Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You can only answer part 16-1 (steps 2,3,5), 16-2, 16-3, 16-4, and evaluation. Thanks! A In this mini-case you will audit and evaluate documents such

You can only answer part 16-1 (steps 2,3,5), 16-2, 16-3, 16-4, and evaluation. Thanks!

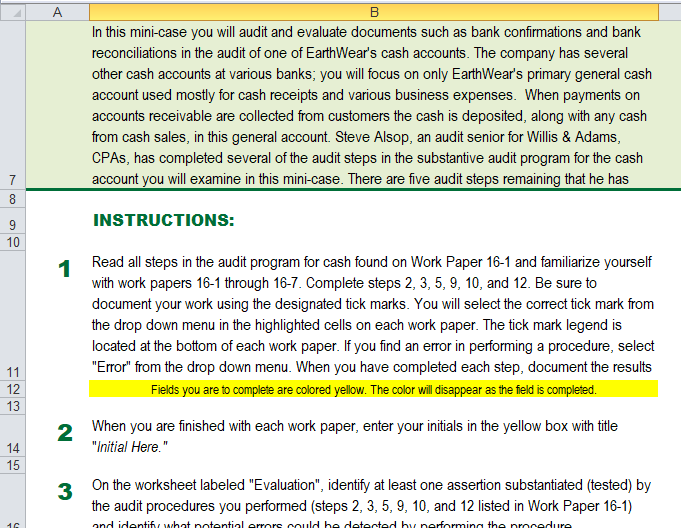

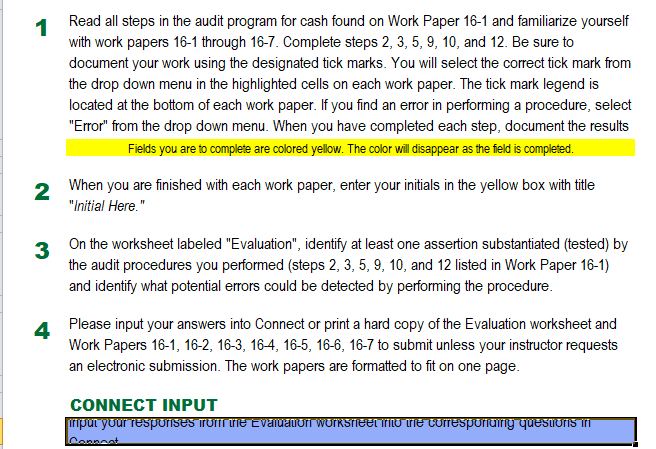

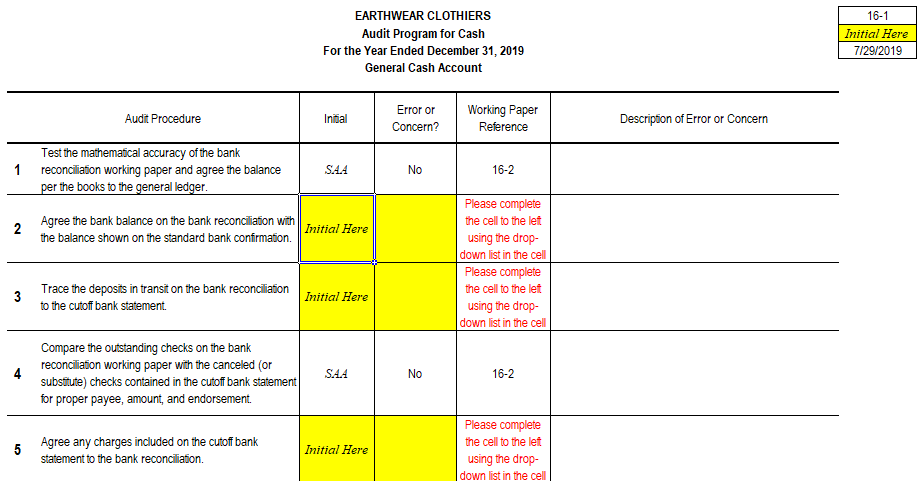

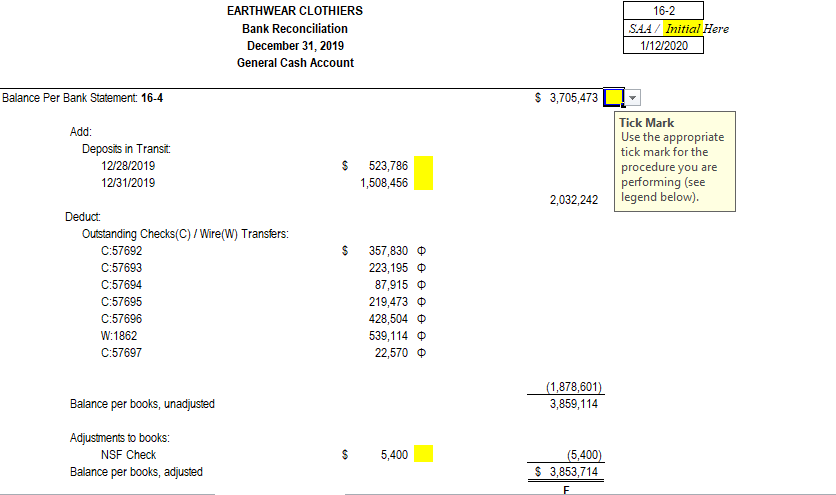

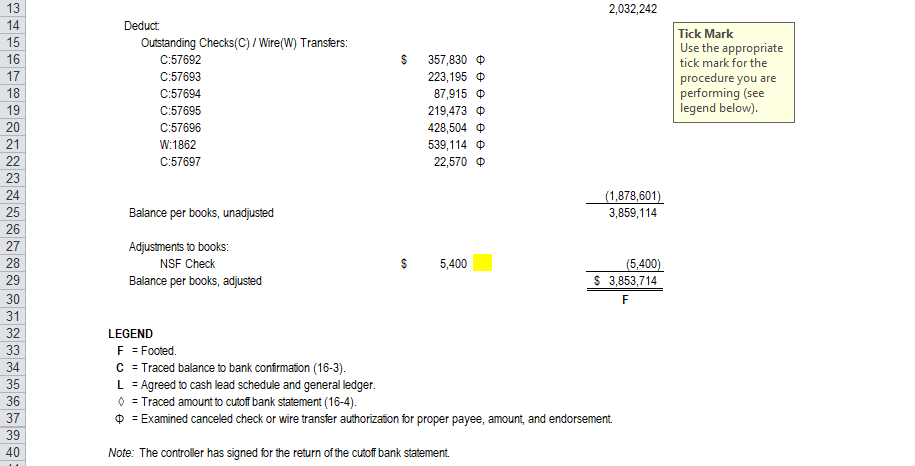

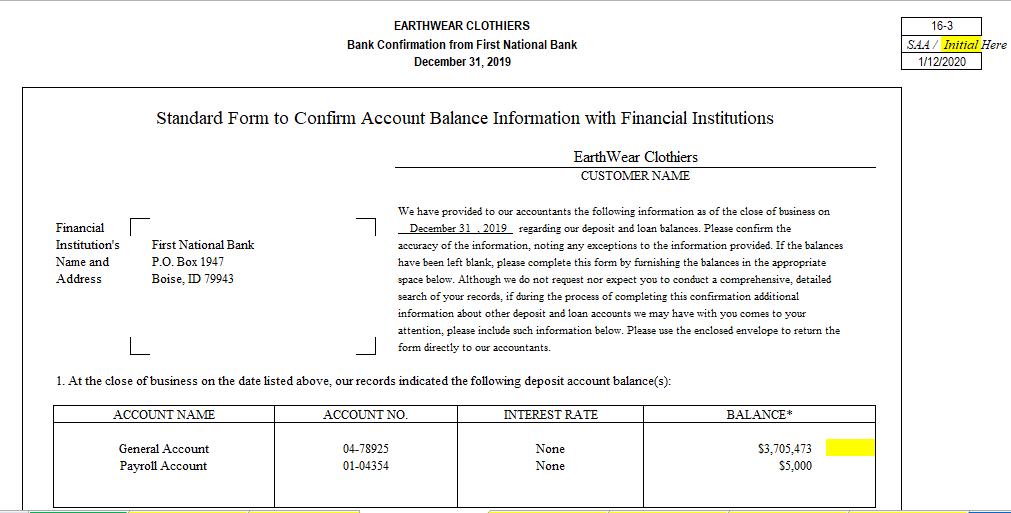

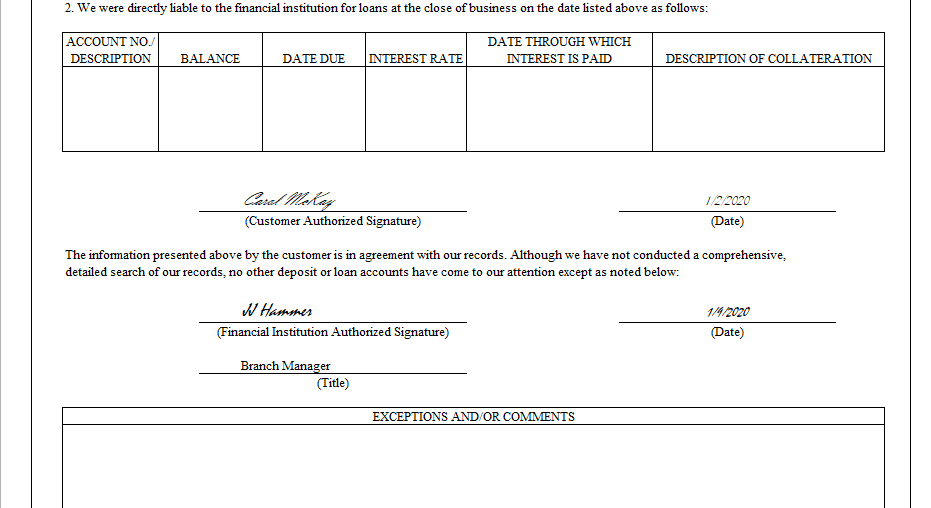

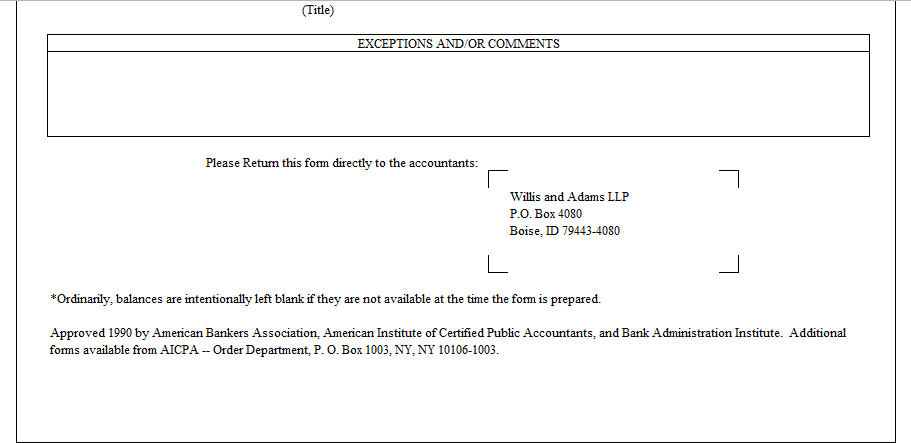

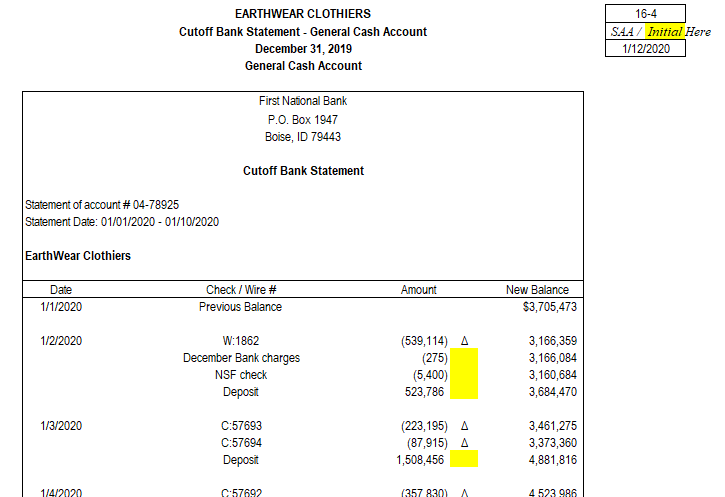

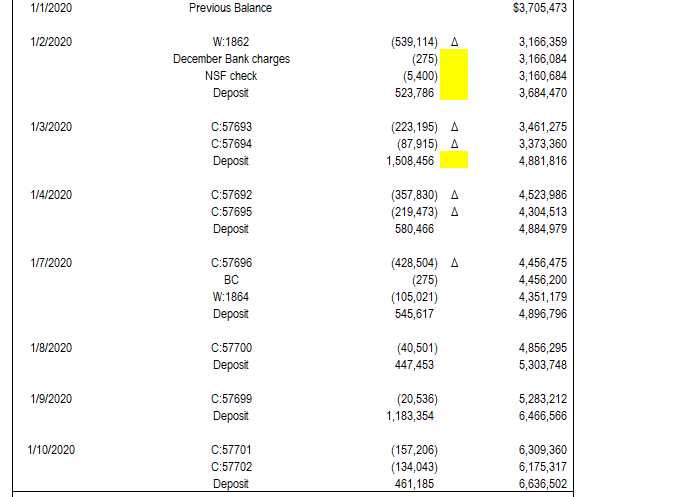

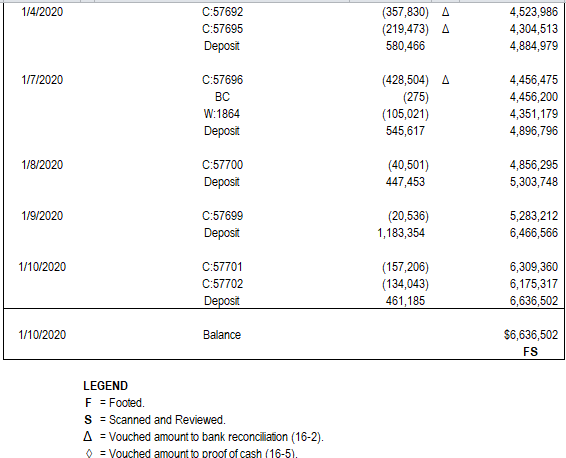

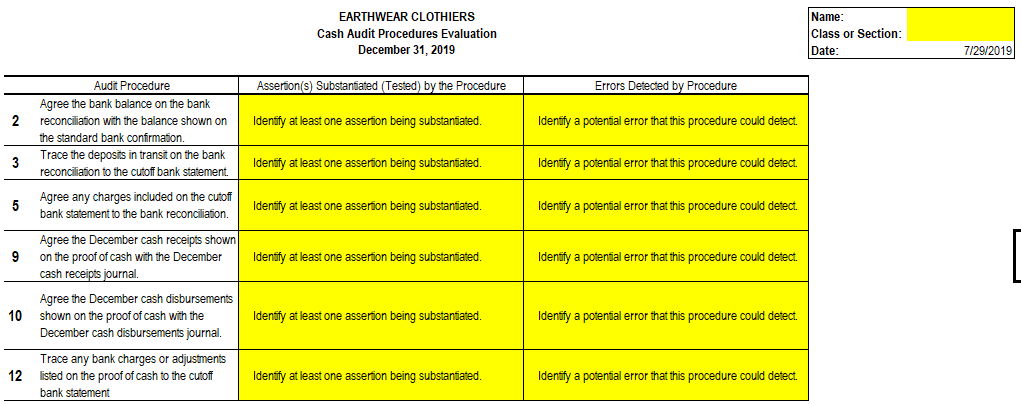

A In this mini-case you will audit and evaluate documents such as bank confirmations and bank reconciliations in the audit of one of EarthWear's cash accounts. The company has several other cash accounts at various banks; you will focus on only EarthWear's primary general cash account used mostly for cash receipts and various business expenses. When payments on accounts receivable are collected from customers the cash is deposited, along with any cash from cash sales, in this general account. Steve Alsop, an audit senior for Willis & Adams, CPAS, has completed several of the audit steps in the substantive audit program for the cash account you will examine in this mini-case. There are five audit steps remaining that he has 7 8 INSTRUCTIONS: 10 1 Read all steps in the audit program for cash found on Work Paper 16-1 and familiarize yourself with work papers 16-1 through 16-7. Complete steps 2, 3, 5, 9, 10, and 12. Be sure to document your work using the designated tick marks. You will select the correct tick mark from the drop down menu in the highlighted cells on each work paper. The tick mark legend is located at the bottom of each work paper. If you find an error in performing a procedure, select "Error" from the drop down menu. When you have completed each step, document the results 11 Fields you are to complete are colored yellow. The color will disappear as the field is completed. 12 13 2When you are finished with each work paper, enter your initials in the yellow box with title "Initial Here." 14 15 3On the worksheet labeled "Evaluation", identify at least one assertion substantiated (tested) by the audit procedures you performed (steps 2, 3, 5, 9, 10, and 12 listed in Work Paper 16-1) and identify what notantial errors could he detacted by nerformina the nrocedure 1C 1Read all steps in the audit program for cash found on Work Paper 16-1 and familiarize yourself with work papers 16-1 through 16-7. Complete steps 2, 3, 5,9, 10, and 12. Be sure to document your work using the designated tick marks. You will select the correct tick mark from the drop down menu in the highlighted cells on each work paper. The tick mark legend is located at the bottom of each work paper. If you find an error in performing a procedure, select "Error" from the drop down menu. When you have completed each step, document the results Fields you are to complete are colored yellow. The color will disappear as the field is completed. 