You can only answer with this ones in the table:

You can only answer with this ones in the table: And with this ones in this table:

And with this ones in this table:

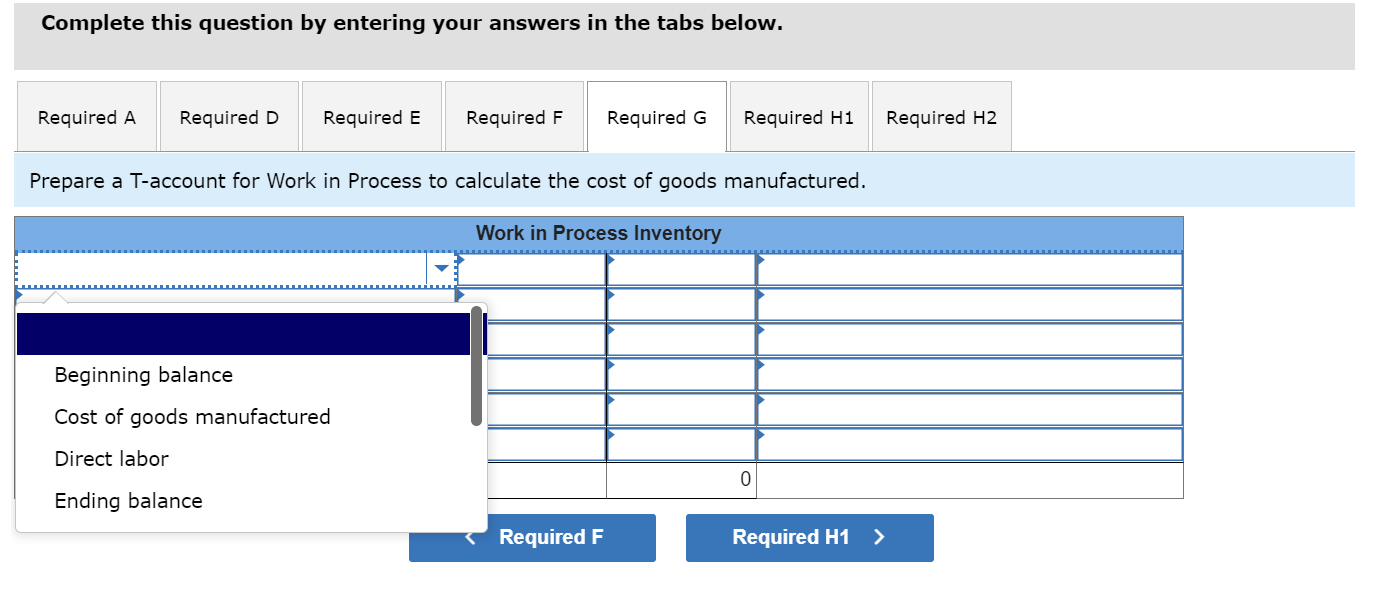

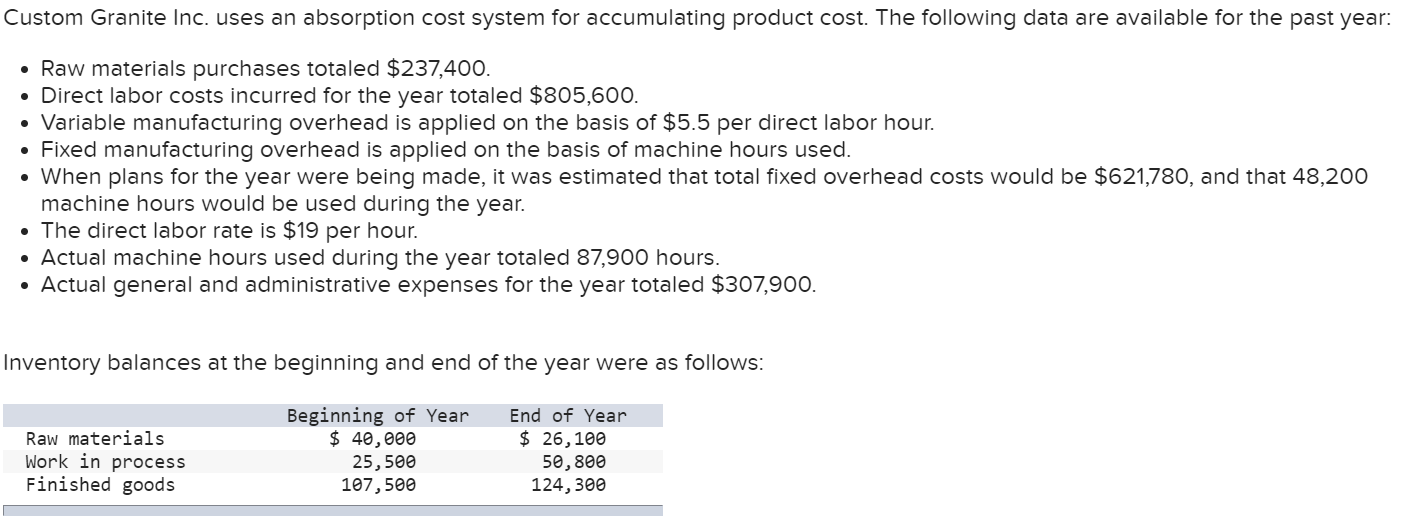

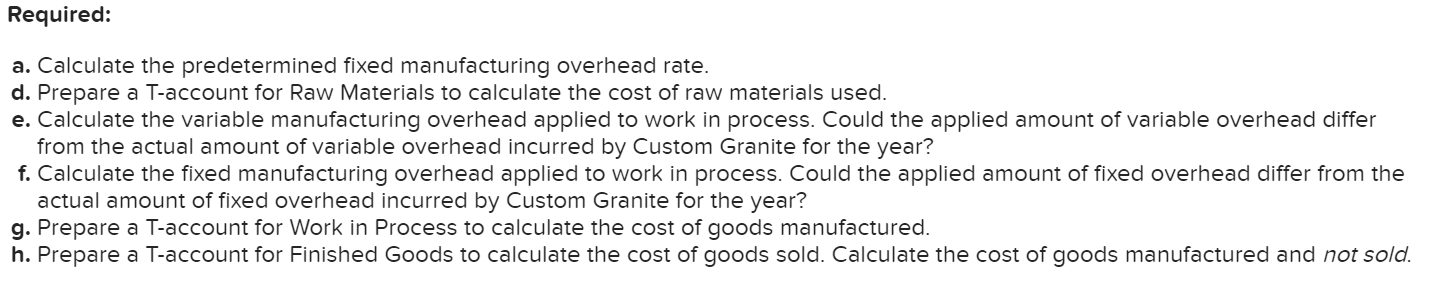

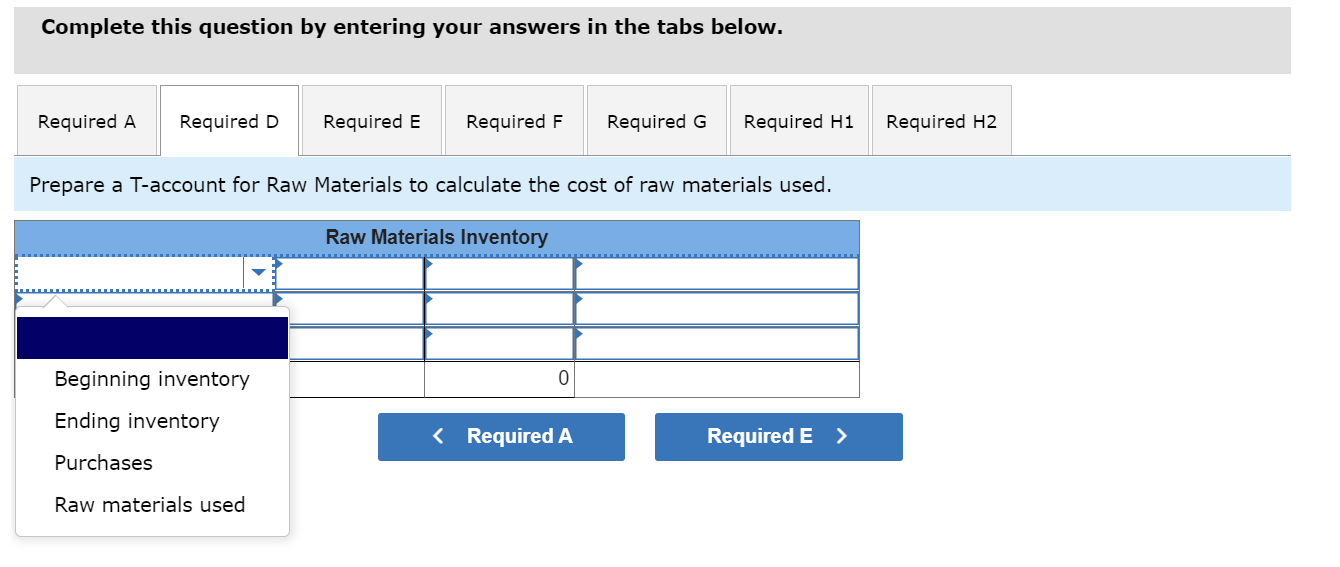

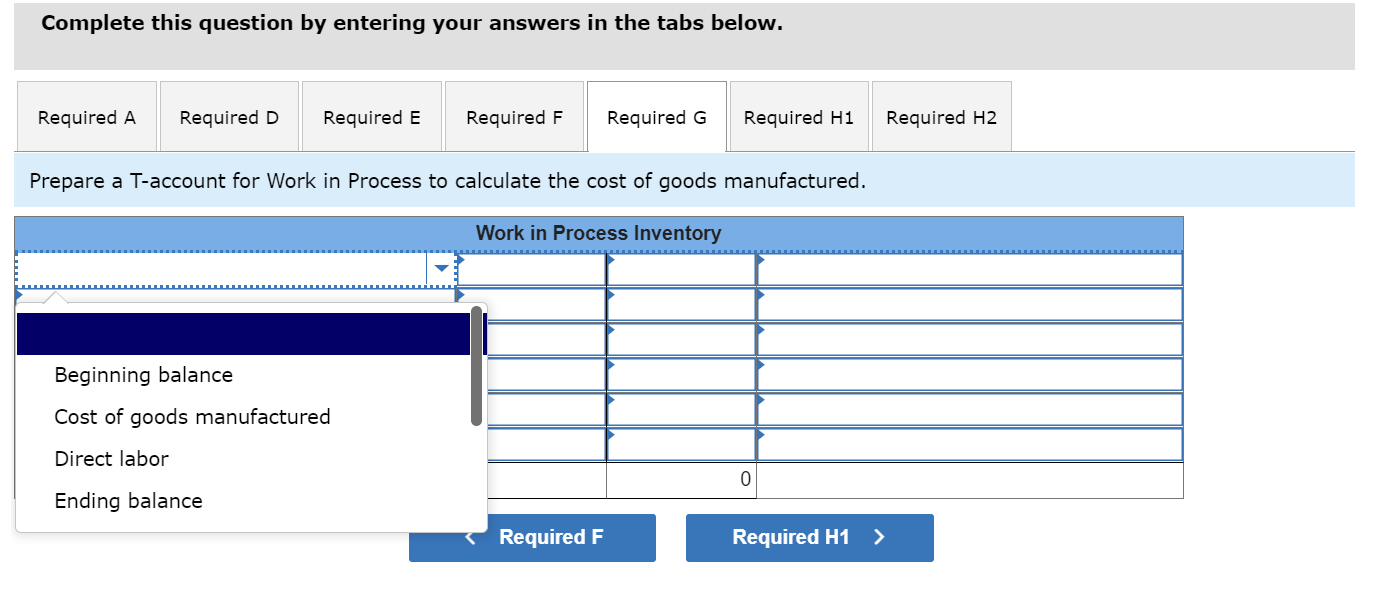

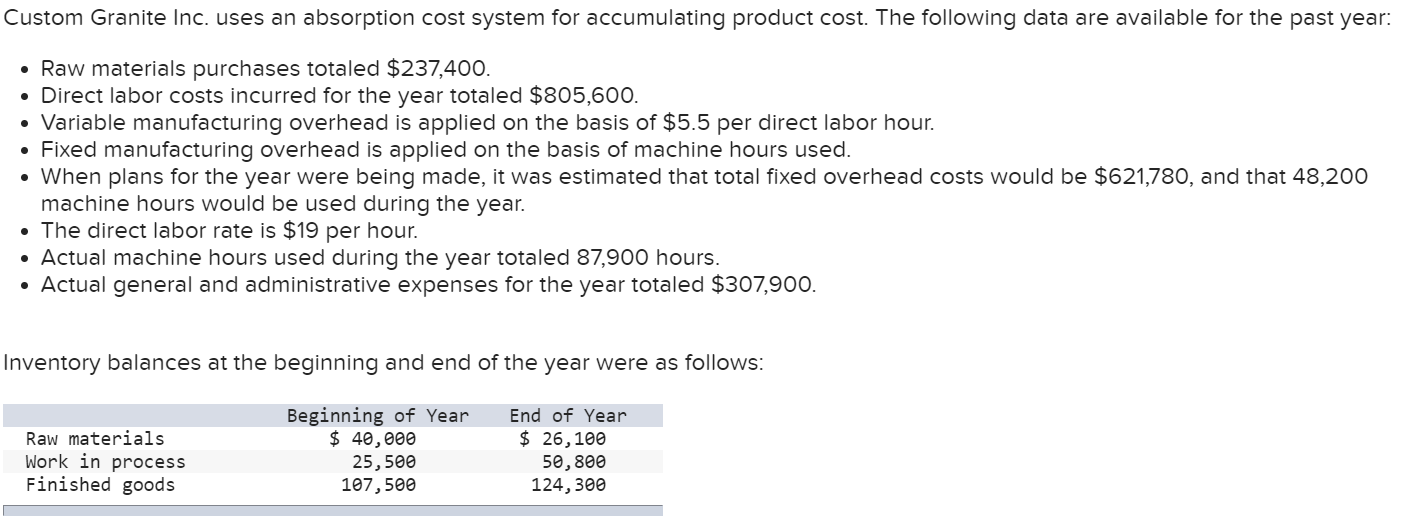

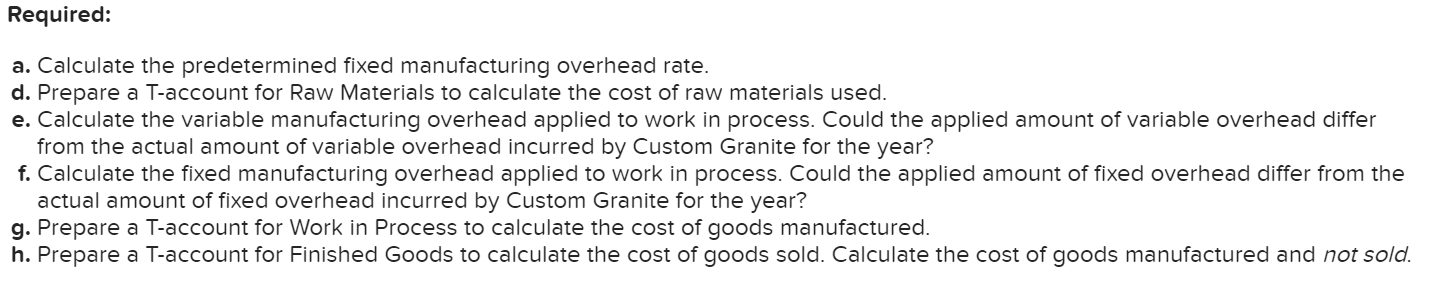

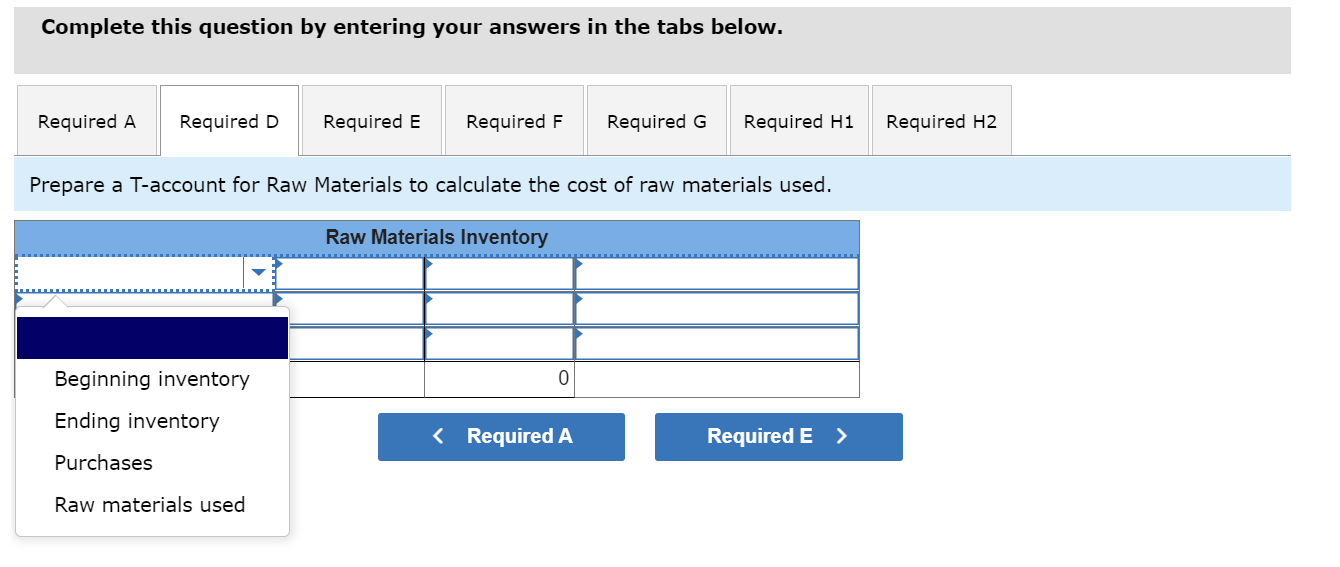

Custom Granite Inc. uses an absorption cost system for accumulating product cost. The following data are available