Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You can use any 3 of the financial ratios available here: -Investor ratios with its all sections - Analysis of management performance with its all

You can use any 3 of the financial ratios available here:

-Investor ratios with its all sections

- Analysis of management performance with its all sections

-Liquidity and working capital ratios with their subsections

-Gearing ratios

-Activity Ratios.

-Debt Ratios.

-Profitability Ratios.

-Market Ratios.

PLEASE EXPLAIN AND JUSTIFY THE RATIOS USED AND THE ANALYSIS AND WHAT DO YOU RECOMMEND TO THE MANAGEMENT

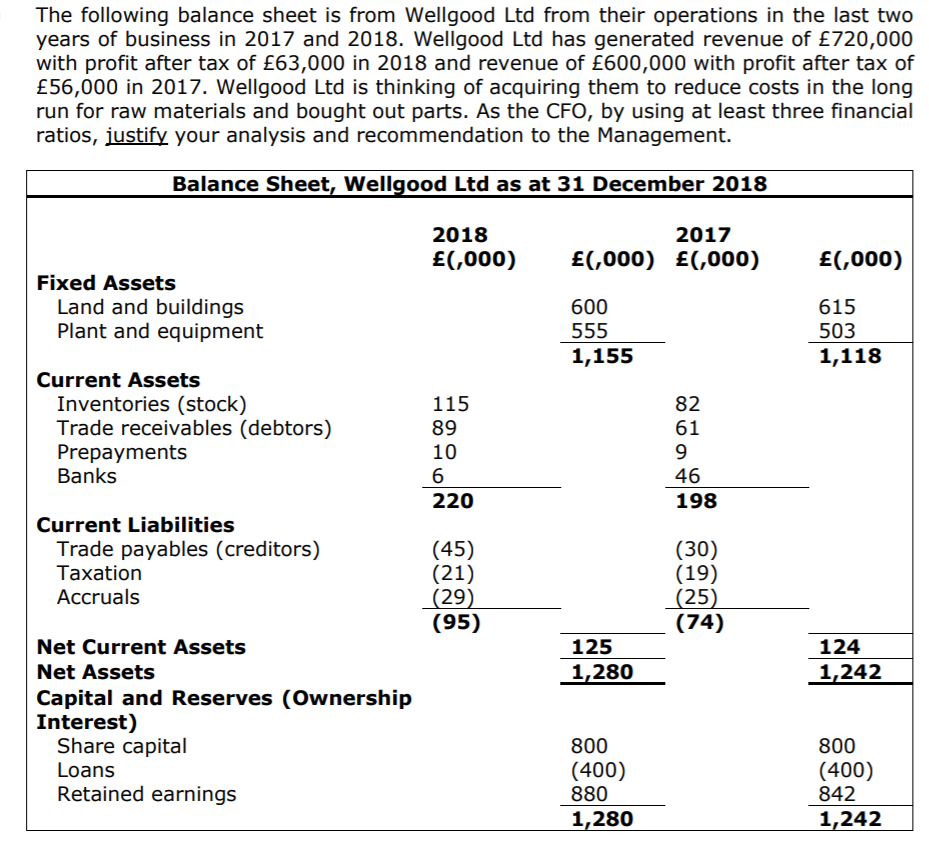

The following balance sheet is from Wellgood Ltd from their operations in the last two years of business in 2017 and 2018. Wellgood Ltd has generated revenue of 720,000 with profit after tax of 63,000 in 2018 and revenue of 600,000 with profit after tax of 56,000 in 2017. Wellgood Ltd is thinking of acquiring them to reduce costs in the long run for raw materials and bought out parts. As the CFO, by using at least three financial ratios, justify your analysis and recommendation to the Management. Balance Sheet, Wellgood Ltd as at 31 December 2018 2018 (,000) 2017 (,000) E(,000) (,000) Fixed Assets Land and buildings Plant and equipment 600 555 1,155 615 503 1,118 Current Assets Inventories (stock) Trade receivables (debtors) Prepayments Banks 115 89 10 6 220 82 61 9 46 198 Current Liabilities Trade payables (creditors) Taxation Accruals (45) (21) (29) (95) (30) (19) (25) (74) 125 1,280 124 1,242 Net Current Assets Net Assets Capital and Reserves (Ownership Interest) Share capital Loans Retained earnings 800 (400) 880 1,280 800 (400) 842 1,242

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started