2When you are finished with each work paper, enter your initials in the yellow box with title "Initial Here." 3On the worksheet labeled "Evaluation", identify at least one assertion substantiated (tested) by the audit procedures you performed (steps 2, 3, 5, 9, 10, and 12 listed in Work Paper 16-1) and identify what potential errors could be detected by performing the procedure. A Please input your answers into Connect or print a hard copy of the Evaluation worksheet and Work Papers 16-1, 16-2, 16-3, 16-4, 16-5, 16-6, 16-7 to submit unless your instructor requests an electronic submission. The work papers are formatted to fit on one page. CONNECT INPUT Iriput your resporises romT re Evaluanoi Worksneet irt trie corresporiairig quesToriS in Copnoat EARTHWEAR CLOTHIERS 16-1 Audit Program for Cash Initial Here For the Year Ended December 31, 2019 7/29/2019 General Cash Account Error or Working Paper Audit Procedure Infial Description of Error or Concern Concern? Reference Test the mathematical accuracy ofthe bank 1 reconciliation working paper and agree the balance SAA No 16-2 per the books to the general ledger Please complete Agree the bank balance on the bank reconciliation with 2 the balance shown on the standard bank confirmaion the cell to the left Initial Here using the drop- down list in the cell Please complete the cell to the let Trace the deposits in transit on the bank reconciliation 3 to the cutoff bank statement. Initial Here using the drop- down list in the cell Compare the outstanding checks on the bank reconciliation working paper with the canceled (or 4 SAA No 16-2 substitute) checks contained in the cutof bank statement for proper payee, amount, and endorsement. Please complete Agree any charges included on the cutoff bank 5 the cell to the let Initial Here statement to the bank reconciliation. using the drop- down list in the cell EARTHWEAR CLOTHIERS 16-2 SAA Initial Here Bank Reconciliation December 31, 2019 1/12/2020 General Cash Account $ 3,705,473 Balance Per Bank Statement 16-4 Tick Mark Add: Use the appropriate tick mark for the Deposits in Transit 12/28/2019 523,786 procedure you are performing (see legend below). 12/31/2019 1,508,456 2,032,242 Deduct Outstanding Checks(C)/ Wire(W) Transfers: C:57692 357,830 D 223.195D C:57693 C:57694 87,915 D 219,473 D C:57695 C:57696 428,504 D W:1862 539,114 C:57697 22,570 D (1,878,601) 3,859,114 Balance per books, unadjusted Adjustments to books 5,400 NSF Check (5,400) $ 3,853,714 Balance per books, adjusted E 13 2,032,242 14 Deduct Tick Mark 15 Outstanding Checks(C)/Wire(W) Transfers: Use the appropriate tick mark for the 16 S C:57692 357,830 D 17 C:57693 223,195 procedure you are performing (see legend below). 18 C:57694 87,915 D 19 219,473 428,504 D C:57695 20 C:57696 21 W:1862 539,114 D 22 C:57697 22,570 D 23 24 (1,878,601) 3,859,114 25 Balance per books, unadjusted 26 Adjustments to books: 27 28 NSF Check 5,400 (5,400) 3,853,714 29 Balance per books, adjusted 30 31 32 LEGEND E Footed C Traced balance to bank confirmaion (16-3). 33 34 L Agreed to cash lead schedule and general ledger 35 36 Traced amount to cutoff bank statement (16-4). D Examined cancelled check or wire transfer authorization for proper payee, amount, and endorsement 37 39 40 Note: The controller has signed for the return of the cutof bank statement EARTHWEAR CLOTHIERS 16-3 SAA Initial Here Bank Confirmation from First National Bank December 31, 2019 1/12/2020 Standard Form to Confirm Account Balance Information with Financial Institutions EarthWear Clothiers CUSTOMER NAME We have provided to our accountants the followine information as of the close of business on December 31 . 2019 Financial regarding our deposit and loan balances. Please confirm the Institution's First National Bank accuracy of the information, noting any exceptions to the information provided. If the balances Name and P.O. Box 1947 have been left blank, please complete this form by furnishing the balances in the appropriate Address Boise, ID 79943 space below. Although v do not request nor expect you to conduct a comprehensive, detailed during the process search fyour records, completing this confirmation additional information about other deposit and loan accounts may have with you comes to your attention, please include such information below. Please use the enclosed envelope to return the form directly to our accountants 1. At the close of business on the date listed above, our records indicated the following deposit account balance(s): BALANCE ACCOUNT NAME INTEREST RATE ACCOUNT NO. $3,705,473 General Account 04-78925 None Payroll Account 01-04354 None $5000 2. We were directly liable to the financial institution for loans at the close of business on the date listed above as follows ACCOUNT NO. DATE THROUGH WHICH DESCRIPTION BALANCE DATE DUE INTEREST RATE INTEREST IS PAID DESCRIPTION OF COLLATERATION Caral Wakey 1/2/2020 (Customer Authorized Signature) (Date) The information presented above by the customer is in agreement with our records. Although we have not conducted a comprehensive detailed search of our records no other deposit or loan accounts have come to our attention except as noted below WHammer 14/2020 (Financial Institution Authorized Signature) (Date) Branch Manager (Title) EXCEPTIONS AND/OR COMMENTS (Title) EXCEPTIONS AND/OR COMMENTS Please Retum this form directly to the accountants: Willis and Adams LLP P.O. Box 4080 Boise, ID 79443-4080 *Ordinanily, balances are intentionally left blank if they are not available at the time the form is prepared Approved 1990 by American Bankers Association, American Institute of Certified Public Accountants, and Bank Administration Institute. Additional forms available from AICPA - Order Department, P. O. Box 1003, NY, NY 10106-1003. EARTHWEAR