for the past year: Raw materials purchases totaled $237,400. Direct labor costs incurred for the year totaled $805,600. Variable manufacturing overhead is applied on the basis of $5.5 per direct labor hour. Fixed manufacturing overhead is applied on the basis of machine hours used. When plans for the year were being made, it was estimated that total fixed overhead costs would be $621,780, and that 48,200 machine hours would be used during the year. The direct labor rate is $19 per hour. Actual machine hours used during the year totaled 87,900 hours. Actual general and administrative expenses for the year totaled $307,900. Inventory balances at the beginning and end of the year were as follows: Raw materials Work in process Finished goods Beginning of Year $ 40,000 25,500 107,500 End of Year $ 26, 100 50,800 124,300 Required: a. Calculate the predetermined fixed manufacturing overhead rate. d. Prepare a T-account for Raw Materials to calculate the cost of raw materials used. e. Calculate the variable manufacturing overhead applied to work in process. Could the applied amount of variable overhead differ from the actual amount of variable overhead incurred by Custom Granite for the year? f. Calculate the fixed manufacturing overhead applied to work in process. Could the applied amount of fixed overhead differ from the actual amount of fixed overhead incurred by Custom Granite for the year? g. Prepare a T-account for Work in Process to calculate the cost of goods manufactured. h. Prepare a T-account for Finished Goods to calculate the cost of goods sold. Calculate the cost of goods manufactured and not sold. Complete this question by entering your answers in the tabs below. Required A Required D Required E Required F Required G Required H1 Required H2 Prepare a T-account for Raw Materials to calculate the cost of raw materials used. Raw Materials Inventory Beginning inventory 0 Ending inventory Purchases Raw materials used Complete this question by entering your answers in the tabs below. Required A Required D Required E Required F Required G Required H1 Required H2 Prepare a T-account for Work in Process to calculate the cost of goods manufactured. Work in Process Inventory Beginning balance Cost of goods manufactured Direct labor 0 Ending balance Required F Required H1 >

You can only answer with this ones in the table:

You can only answer with this ones in the table: And with this ones in this table:

And with this ones in this table: