Answered step by step

Verified Expert Solution

Question

1 Approved Answer

you can name the merchandising company Memphis Style corporation. these are all of the directions. you are can make up everything else aslong as its

you can name the merchandising company Memphis Style corporation.

you can name the merchandising company Memphis Style corporation.

these are all of the directions. you are can make up everything else aslong as its accurate

these are all of the directions. you are can make up everything else aslong as its accurateyou are to make up the equity investment. that is all of the directions

start by finding common and preffered stock

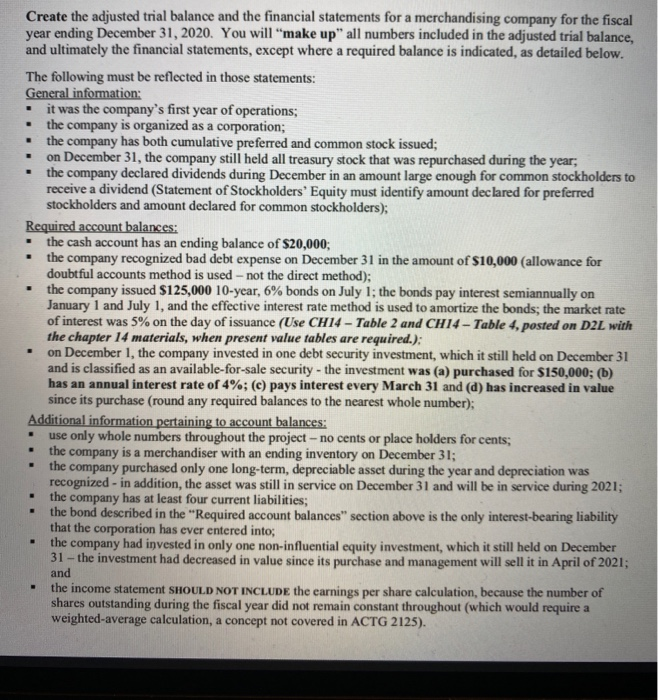

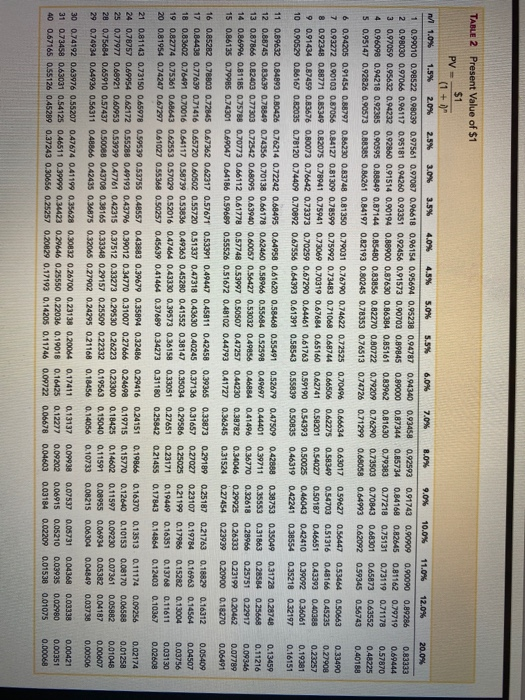

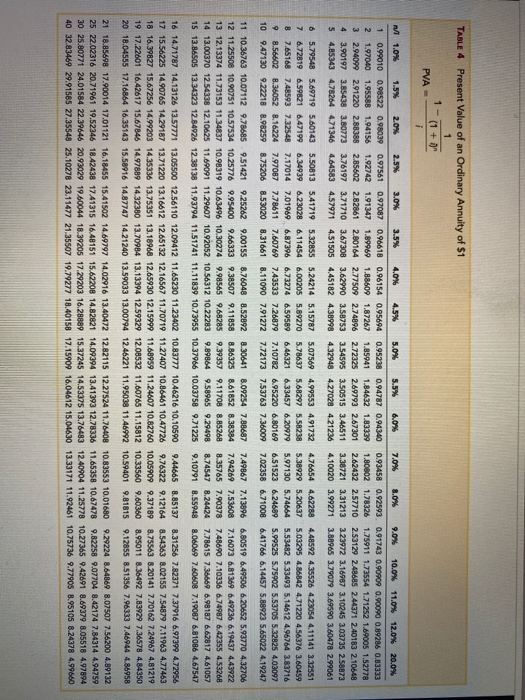

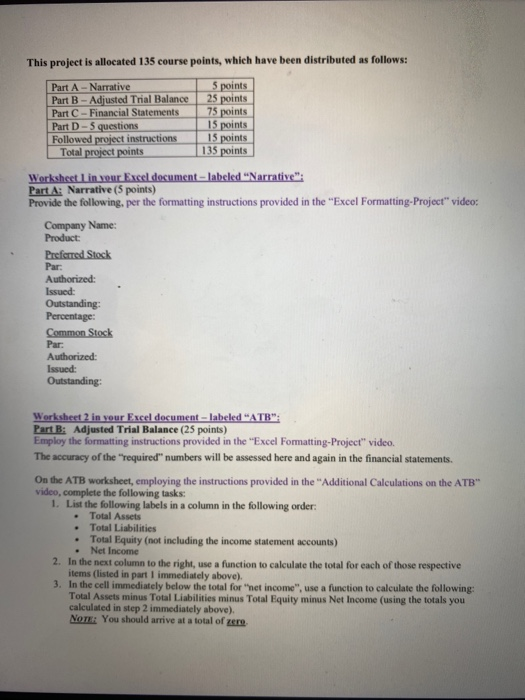

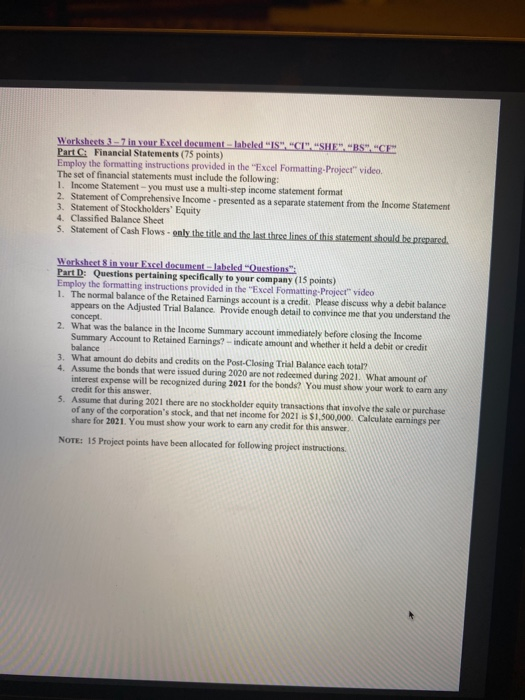

Create the adjusted trial balance and the financial statements for a merchandising company for the fiscal year ending December 31, 2020. You will make up all numbers included in the adjusted trial balance. and ultimately the financial statements, except where a required balance is indicated, as detailed below. The following must be reflected in those statements: General information: . it was the company's first year of operations; the company is organized as a corporation; the company has both cumulative preferred and common stock issued; . on December 31, the company still held all treasury stock that was repurchased during the year; the company declared dividends during December in an amount large enough for common stockholders to receive a dividend (Statement of Stockholders' Equity must identify amount declared for preferred stockholders and amount declared for common stockholders); Required account balances: the cash account has an ending balance of $20,000; the company recognized bad debt expense on December 31 in the amount of $10,000 (allowance for doubtful accounts method is used - not the direct method); the company issued $125,000 10-year, 6% bonds on July 1: the bonds pay interest semiannually on January 1 and July 1, and the effective interest rate method is used to amortize the bonds, the market rate of interest was 5% on the day of issuance (Use CH14 - Table 2 and CH14 - Table 4. posted on D2L with the chapter 14 materials, when present value tables are required.): on December 1, the company invested in one debt security investment, which it still held on December 31 and is classified as an available-for-sale security - the investment was (a) purchased for $150,000; (b) has an annual interest rate of 4%; (c) pays interest every March 31 and (d) has increased in value since its purchase (round any required balances to the nearest whole number); Additional information pertaining to account balances: . use only whole numbers throughout the project - no cents or place holders for cents; the company is a merchandiser with an ending inventory on December 31; - the company purchased only one long-term, depreciable asset during the year and depreciation was recognized - in addition, the asset was still in service on December 31 and will be in service during 2021 the company has at least four current liabilities; the bond described in the "Required account balances" section above is the only interest-bearing liability that the corporation has ever entered into; the company had invested in only one non-influential equity investment, which it still held on December 31 - the investment had decreased in value since its purchase and management will sell it in April of 2021, and the income statement SHOULD NOT INCLUDE the earnings per share calculation, because the number of shares outstanding during the fiscal year did not remain constant throughout (which would require a weighted average calculation, a concept not covered in ACTG 2125). TABLE 2 Present Value of $1 $1 PV (1 + M 1.0% 1.5% 2.0% 2.5% 3.0 3.5 4.0% 4.5 5.0% 5.5% 6.0% 7.0% 0.0% 0.0% 10.0% 11.0% 12.0% 1 0.99010 0.98522 0.98039 0.97561 0.97087 0.96618 0.96154 0.95694 0.95238 0.94787 0.94340 0.93458 0.92593 0.91743 0.909090.90090 0.89286 2 0.98030 0.97066 0.96117 0.95181 0.94260 0.93351 0.92456 0.91573 0.90703 0.89845 0.89000 0.87344 0.85734 0.84168 0.82645 0.81162 0.79719 3 0.97059 0.95632 0.94232 0.92860 0.91514 0.90194 0.88900 0.87630 0.86384 0.85161 0.83962 0.81630 0.79383 0.77218 0.75131 0.73119 0.71178 4 0.96098 0.94218 0.92385 0.90595 0.88849 0.87144 0.65480 0.83856 0.82270 0.80722 0.79209 0.76290 0.73503 0.70143 0.66301 0.65873 0.63552 5 0.95147 0.92826 0.90573 0.88385 0.86261 0.84197 0.82193 0.80245 0.78353 0.76513 0.74726 0.71299 0.66058 0.64993 0.62092 0.59345 0.56743 6 0.94205 0.91454 0.88797 0.86230 0.83746 0.81350 0.79031 0.76790 0.74622 0.72525 0.70496 0.66634 0.63017 0.59627 0.56447 0.53464 0.50663 7 0.93272 0.90103 0.87056 0.84127 0.81309 0.78590 0.75992 0.73483 0.71068 0.68744 0.66506 0.62275 0.58340 0.54703 0.51316 0.48166 0.45235 8 0.92348 0.88771 0.85349 0.82075 0.78041 0.75041 0.73069 0.70319 0.67684 0.65160 0.62741 0.58201 0.54027 0.50187 0.46651 0.43393 0.40388 9 0.91434 0.87459 0.83676 0.10073 0.76642 0.73373 0.70259 0.67290 0.64461 0.61763 0.59190 0.54393 0.50025 0.46043 0.42410 0.39092 0.36061 10 0.90529 0.86167 0.82035 0.78120 0.74409 0.70892 0.67556 0.64393 0.61391 0.58543 0.55639 0.50835 0.46319 042241 0.38554 0.35218 0.32197 20.0% 0.83333 0.69444 0.57870 0.48225 0.40188 0.33490 0.27908 0.23257 0.19381 0.16151 0.13459 0.11216 0.09346 0.07789 0.06491 11 0.89632 0.84093 0.80426 0.76214 0.72242 0.66495 0.64958 0.61620 0.58468 0.55491 0.52679 0.47509 0.42668 0.36753 0.35049 0.31728 0.28748 12 0.88745 0.83639 0.78849 0.74356 0.70138 0.66178 0.62460 0.58966 0.55664 0.52598 0.49697 0.44401 0.39711 0.35553 0.31863 0.28584 0.25668 13 0.87866 0.82403 0.77303 0.72542 0.68095 0.63940 0.60057 0.56427 0.53032 0.49856 0.46884 0.41496 0.36770 0.32618 0.28966 0.25751 0.22917 14 0.86996 0.81185 0.75788 0.70773 0.66112 0.61778 0.57748 0.53997 0.50507 0.47257 0.44230 0.38782 0.34046 0.29925 0.26333 0.23199 0.20462 15 0.86135 0.79985 0.74301 0.69047 0.64186 0.59689 0.55526 0.51672 0.48102 0.44793 0.41727 0.36245 0.31524 0.27454 0.23939 0.20900 0.18270 16 0.85282 0.78803 0.72845 0.67362 0.62317 0.57671 0.53391 0.49447 0.45811 042458 0.39365 0.33873 0.29189 0.25187 0.21763 0.18829 0.16312 17 0.84438 0.77639 0.71416 0.65720 0.60502 0.55720 0.51337 0.47318 0.43630 040245 0.37136 0.31657 0.27027 0.23107 0.19784 0.16963 0.14564 18 0.83602 0.76491 0.70016 0.54117 0.58739 0.53836 0.49363 0.45280 0.41552 0.38147 0.35034 0.29586 0.25025 0.21199 0.17986 0.15282 0.13004 19 0.82774 0.75361 0.68643 0.62553 0.57029 0.52016 0.47464 0.43330 0.39573 0.36158 0.33051 0.27651 0.23171 0.19409 0.16351 0.13768 0.11611 20 0.81954 0.74247 0.67297 0.61027 0.55368 0.50257 0.45639 0.41464 0.37689 0.34273 0.31180 0.25842 0.21455 0.17843 0.14864 0.12403 0.10367 21 0.81143 0.73150 0.65978 0.59539 0.53755 0.48557 0.43883 0.39679 0.35894 0.32486 0.29416 0.24151 0.1986 0.16370 0.13513 0.11174 0.00256 24 0.78757 0.69954 0.62172 0.55288 0.49193 0.43796 0.39012 0.34770 0.31007 0.27666 0.2478 0.19715 0.15770 0.12640 0.10153 0.08170 0.06588 25 0.77977 0.68921 0.60953 0.53939 0.47761 0.42315 0.37512 0.33273 0.29530 0.26223 0.233000.15425 0.14602 0.11597 0.09230 0.07361 0.05882 28 0.75684 0.65910 0.57437 0.50088 0.43708 0.30165 0.33348 0.20157 0.25509 0.22332 0.19563 0.15040 0.11591 0.08955 0.06934 0.05382 0.04187 29 0.74934 0.64936 0.56311 0.48866 0.42435 0.875 0.32065 0.27902 0.24295 0.21168 0.18456 0.14056 0.10733 0.06215 0.06304 0.04849 0.03738 30 0.74192 0.63976 0.55207 0.47674 0.4119 0.35628 0.30832 0.26700 0.23138 0.20064 0.17411 0.13137 0.09938 0.07537 0.05731 0.04368 0.03338 31 0.73458 0.63031 0.54125 0.46511 0.3 0. 