CLOTHIERS 16-4 SAA Initial Here Cutoff Bank Statement General Cash Account December 31, 2019 1/12/2020 General Cash Account First National Bank P.O. Box 1947 Boise, ID 79443 Cutoff Bank Statement Statement of account # 04-78925 Statement Date: 01/01/2020 01/10/2020 EarthWear Clothiers Date Check/Wire # Amount New Balance $3,705,473 1/1/2020 Previous Balance W:1862 (539,114) A (275) (5,400) 523,786 1/2/2020 3,166,359 December Bank Charges 3,166,084 NSF check 3,160,684 3,684,470 Deposit (223,195) A (87,915) A 1,508,456 1/3/2020 3,461,275 C:57693 C:57694 3,373,360 Deposit 4,881,816 1/4/2020 C:57692 (357 830) A 4.523 986 $3,705,473 1/1/2020 Previous Balance (539,114) A (275) (5,400) 523,786 1/2/2020 W:1862 3,166,359 December Bank charges 3,166,084 NSF check 3,160,684 Deposit 3,684,470 (223,195) A (87,915) A 1,508,456 1/3/2020 C:57693 3,461,275 C:57694 3,373,360 Deposit 4,881,816 1/4/2020 (357,830) A (219,473) A 580,466 C:57692 4,523,986 C:57695 4,304,513 Deposit 4,884,979 (428,504) A (275) (105,021) 545,617 1/7/2020 C:57696 4,456,475 4,456,200 4,351,179 BC W:1864 Deposit 4,896,796 (40,501) 447,453 1/8/2020 C:57700 4,856,295 Deposit 5,303,748 1/9/2020 C:57699 (20,536) 1,183,354 5,283,212 6,466,566 Deposit 6,309,360 1/10/2020 C:57701 (157,206) (134,043) C:57702 6,175,317 Deposit 461,185 6,636,502 1/4/2020 (357,830) A (219,473) A C:57692 4,523,986 C:57695 4,304,513 Deposit 580,466 4,884,979 (428,504) A (275) (105,021) 545,617 C:57696 1/7/2020 4,456,475 4,456,200 BC W:1864 4,351,179 4,896,796 Deposit (40,501) 447,453 1/8/2020 C:57700 4,856,295 Deposit 5,303,748 1/9/2020 C:57699 (20,536) 1,183,354 5,283,212 Deposit 6,466,566 1/10/2020 C:57701 (157,206) (134,043) 461,185 6,309,360 C:57702 6,175,317 6,636,502 Deposit $6,636,502 1/10/2020 Balance FS LEGEND F Footed. S Scanned and Reviewed. A = Vouched amount to bank reconciliation (16-2) Vouched amount to proof of cash (16-5) Name: Class or Section: EARTHWEAR CLOTHIERS Cash Audit Procedures Evaluation 7/29/2019 December 31, 2019 Date: Audit Procedure Errors Detected by Procedure Assertion(s) Substaniated (Tested) by the Procedure Agree the bank balance on the bank 2 reconciliation with the balance shown on Identify at least one asserion being substantiated. Identify a potential error that this procedure could detect. the standard bank confirmation Trace the deposits in transit on the bank 3 Identify at least one assertion being substantiated. Identify a potential error that this procedure could detect reconciliation to the cutoff bank statement. Agree any charges included on the cutof 5 bank statement to the bank reconiliation. Idenify at least one asserion being substantiated. Identify a potenial error that this procedure could detect Agree the December cash receipts shown on the proof of cash with the December cash receipts journal Identify at least one asserion being substantiated. Identify a potenial error that this procedure could detect. Agree the December cash disbursements Identify at least one assertion being substantiated. 