Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You, CPA, are a controller with Old Timey Furniture Ltd. (OTF), a company that manufactures furniture to look like it is from the 1960s

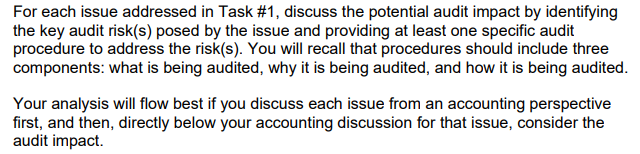

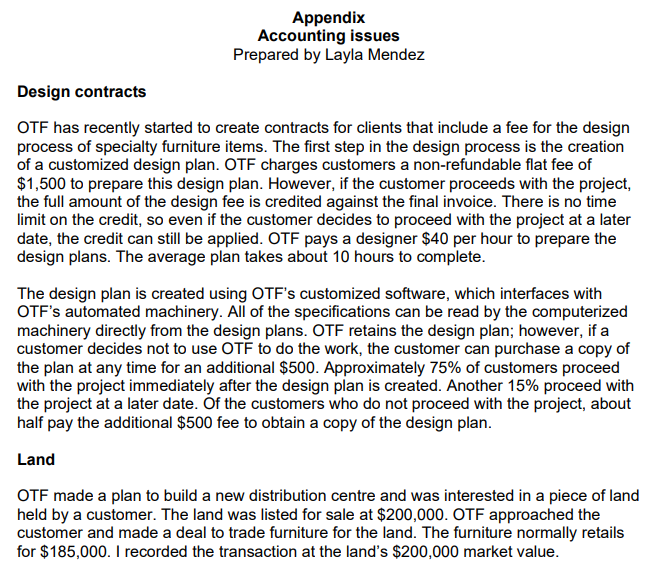

You, CPA, are a controller with Old Timey Furniture Ltd. (OTF), a company that manufactures furniture to look like it is from the 1960s and '70s. The latest trend in home decor is to have your home look old-fashioned and OTF entered the market just at the right time. You recently met with the CFO of OTF, Layla Mendez, and she is looking for your help with some accounting issues that were identified upon inspection of the December 31, 2023, financial statements. She has made a list of the issues she was unsure about (Appendix). For each accounting issue, she would like you to discuss the potential audit impact so that she is prepared for it. Task #1 For each issue, you will need to provide Layla with the following: an explanation of why it is an issue an analysis of the issue using the relevant sections from ASPE a recommendation that is consistent with your analysis and considers the impact on the relevant users You know that the OTF management group is paid a bonus based on net income and that you need to consider how these issues will impact the bonuses for the current year. For each issue addressed in Task #1, discuss the potential audit impact by identifying the key audit risk(s) posed by the issue and providing at least one specific audit procedure to address the risk(s). You will recall that procedures should include three components: what is being audited, why it is being audited, and how it is being audited. Your analysis will flow best if you discuss each issue from an accounting perspective first, and then, directly below your accounting discussion for that issue, consider the audit impact. Appendix Accounting issues Prepared by Layla Mendez Design contracts OTF has recently started to create contracts for clients that include a fee for the design process of specialty furniture items. The first step in the design process is the creation of a customized design plan. OTF charges customers a non-refundable flat fee of $1,500 to prepare this design plan. However, if the customer proceeds with the project, the full amount of the design fee is credited against the final invoice. There is no time limit on the credit, so even if the customer decides to proceed with the project at a later date, the credit can still be applied. OTF pays a designer $40 per hour to prepare the design plans. The average plan takes about 10 hours to complete. The design plan is created using OTF's customized software, which interfaces with OTF's automated machinery. All of the specifications can be read by the computerized machinery directly from the design plans. OTF retains the design plan; however, if a customer decides not to use OTF to do the work, the customer can purchase a copy of the plan at any time for an additional $500. Approximately 75% of customers proceed with the project immediately after the design plan is created. Another 15% proceed with the project at a later date. Of the customers who do not proceed with the project, about half pay the additional $500 fee to obtain a copy of the design plan. Land OTF made a plan to build a new distribution centre and was interested in a piece of land held by a customer. The land was listed for sale at $200,000. OTF approached the customer and made a deal to trade furniture for the land. The furniture normally retails for $185,000. I recorded the transaction at the land's $200,000 market value. Appendix (continued) Accounting issues Prepared by Layla Mendez Leased facility OTF leased a facility to carry out the spray-painting of furniture and moved into the new premises at the beginning of the year. The building belongs to a private developer, LAW Properties Inc. (LAW). LAW and OTF signed a lease effective January 1, 2023. The building met OTF's requirements perfectly for the spray-painting equipment. OTF would have liked to have purchased the building, but LAW did not want to sell it. I have summarized the terms of the lease agreement below. The fair value of the building at January 1, 2023, was $1,200,000, as determined by an independent appraiser. OTF normally depreciates buildings on a straight-line basis over their useful life. I included the lease payments in rent expense for the current year-end financial statements. The lease term is 15 years, with annual payments of $98,000. The first payment was made on January 1, 2023. All other payments will be payable on January 1 of each year for the lease term. LAW is responsible for building maintenance. The property has a remaining useful life of 35 years. OTF's borrowing rate is 5%. The residual value of the facility at the end of the lease term is estimated to be $500,000.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Design Contracts Accounting Analysis Issue Explanation The issue revolves around the timing and recognition of revenue for the 1500 nonrefundable design fee and the potential credit towards the final ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started