23 0.29646 0.25550 0.22036 0.19018 0.16425 0.12277 0.09202 0.06915 0.05210 0.03935 0.02780 40 0.67165 0.55126 045289 0.37243 0.30656 0.25257 0.20020 0.17193 0.14205 0.11746 0.09722 0.00678 0.04603 0.03184 0.02209 0.01538 0.01075 0.05409 0.04507 0.03756 0.03130 0.02608 0.02174 0.01258 0.01048 0.00607 0.00506 0.00421 0.0031 0.00068 TABLE 4 Present Value of an ordinary Annuity of $1 1- (1+ PVA - mi 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% 4.0% 4.5% 5.0% 5.5% 6.0% 7.0% 0.0% 9.0% 0.0% 11.0% 12.0% 20.0% 1 0.99010 0.98522 0.98039 0.97561 0.97087 0.96618 0.96154 0.95694 0.95238 0.94787 0.94340 0.93458 0.92593 0.91743 0.90909 0.90090 0.89286 0.83333 2 1.97040 1.95588 1.94156 1.92742 1.91347 1.89969 1.88609 1.87267 1.85941 1.84632 1.83339 1.80802 1.78326 1.75911 1.73554 1.71252 1.69005 1.52778 3 2.94099 2.91220 2.86385 2.85602 2.82861 2.80164 2.77509 2.74896 2.72325 2.69793 2.67301 2.62432 2.57710 2.53129 2.48685 2.44371 2.40183 2.10548 4 3.90197 3.85438 3.80773 3.76197 3.71710 3.67308 3.62990 3.58753 3.54595 3.50515 3.46511 3.38721 3.31213 3.23972 3.16987 3.10245 3.03735 2.58873 $ 4.85343 4.78264 471346 4.64583 4.57971 4.51505 4.45182 4.38998 4.32948 4.27028 4.21236 4.10020 3.99271 3.88965 3.79079 3.69590 3.60478 2.99061 6 5.79548 5.69719 5.60143 5.50813 5.41719 5.32855 5.24214 5.157875.07569 4.99553 4.91732 4.76654 4.62288 4.48592 4.35526 4.23054 4.11141 3.32551 7 6.72819 6.59821 6.47199 6.34939 6.23028 6.11454 6.00205 5.89270 5.786375.68297 5.58238 5.38929 5.206375.03295 4.86842 4.71220 4.56376 3.60459 8 7.65168 7.48593 7.32548 7.170147.01969 6.87396 6.73274 6.59589 6.46321 6.33457 6.20979 5.97130 5.74654 5.53482 5.33493 5.14612 4.96764 3.83716 9 8.56602 8.36052 8.16224 7.970877.78611 7.60769743533 7.26879 7.10782 6.95220 6.80169 6.51523 6.24689 5.99525 5.75902 5.53705 5.32825 4.03097 10 9.47130 9.22218 8.98259 8.75206 8.53020 8.31661 8.11090 7.91272 7.72173 7.53763 7.36009 7.02358 6.71008 6,41766 6.14457 5.88923 5.65022 4.19247 11 10.36763 10.07112 9.786859.51421 9.252629.00155 8.76048 8.52092 8.30641 8.09254 7.88687 7.49867 7.13996 6.80519 6.49506 6.20652 5.93770 4.32706 12 11.25508 10.90751 10.57534 10.25776 9.95400 9.66333 9.38507 9.11858 8.86325 8.61852 8.38384 7.94269 7.53608 7.16073 6.81369 6.49236 6.19437 443922 13 12.13374 11.73153 11.34837 10.98319 10.63496 10.30274 9.98565 9.68285 9.39357 9.11708 8.85268 8.35765 7.90378 7.48690 7.10336 6.74987 6.42355 4.53268 14 13.00370 12.54338 12.10625 11.69091 11.29607 10.92052 10.56312 10.22283 9.89864 9.58965 9.29498 8.74547 8.24424 7.78615 7.36669 6.98187 6.62817 4.61057 15 13.86505 12.34323 12.84926 12.38138 11.93794 11.51741 11.11839 10.73955 10.37966 10.03758 9.71225 9.10791 8.55948 8.06089 7.60608 7.19087 6.81086 4.67547 16 14.71787 14.13126 13.57771 13.05500 12.56110 12.09412 11.65230 11.23402 10.83777 10.46216 10.10590 9.44665 8.85137 8.31256 7.82371 7.37916 6.97399 4.72956 17 15.56225 14.90765 14.29187 13.71220 13.16612 12.65132 12.16567 11.70719 11.27407 10.86461 10.47726 9.76322 9.12164 8.54363 8.02155 7.54879 7.11963 477463 18 16.39827 15.67256 14.99203 14.35336 13.75351 13.18968 12.65930 12.15999 11.68959 11.24607 10.82760 10.05909 9.37189 8.75563 8.20141 7.70162 7.24967 4.81219 19 17.22601 16.42617 15.67846 14.97689 14.32380 13.70984 13.13394 12.59329 12.08532 11.60765 11.15812 10.33560 9.60360 8.95011 8.36492 7.839297.36578 4.84350 20 18.04555 17.16864 16.35143 15.58916 14.87747 14.21240 13.59033 13.00794 12.46221 11.95038 11.46992 10.59401 9.81815 9.12855 8.51356 7.96333 7.46944 4.86958 21 18.85698 17.90014 17.01121 16.18455 15.41502 14.69797 14.02916 13.40472 12.82115 12.27524 11.76408 10.83553 10.01680 9.29224 8.64869 8.07507 7.56200 4.89132 25 22.02316 20.71961 19.52346 18.42438 1741315 16.48151 15.62208 14.82821 14.09394 13.41393 12.78336 11.65358 10.67478 9.82258 9.07704 8.42174 7.84314 4.94759 30 25.80771 24.01584 22.39646 20.93029 19.60044 18.39205 17.29203 16.28889 15.37245 14.53375 13.76483 12.40904 11.25778 10.27365 9.42691 8.69379 8.05518 4.97894 40 32.83469 29.91585 27.35548 25.10278 23.11477 21.35507 19.79277 18.40158 17.15909 16.04612 15.04630 13.33171 11.92461 10.75736 9.77905 8.95105 8.24378 4.99660 This project is allocated 135 course points, which have been distributed as follows: Part A-Narrative Part B - Adjusted Trial Balance Part C - Financial Statements Part D-5 questions Followed project instructions Total project points 5 points 25 points 75 points 15 points 15 points 135 points Worksheet Lin your Excel document-labeled Narrative": Part A: Narrative (5 points) Provide the following, per the formatting instructions provided in the "Excel Formatting Project" video: Company Name: Product: Preferred Stock Par: Authorized: Issued: Outstanding: Percentage: Common Stock Par: Authorized: Issued: Outstanding Worksheet 2 in your Excel document - labeled "ATB": Part B: Adjusted Trial Balance (25 points) Employ the formatting instructions provided in the "Excel Formatting Project" video. The accuracy of the required" numbers will be assessed here and again in the financial statements. On the ATB worksheet, employing the instructions provided in the "Additional Calculations on the ATB" video, complete the following tasks: 1. List the following labels in a column in the following order: Total Assets Total Liabilities Total Equity (not including the income statement accounts) Net Income 2. In the next column to the right, use a function to calculate the total for each of those respective items (listed in part I immediately above). 3. In the cell immediately below the total for "net income, use a function to calculate the following: Total Assets minus Total Liabilities minus Total Equity minus Net Income (using the totals you calculated in step 2 immediately above). NOTE: You should arrive at a total of zere Worksheets 37 in your Excel document - labeled "ISC USHE.S E Part C: Financial Statements (75 points) Employ the formatting instructions provided in the "Excel Formatting Project" video, The set of financial statements must include the following: 1. Income Statement - you must use a multi-step income statement format 2. Statement of Comprehensive Income - presented as a separate statement from the Income Statement 3. Statement of Stockholders' Equity 4. Classified Balance Sheet 5. Statement of Cash Flows only the title and the last three lines of this statement should be prepared Worksheets in your Excel document-labeled "Ouestions Part D: Questions pertaining specifically to your company (15 points) Employ the formatting instructions provided in the "Excel Formatting Project" video 1. The normal balance of the Retained Earnings account is a credit. Please discuss why a debit balance appears on the Adjusted Trial Balance Provide enough detail to convince me that you understand the concept 2. What was the balance in the Income Summary account immediately before closing the income Summary Account to Retained Earnings indicate amount and whether it held a debitor credit balance 3. What amount do debits and credits on the Post-Closing Trial Balance cach total? 4. Assume the bonds that were issued during 2020 are not redeemed during 2021. What amount of interest expense will be recognized during 2021 for the honds. You must show your work to earn any credit for this answer. 5. Asume that during 2021 there are no stockholder equity transactions that involve the sale or purchase of any of the corporation's stock, and that net income for 2021 is $1.500.000. Calculate earnings per share for 2021. You must show your work to cam any credit for this answer NOTE: 15 Project points have been allocated for following project instructions Create the adjusted trial balance and the financial statements for a merchandising company for the fiscal year ending December 31, 2020. You will make up all numbers included in the adjusted trial balance. and ultimately the financial statements, except where a required balance is indicated, as detailed below. The following must be reflected in those statements: General information: . it was the company's first year of operations; the company is organized as a corporation; the company has both cumulative preferred and common stock issued; . on December 31, the company still held all treasury stock that was repurchased during the year; the company declared dividends during December in an amount large enough for common stockholders to receive a dividend (Statement of Stockholders' Equity must identify amount declared for preferred stockholders and amount declared for common stockholders); Required account balances: the cash account has an ending balance of $20,000; the company recognized bad debt expense on December 31 in the amount of $10,000 (allowance for doubtful accounts method is used - not the direct method); the company issued $125,000 10-year, 6% bonds on July 1: the bonds pay interest semiannually on January 1 and July 1, and the effective interest rate method is used to amortize the bonds, the market rate of interest was 5% on the day of issuance (Use CH14 - Table 2 and CH14 - Table 4. posted on D2L with the chapter 14 materials, when present value tables are required.): on December 1, the company invested in one debt security investment, which it still held on December 31 and is classified as an available-for-sale security - the investment was (a) purchased for $150,000; (b) has an annual interest rate of 4%; (c) pays interest every March 31 and (d) has increased in value since its purchase (round any required balances to the nearest whole number); Additional information pertaining to account balances: . use only whole numbers throughout the project - no cents or place holders for cents; the company is a merchandiser with an ending inventory on December 31; - the company purchased only one long-term, depreciable asset during the year and depreciation was recognized - in addition, the asset was still in service on December 31 and will be in service during 2021 the company has at least four current liabilities; the bond described in the "Required account balances" section above is the only interest-bearing liability that the corporation has ever entered into; the company had invested in only one non-influential equity investment, which it still held on December 31 - the investment had decreased in value since its purchase and management will sell it in April of 2021, and the income statement SHOULD NOT INCLUDE the earnings per share calculation, because the number of shares outstanding during the fiscal year did not remain constant throughout (which would require a weighted average calculation, a concept not covered in ACTG 2125). TABLE 2 Present Value of $1 $1 PV (1 + M 1.0% 1.5% 2.0% 2.5% 3.0 3.5 4.0% 4.5 5.0% 5.5% 6.0% 7.0% 0.0% 0.0% 10.0% 11.0% 12.0% 1 0.99010 0.98522 0.98039 0.97561 0.97087 0.96618 0.96154 0.95694 0.95238 0.94787 0.94340 0.93458 0.92593 0.91743 0.909090.90090 0.89286 2 0.98030 0.97066 0.96117 0.95181 0.94260 0.93351 0.92456 0.91573 0.90703 0.89845 0.89000 