December 31, 2020 the one Seaf Hama Mprepared income with Generally accepted in Revums 3974.000 Expenses Cost of Good Sold S273.000) Serleg And Administrative Cote 532.000 Amorization Expense (15.000 Others 17.000 7.000 Income Before Totene $276.000 Income Two Curen.000) B33000 33.000 Nietot $143.600 Other Information: 1. The Company spent 55.000 Garing the year on landscaping for a new building For accounting purposes this was eated as an asset The Company wil not amortize this balance as it believes the worsan businesses and entertainment 3.Selling And Admin Condum fosfor every in a local gol and country Club These fost 3.600 4. One contoured charities of 53.700 Omer Experience on our of 52.500 During 2000. Hamad, and conting tatal indlused of 50.000 CPU here to mentor wite-down of the goodwill purchase 2. As the Company expectatimore shang 2021, made a number of ander os tics corporation in 2020 and included the legal conser Expense The.000 on January 1, 2020. The Company has UOC Balance for a targets as follow Class $400,000 Class 55.000 Class 10 45.000 C135.000 The Cumbuling In 2000 at a cost of 5550.000 is estimated that the value of the land at this was $50.000 Oes February 1, 2020 this building sold for 5612.000 is estimated that the value of the land is unchanged 550.000. Inte accusing records, this to properly was carried 5507.000. 5457.000 for the building and 550,000 for the land. The resulting an on the building is included in the accounting revenue The building is placed on February 15, 2020 new building oquired at a cost of which 360.000 located in one. The Company doente put the new building interessant ally for the percent CCA. No sections are made with respect to the replacement of the building There are no disposition of Classemete year. However, there are on the amount of 5126.000 As the Company decided to come all of the vehicle The capital cost of these was 5.000 and the procede of disposition mounted to do. There book value of these sw $2.000 de accounting out of 515.000 was included in the The Class 13 baleta commented on January 1, 2018. The seasain Dorm of seven years in two sive ptions are for three years each Expenditures on this sold were 550.000 in 2018 and 27.000 in 2018. There were to herpenditures in 2020. The woofthese expenditures for accounting purpose is de Amination On you can make Question 1 (35 marks) For the ending December 31, 2020 the one Seaf Hama Mprepared income with Generally accepted in Revums 3974.000 Expenses Cost of Good Sold S273.000) Serleg And Administrative Cote 532.000 Amorization Expense (15.000 Others 17.000 7.000 Income Before Totene $276.000 Income Two Curen.000) B33000 33.000 Nietot $143.600 Other Information: 1. The Company spent 55.000 Garing the year on landscaping for a new building For accounting purposes this was eated as an asset The Company wil not amortize this balance as it believes the worsan businesses and entertainment 3.Selling And Admin Condum fosfor every in a local gol and country Club These fost 3.600 4. One contoured charities of 53.700 Omer Experience on our of 52.500 During 2000. Hamad, and conting tatal indlused of 50.000 CPU here to mentor wite-down of the goodwill purchase 2. As the Company expectatimore shang 2021, made a number of ander os tics corporation in 2020 and included the legal conser Expense The.000 on January 1, 2020. The Company has UOC Balance for a targets as follow Class $400,000 Class 55.000 Class 10 45.000 C135.000 The Cumbuling In 2000 at a cost of 5550.000 is estimated that the value of the land at this was $50.000 Oes February 1, 2020 this building sold for 5612.000 is estimated that the value of the land is unchanged 550.000. Inte accusing records, this to properly was carried 5507.000. 5457.000 for the building and 550,000 for the land. The resulting an on the building is included in the accounting revenue The building is placed on February 15, 2020 new building oquired at a cost of which 360.000 located in one. The Company doente put the new building interessant ally for the percent CCA. No sections are made with respect to the replacement of the building There are no disposition of Classemete year. However, there are on the amount of 5126.000 As the Company decided to come all of the vehicle The capital cost of these was 5.000 and the procede of disposition mounted to do. There book value of these sw $2.000 de accounting out of 515.000 was included in the The Class 13 baleta commented on January 1, 2018. The seasain Dorm of seven years in two sive ptions are for three years each Expenditures on this sold were 550.000 in 2018 and 27.000 in 2018. There were to herpenditures in 2020. The woofthese expenditures for accounting purpose is de Amination On