10 shown on the proof of cash with the Identify a potential error that this procedure could detect December cash disbursements journal. Trace any bank charges or adjustments 12 listed on the proof of cash to the cutoff Identify at least one assertion being substantiated. Identify a potential error that this procedure could detect bank statement A In this mini-case you will audit and evaluate documents such as bank confirmations and bank reconciliations in the audit of one of EarthWear's cash accounts. The company has several other cash accounts at various banks; you will focus on only EarthWear's primary general cash account used mostly for cash receipts and various business expenses. When payments on accounts receivable are collected from customers the cash is deposited, along with any cash from cash sales, in this general account. Steve Alsop, an audit senior for Willis & Adams, CPAS, has completed several of the audit steps in the substantive audit program for the cash account you will examine in this mini-case. There are five audit steps remaining that he has 7 8 INSTRUCTIONS: 10 1 Read all steps in the audit program for cash found on Work Paper 16-1 and familiarize yourself with work papers 16-1 through 16-7. Complete steps 2, 3, 5, 9, 10, and 12. Be sure to document your work using the designated tick marks. You will select the correct tick mark from the drop down menu in the highlighted cells on each work paper. The tick mark legend is located at the bottom of each work paper. If you find an error in performing a procedure, select "Error" from the drop down menu. When you have completed each step, document the results 11 Fields you are to complete are colored yellow. The color will disappear as the field is completed. 12 13 2When you are finished with each work paper, enter your initials in the yellow box with title "Initial Here." 14 15 3On the worksheet labeled "Evaluation", identify at least one assertion substantiated (tested) by the audit procedures you performed (steps 2, 3, 5, 9, 10, and 12 listed in Work Paper 16-1) and identify what notantial errors could he detacted by nerformina the nrocedure 1C 1Read all steps in the audit program for cash found on Work Paper 16-1 and familiarize yourself with work papers 16-1 through 16-7. Complete steps 2, 3, 5,9, 10, and 12. Be sure to document your work using the designated tick marks. You will select the correct tick mark from the drop down menu in the highlighted cells on each work paper. The tick mark legend is located at the bottom of each work paper. If you find an error in performing a procedure, select "Error" from the drop down menu. When you have completed each step, document the results Fields you are to complete are colored yellow. The color will disappear as the field is completed. 2When you are finished with each work paper, enter your initials in the yellow box with title "Initial Here." 3On the worksheet labeled "Evaluation", identify at least one assertion substantiated (tested) by the audit procedures you performed (steps 2, 3, 5, 9, 10, and 12 listed in Work Paper 16-1) and identify what potential errors could be detected by performing the procedure. A Please input your answers into Connect or print a hard copy of the Evaluation worksheet and Work Papers 16-1, 16-2, 16-3, 16-4, 16-5, 16-6, 16-7 to submit unless your instructor requests an electronic submission. The work papers are formatted to fit on one page. CONNECT INPUT Iriput your resporises romT re Evaluanoi Worksneet irt trie corresporiairig quesToriS in Copnoat EARTHWEAR CLOTHIERS 16-1 Audit Program for Cash Initial Here For the Year Ended December 31, 2019 7/29/2019 General Cash Account Error or Working Paper Audit Procedure Infial Description of Error or Concern Concern? Reference Test the mathematical accuracy ofthe bank 1 reconciliation working paper and agree the balance SAA No 16-2 per the books to the general ledger Please complete Agree the bank balance on the bank reconciliation with 2 the balance shown on the standard bank confirmaion the cell to the left Initial Here using the drop- down list in the cell Please complete the cell to the let Trace the deposits in transit on the bank reconciliation 3 to the cutoff bank statement. Initial Here using the drop- down list in the cell Compare the outstanding checks on the bank reconciliation working paper with the canceled (or 4 SAA No 16-2 substitute) checks contained in the cutof bank statement for proper payee, amount, and endorsement. Please complete Agree any charges included on the cutoff bank 5 the cell to the let Initial Here statement to the bank reconciliation. using the drop- down list in the cell EARTHWEAR CLOTHIERS 16-2 SAA Initial Here Bank Reconciliation December 31, 2019 1/12/2020 General Cash Account $ 3,705,473 Balance Per Bank Statement 16-4 Tick Mark Add: Use the appropriate tick mark for the Deposits in Transit 12/28/2019 523,786 procedure you are performing (see legend below). 12/31/2019 1,508,456 2,032,242 Deduct Outstanding Checks(C)/ Wire(W) Transfers: C:57692 357,830 D 223.195D C:57693 C:57694 87,915 D 219,473 D C:57695 C:57696 428,504 D W:1862 539,114 C:57697 22,570 D (1,878,601) 3,859,114 Balance per books, unadjusted Adjustments to books 5,400 NSF Check (5,400) $ 3,853,714 Balance per books, adjusted E 13 2,032,242 14 Deduct Tick Mark 15 Outstanding Checks(C)/Wire(W) Transfers: Use the appropriate tick mark for the 16 S C:57692 357,830 D 17 C:57693 223,195 procedure you are performing (see legend below). 18 C:57694 87,915 D 19 219,473 428,504 D C:57695 20 C:57696 21 W:1862 539,114 D 22 C:57697 22,570 D 23 24 (1,878,601) 3,859,114 25 Balance per books, unadjusted 26 Adjustments to books: 27 28 NSF Check 5,400 (5,400) 3,853,714 29 Balance per books, adjusted 30 31 32 LEGEND E Footed C Traced balance to bank confirmaion (16-3). 33 34 L Agreed to cash lead schedule and general ledger 35 36 Traced amount to cutoff bank statement (16-4). D Examined cancelled check or wire transfer authorization for proper payee, amount, and endorsement 37 39 40 Note: The controller has signed for the return of the cutof bank statement EARTHWEAR CLOTHIERS 16-3 SAA Initial Here Bank Confirmation from First National Bank December 31, 2019 1/12/2020 Standard Form to Confirm Account Balance Information with Financial Institutions EarthWear Clothiers CUSTOMER NAME We have provided to our accountants the followine information as of the close of business on December 31 . 2019 Financial regarding our deposit and loan balances. Please confirm the Institution's First National Bank accuracy of the information, noting any exceptions to the information provided. If the balances Name and P.O. Box 1947 have been left blank, please complete this form by furnishing the balances in the appropriate Address Boise, ID 79943 space below. Although v do not request nor expect you to conduct a comprehensive, detailed during the process search fyour records, completing this confirmation additional information about other deposit and loan accounts may have with you comes to your attention, please include such information below. Please use the enclosed envelope to return the form directly to our accountants 1. At the close of business on the date listed above, our records indicated the following deposit account balance(s): BALANCE ACCOUNT NAME INTEREST RATE ACCOUNT NO. $3,705,473 General Account 04-78925 None Payroll Account 01-04354 None $5000 2. We were directly liable to the financial institution for loans at the close of business on the date listed above as follows ACCOUNT NO. DATE THROUGH WHICH DESCRIPTION BALANCE DATE DUE INTEREST RATE INTEREST IS PAID DESCRIPTION OF COLLATERATION Caral Wakey 1/2/2020 (Customer Authorized Signature) (Date) The information presented above by the customer is in agreement with our records. Although we have not conducted a comprehensive detailed search of our records no other deposit or loan accounts have come to our attention except as noted below WHammer 14/2020 (Financial Institution Authorized Signature) (Date) Branch Manager (Title) EXCEPTIONS AND/OR COMMENTS (Title) EXCEPTIONS AND/OR COMMENTS Please Retum this form directly to the accountants: Willis and Adams LLP P.O. Box 4080 Boise, ID 79443-4080 *Ordinanily, balances are intentionally left blank if they are not available at the time the form is prepared Approved 1990 by American Bankers Association, American Institute of Certified Public Accountants, and Bank Administration Institute. Additional forms available from AICPA - Order Department, P. O. Box 1003, NY, NY 10106-1003. EARTHWEAR CLOTHIERS 16-4 SAA Initial Here Cutoff Bank Statement General Cash Account December 31, 2019 1/12/2020 General Cash Account First National Bank P.O. Box 1947 Boise, ID 79443 Cutoff Bank Statement Statement of account # 04-78925 Statement Date: 01/01/2020 01/10/2020 EarthWear Clothiers Date Check/Wire # Amount New Balance $3,705,473 1/1/2020 Previous Balance W:1862 (539,114) A (275) (5,400) 523,786 1/2/2020 3,166,359 December Bank Charges 3,166,084 NSF check 3,160,684 3,684,470 Deposit (223,195) A (87,915) A 1,508,456 1/3/2020 3,461,275 C:57693 C:57694 3,373,360 Deposit 4,881,816 1/4/2020 C:57692 (357 830) A 4.523 986 $3,705,473 1/1/2020 Previous Balance (539,114) A (275) (5,400) 523,786 1/2/2020 W:1862 3,166,359 December Bank charges 3,166,084 NSF check 3,160,684 Deposit 3,684,470 (223,195) A (87,915) A 1,508,456 1/3/2020 C:57693 3,461,275 C:57694 3,373,360 Deposit 4,881,816 1/4/2020 (357,830) A (219,473) A 580,466 C:57692 4,523,986 C:57695 4,304,513 Deposit 4,884,979 (428,504) A (275) (105,021) 545,617 1/7/2020 C:57696 4,456,475 4,456,200 4,351,179 BC W:1864 Deposit 4,896,796 (40,501) 447,453 1/8/2020 C:57700 4,856,295 Deposit 5,303,748 1/9/2020 C:57699 (20,536) 1,183,354 5,283,212 6,466,566 Deposit 6,309,360 1/10/2020 C:57701 (157,206) (134,043) C:57702 6,175,317 Deposit 461,185 6,636,502 1/4/2020 (357,830) A (219,473) A C:57692 4,523,986 C:57695 4,304,513 Deposit 580,466 4,884,979 (428,504) A (275) (105,021) 545,617 C:57696 1/7/2020 4,456,475 4,456,200 BC W:1864 4,351,179 4,896,796 Deposit (40,501) 447,453 1/8/2020 C:57700 4,856,295 Deposit 5,303,748 1/9/2020 C:57699 (20,536) 1,183,354 5,283,212 Deposit 6,466,566 1/10/2020 C:57701 (157,206) (134,043) 461,185 6,309,360 C:57702 6,175,317 6,636,502 Deposit $6,636,502 1/10/2020 Balance FS LEGEND F Footed. S Scanned and Reviewed. A = Vouched amount to bank reconciliation (16-2) Vouched amount to proof of cash (16-5) Name: Class or Section: EARTHWEAR CLOTHIERS Cash Audit Procedures Evaluation 7/29/2019 December 31, 2019 Date: Audit Procedure Errors Detected by Procedure Assertion(s) Substaniated (Tested) by the Procedure Agree the bank balance on the bank 2 reconciliation with the balance shown on Identify at least one asserion being substantiated. Identify a potential error that this procedure could detect. the standard bank confirmation Trace the deposits in transit on the bank 3 Identify at least one assertion being substantiated. Identify a potential error that this procedure could detect reconciliation to the cutoff bank statement. Agree any charges included on the cutof 5 bank statement to the bank reconiliation. Idenify at least one asserion being substantiated. Identify a potenial error that this procedure could detect Agree the December cash receipts shown on the proof of cash with the December cash receipts journal Identify at least one asserion being substantiated. Identify a potenial error that this procedure could detect. Agree the December cash disbursements Identify at least one assertion being substantiated. 10 shown on the proof of cash with the Identify a potential error that this procedure could detect December cash disbursements journal. Trace any bank charges or adjustments 12 listed on the proof of cash to the cutoff Identify at least one assertion being substantiated. Identify a potential error that this procedure could detect bank statement

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started