Answered step by step

Verified Expert Solution

Question

1 Approved Answer

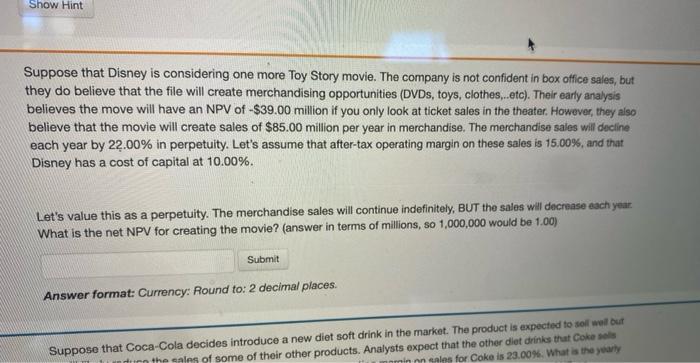

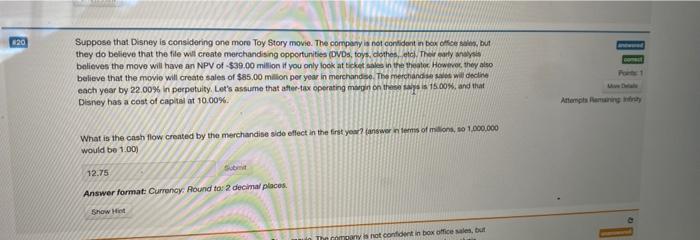

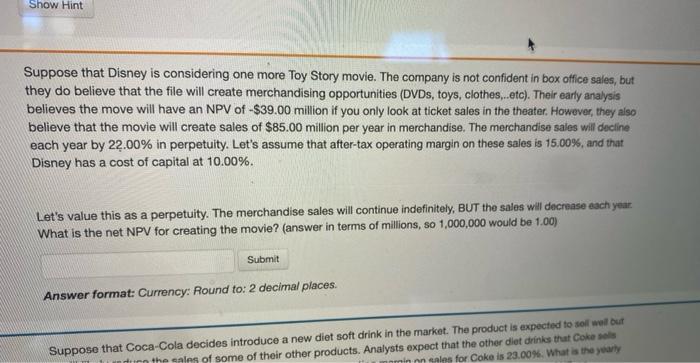

you can use answer #20 to help with the calculations of #21! will upvote! Show Hint Suppose that Disney is considering one more Toy Story

you can use answer #20 to help with the calculations of #21!

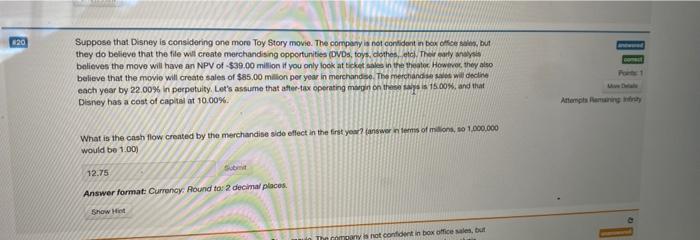

Show Hint Suppose that Disney is considering one more Toy Story movie. The company is not confident in box office sales, but they do believe that the file will create merchandising opportunities (DVDs, toys, clothes...etc). Their early analysis believes the move will have an NPV of -$39.00 million if you only look at ticket sales in the theater. However, they also believe that the movie will create sales of $85.00 million per year in merchandise. The merchandise sales will decline each year by 22.00% in perpetuity. Let's assume that after-tax operating margin on these sales is 15.00%, and that Disney has a cost of capital at 10.00%. Let's value this as a perpetuity. The merchandise sales will continue indefinitely, BUT the sales will decrease each year What is the net NPV for creating the movie? (answer in terms of millions, so 1,000,000 would be 1.00) Submit Answer format: Currency: Round to: 2 decimal places. Suppose that Coca-Cola decides introduce a new diet soft drink in the market. The product is expected to sol well but in the sales of some of their other products. Analysts expect that the other diet drinks that Coke minnn cains for Coke is 23.00%. What is the yearly 220 co Suppose that Disney is considering one more Toy Story movie. The company is not conlident in box offices, but they do believe that the file will create merchandising opportunities (DVDs, toys, clothes, etc. Thorary anys believes the move will have an NPV of $39.00 million if you only look at ticket sales in the theater. However, they also believe that the movie will create sales of $85.00 million per year in merchandise. The merchandise will decline each year by 22.00% in perpetuity. Let's assume that after-tax operating in on these si 15.00$, and that Disney has a cost of capital at 10.00% Antemps What is the cash flow created by the merchandise side effect in the first your answer in terms of milions, so 1.000.000 would be 1.00) 12.75 Answer format: Currency: Round to: 2 decimal places Show Hiet is not confidentin box offices, but will upvote!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started