0.87344 0.85734 0.84168 0.82645 0.81162 0.79719 3 0.97059 0.95632 0.94232 0.92860 0.91514 0.90194 0.88900 0.87630 0.86384 0.85161 0.83962 0.81630 0.79383 0.77218 0.75131 0.73119 0.71178 4 0.96098 0.94218 0.92385 0.90595 0.88849 0.87144 0.65480 0.83856 0.82270 0.80722 0.79209 0.76290 0.73503 0.70143 0.66301 0.65873 0.63552 5 0.95147 0.92826 0.90573 0.88385 0.86261 0.84197 0.82193 0.80245 0.78353 0.76513 0.74726 0.71299 0.66058 0.64993 0.62092 0.59345 0.56743 6 0.94205 0.91454 0.88797 0.86230 0.83746 0.81350 0.79031 0.76790 0.74622 0.72525 0.70496 0.66634 0.63017 0.59627 0.56447 0.53464 0.50663 7 0.93272 0.90103 0.87056 0.84127 0.81309 0.78590 0.75992 0.73483 0.71068 0.68744 0.66506 0.62275 0.58340 0.54703 0.51316 0.48166 0.45235 8 0.92348 0.88771 0.85349 0.82075 0.78041 0.75041 0.73069 0.70319 0.67684 0.65160 0.62741 0.58201 0.54027 0.50187 0.46651 0.43393 0.40388 9 0.91434 0.87459 0.83676 0.10073 0.76642 0.73373 0.70259 0.67290 0.64461 0.61763 0.59190 0.54393 0.50025 0.46043 0.42410 0.39092 0.36061 10 0.90529 0.86167 0.82035 0.78120 0.74409 0.70892 0.67556 0.64393 0.61391 0.58543 0.55639 0.50835 0.46319 042241 0.38554 0.35218 0.32197 20.0% 0.83333 0.69444 0.57870 0.48225 0.40188 0.33490 0.27908 0.23257 0.19381 0.16151 0.13459 0.11216 0.09346 0.07789 0.06491 11 0.89632 0.84093 0.80426 0.76214 0.72242 0.66495 0.64958 0.61620 0.58468 0.55491 0.52679 0.47509 0.42668 0.36753 0.35049 0.31728 0.28748 12 0.88745 0.83639 0.78849 0.74356 0.70138 0.66178 0.62460 0.58966 0.55664 0.52598 0.49697 0.44401 0.39711 0.35553 0.31863 0.28584 0.25668 13 0.87866 0.82403 0.77303 0.72542 0.68095 0.63940 0.60057 0.56427 0.53032 0.49856 0.46884 0.41496 0.36770 0.32618 0.28966 0.25751 0.22917 14 0.86996 0.81185 0.75788 0.70773 0.66112 0.61778 0.57748 0.53997 0.50507 0.47257 0.44230 0.38782 0.34046 0.29925 0.26333 0.23199 0.20462 15 0.86135 0.79985 0.74301 0.69047 0.64186 0.59689 0.55526 0.51672 0.48102 0.44793 0.41727 0.36245 0.31524 0.27454 0.23939 0.20900 0.18270 16 0.85282 0.78803 0.72845 0.67362 0.62317 0.57671 0.53391 0.49447 0.45811 042458 0.39365 0.33873 0.29189 0.25187 0.21763 0.18829 0.16312 17 0.84438 0.77639 0.71416 0.65720 0.60502 0.55720 0.51337 0.47318 0.43630 040245 0.37136 0.31657 0.27027 0.23107 0.19784 0.16963 0.14564 18 0.83602 0.76491 0.70016 0.54117 0.58739 0.53836 0.49363 0.45280 0.41552 0.38147 0.35034 0.29586 0.25025 0.21199 0.17986 0.15282 0.13004 19 0.82774 0.75361 0.68643 0.62553 0.57029 0.52016 0.47464 0.43330 0.39573 0.36158 0.33051 0.27651 0.23171 0.19409 0.16351 0.13768 0.11611 20 0.81954 0.74247 0.67297 0.61027 0.55368 0.50257 0.45639 0.41464 0.37689 0.34273 0.31180 0.25842 0.21455 0.17843 0.14864 0.12403 0.10367 21 0.81143 0.73150 0.65978 0.59539 0.53755 0.48557 0.43883 0.39679 0.35894 0.32486 0.29416 0.24151 0.1986 0.16370 0.13513 0.11174 0.00256 24 0.78757 0.69954 0.62172 0.55288 0.49193 0.43796 0.39012 0.34770 0.31007 0.27666 0.2478 0.19715 0.15770 0.12640 0.10153 0.08170 0.06588 25 0.77977 0.68921 0.60953 0.53939 0.47761 0.42315 0.37512 0.33273 0.29530 0.26223 0.233000.15425 0.14602 0.11597 0.09230 0.07361 0.05882 28 0.75684 0.65910 0.57437 0.50088 0.43708 0.30165 0.33348 0.20157 0.25509 0.22332 0.19563 0.15040 0.11591 0.08955 0.06934 0.05382 0.04187 29 0.74934 0.64936 0.56311 0.48866 0.42435 0.875 0.32065 0.27902 0.24295 0.21168 0.18456 0.14056 0.10733 0.06215 0.06304 0.04849 0.03738 30 0.74192 0.63976 0.55207 0.47674 0.4119 0.35628 0.30832 0.26700 0.23138 0.20064 0.17411 0.13137 0.09938 0.07537 0.05731 0.04368 0.03338 31 0.73458 0.63031 0.54125 0.46511 0.3 0. 23 0.29646 0.25550 0.22036 0.19018 0.16425 0.12277 0.09202 0.06915 0.05210 0.03935 0.02780 40 0.67165 0.55126 045289 0.37243 0.30656 0.25257 0.20020 0.17193 0.14205 0.11746 0.09722 0.00678 0.04603 0.03184 0.02209 0.01538 0.01075 0.05409 0.04507 0.03756 0.03130 0.02608 0.02174 0.01258 0.01048 0.00607 0.00506 0.00421 0.0031 0.00068 TABLE 4 Present Value of an ordinary Annuity of $1 1- (1+ PVA - mi 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% 4.0% 4.5% 5.0% 5.5% 6.0% 7.0% 0.0% 9.0% 0.0% 11.0% 12.0% 20.0% 1 0.99010 0.98522 0.98039 0.97561 0.97087 0.96618 0.96154 0.95694 0.95238 0.94787 0.94340 0.93458 0.92593 0.91743 0.90909 0.90090 0.89286 0.83333 2 1.97040 1.95588 1.94156 1.92742 1.91347 1.89969 1.88609 1.87267 1.85941 1.84632 1.83339 1.80802 1.78326 1.75911 1.73554 1.71252 1.69005 1.52778 3 2.94099 2.91220 2.86385 2.85602 2.82861 2.80164 2.77509 2.74896 2.72325 2.69793 2.67301 2.62432 2.57710 2.53129 2.48685 2.44371 2.40183 2.10548 4 3.90197 3.85438 3.80773 3.76197 3.71710 3.67308 3.62990 3.58753 3.54595 3.50515 3.46511 3.38721 3.31213 3.23972 3.16987 3.10245 3.03735 2.58873 $ 4.85343 4.78264 471346 4.64583 4.57971 4.51505 4.45182 4.38998 4.32948 4.27028 4.21236 4.10020 3.99271 3.88965 3.79079 3.69590 3.60478 2.99061 6 5.79548 5.69719 5.60143 5.50813 5.41719 5.32855 5.24214 5.157875.07569 4.99553 4.91732 4.76654 4.62288 4.48592 4.35526 4.23054 4.11141 3.32551 7 6.72819 6.59821 6.47199 6.34939 6.23028 6.11454 6.00205 5.89270 5.786375.68297 5.58238 5.38929 5.206375.03295 4.86842 4.71220 4.56376 3.60459 8 7.65168 7.48593 7.32548 7.170147.01969 6.87396 6.73274 6.59589 6.46321 6.33457 6.20979 5.97130 5.74654 5.53482 5.33493 5.14612 4.96764 3.83716 9 8.56602 8.36052 8.16224 7.970877.78611 7.60769743533 7.26879 7.10782 6.95220 6.80169 6.51523 6.24689 5.99525 5.75902 5.53705 5.32825 4.03097 10 9.47130 9.22218 8.98259 8.75206 8.53020 8.31661 8.11090 7.91272 7.72173 7.53763 7.36009 7.02358 6.71008 6,41766 6.14457 5.88923 5.65022 4.19247 11 10.36763 10.07112 9.786859.51421 9.252629.00155 8.76048 8.52092 8.30641 8.09254 7.88687 7.49867 7.13996 6.80519 6.49506 6.20652 5.93770 4.32706 12 11.25508 10.90751 10.57534 10.25776 9.95400 9.66333 9.38507 9.11858 8.86325 8.61852 8.38384 7.94269 7.53608 7.16073 6.81369 6.49236 6.19437 443922 13 12.13374 11.73153 11.34837 10.98319 10.63496 10.30274 9.98565 9.68285 9.39357 9.11708 8.85268 8.35765 7.90378 7.48690 7.10336 6.74987 6.42355 4.53268 14 13.00370 12.54338 12.10625 11.69091 11.29607 10.92052 10.56312 10.22283 9.89864 9.58965 9.29498 8.74547 8.24424 7.78615 7.36669 6.98187 6.62817 4.61057 15 13.86505 12.34323 12.84926 12.38138 11.93794 11.51741 11.11839 10.73955 10.37966 10.03758 9.71225 9.10791 8.55948 8.06089 7.60608 7.19087 6.81086 4.67547 16 14.71787 14.13126 13.57771 13.05500 12.56110 12.09412 11.65230 11.23402 10.83777 10.46216 10.10590 9.44665 8.85137 8.31256 7.82371 7.37916 6.97399 4.72956 17 15.56225 14.90765 14.29187 13.71220 13.16612 12.65132 12.16567 11.70719 11.27407 10.86461 10.47726 9.76322 9.12164 8.54363 8.02155 7.54879 7.11963 477463 18 16.39827 15.67256 14.99203 14.35336 13.75351 13.18968 12.65930 12.15999 11.68959 11.24607 10.82760 10.05909 9.37189 8.75563 8.20141 7.70162 7.24967 4.81219 19 17.22601 16.42617 15.67846 14.97689 14.32380 13.70984 13.13394 12.59329 12.08532 11.60765 11.15812 10.33560 9.60360 8.95011 8.36492 7.839297.36578 4.84350 20 18.04555 17.16864 16.35143 15.58916 14.87747 14.21240 13.59033 13.00794 12.46221 11.95038 11.46992 10.59401 9.81815 9.12855 8.51356 7.96333 7.46944 4.86958 21 18.85698 17.90014 17.01121 16.18455 15.41502 14.69797 14.02916 13.40472 12.82115 12.27524 11.76408 10.83553 10.01680 9.29224 8.64869 8.07507 7.56200 4.89132 25 22.02316 20.71961 19.52346 18.42438 1741315 16.48151 15.62208 14.82821 14.09394 13.41393 12.78336 11.65358 10.67478 9.82258 9.07704 8.42174 7.84314 4.94759 30 25.80771 24.01584 22.39646 20.93029 19.60044 18.39205 17.29203 16.28889 15.37245 14.53375 13.76483 12.40904 11.25778 10.27365 9.42691 8.69379 8.05518 4.97894 40 32.83469 29.91585 27.35548 25.10278 23.11477 21.35507 19.79277 18.40158 17.15909 16.04612 15.04630 13.33171 11.92461 10.75736 9.77905 8.95105 8.24378 4.99660 This project is allocated 135 course points, which have been distributed as follows: Part A-Narrative Part B - Adjusted Trial Balance Part C - Financial Statements Part D-5 questions Followed project instructions Total project points 5 points 25 points 75 points 15 points 15 points 135 points Worksheet Lin your Excel document-labeled Narrative": Part A: Narrative (5 points) Provide the following, per the formatting instructions provided in the "Excel Formatting Project" video: Company Name: Product: Preferred Stock Par: Authorized: Issued: Outstanding: Percentage: Common Stock Par: Authorized: Issued: Outstanding Worksheet 2 in your Excel document - labeled "ATB": Part B: Adjusted Trial Balance (25 points) Employ the formatting instructions provided in the "Excel Formatting Project" video. The accuracy of the required" numbers will be assessed here and again in the financial statements. On the ATB worksheet, employing the instructions provided in the "Additional Calculations on the ATB" video, complete the following tasks: 1. List the following labels in a column in the following order: Total Assets Total Liabilities Total Equity (not including the income statement accounts) Net Income 2. In the next column to the right, use a function to calculate the total for each of those respective items (listed in part I immediately above). 3. In the cell immediately below the total for "net income, use a function to calculate the following: Total Assets minus Total Liabilities minus Total Equity minus Net Income (using the totals you calculated in step 2 immediately above). NOTE: You should arrive at a total of zere Worksheets 37 in your Excel document - labeled "ISC USHE.S E Part C: Financial Statements (75 points) Employ the formatting instructions provided in the "Excel Formatting Project" video, The set of financial statements must include the following: 1. Income Statement - you must use a multi-step income statement format 2. Statement of Comprehensive Income - presented as a separate statement from the Income Statement 3. Statement of Stockholders' Equity 4. Classified Balance Sheet 5. Statement of Cash Flows only the title and the last three lines of this statement should be prepared Worksheets in your Excel document-labeled "Ouestions Part D: Questions pertaining specifically to your company (15 points) Employ the formatting instructions provided in the "Excel Formatting Project" video 1. The normal balance of the Retained Earnings account is a credit. Please discuss why a debit balance appears on the Adjusted Trial Balance Provide enough detail to convince me that you understand the concept 2. What was the balance in the Income Summary account immediately before closing the income Summary Account to Retained Earnings indicate amount and whether it held a debitor credit balance 3. What amount do debits and credits on the Post-Closing Trial Balance cach total? 4. Assume the bonds that were issued during 2020 are not redeemed during 2021. What amount of interest expense will be recognized during 2021 for the honds. You must show your work to earn any credit for this answer. 5. Asume that during 2021 there are no stockholder equity transactions that involve the sale or purchase of any of the corporation's stock, and that net income for 2021 is $1.500.000. Calculate earnings per share for 2021. You must show your work to cam any credit for this answer NOTE: 15 Project points have been allocated for following project instructions Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started