Question

You, CPA, have recently obtained a position with Green Inc. (Green), a manufacturer and distributor of environmentally friendly cleaning products. Jason and Jaclyn Brown started

You, CPA, have recently obtained a position with Green Inc. (Green), a manufacturer and distributor of environmentally friendly cleaning products. Jason and Jaclyn Brown started the company 20 years ago in response to concerns over the impact of cleaning products on the environment. Green reports under the accounting standards for private enterprises (ASPE).

As Green is growing and the financial reporting and tax requirements are becoming more complex, Jason and Jaclyn have decided that they need help and have hired you, CPA, as their financial controller.

It is February 10, 2021, and you have just left a meeting with Jason and Jaclyn, and Green's bookkeeper.

Question 1:

Jason has asked you to provide him with an estimate of taxes payable for the year ended December 31, 2020, using an effective tax rate of 13% for active business income below the business limit and 27% for active business income above the business limit. He would also like explanations supporting the adjustments made to net income per the financial statements in the determination of net income for tax purposes and taxable income. Jason provided you with the prior year's corporate income tax return. You reviewed the return and made notes (Appendix I) of relevant information for the current return.

Question 2:

Jason has also asked for your advice on whether Green should pay any estimated taxes payable now or wait until the tax return is completed, in two to three months.

Question 3:

In order to avoid interest and penalties in the future, Jason and Jaclyn have requested that you calculate Green's corporate income tax instalments for 2021 and provide them with a recommended payment schedule. Jason thinks that Green's taxable income for 2021 will be reduced by approximately 25% from 2020.

Question 4:

In addition to your work on Green's estimate of taxes payable, Jason would like your advice on how to account for the year-end inventory balance and related revenue.

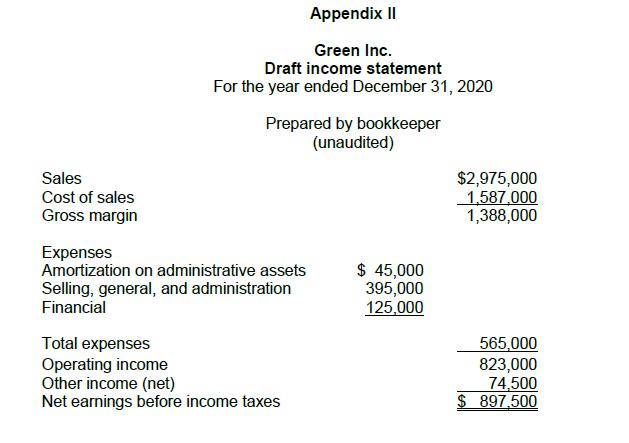

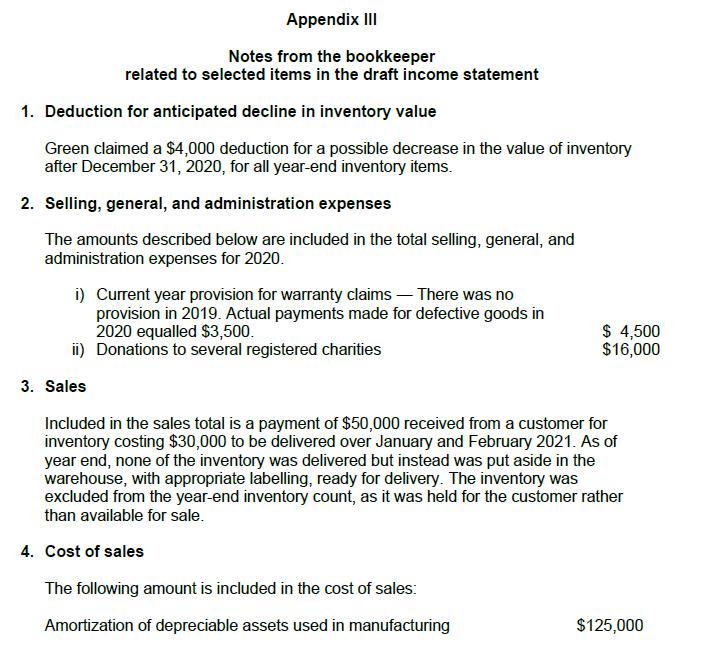

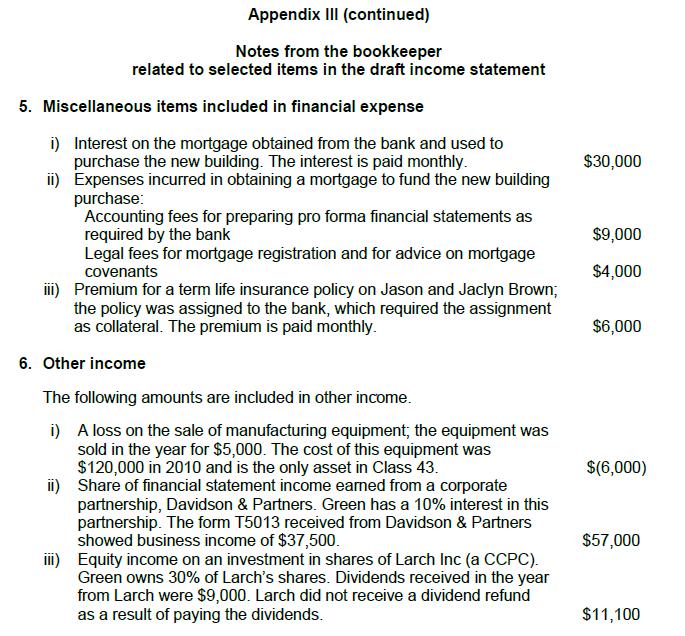

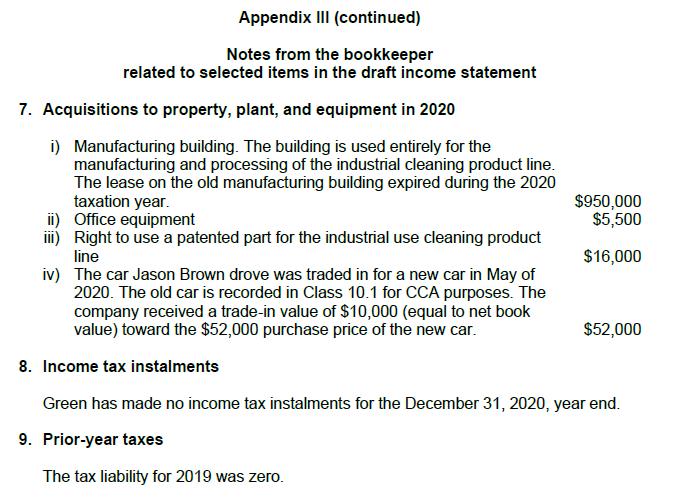

You are provided with a copy of Green's draft income statement for the year ended December 31, 2020 (Appendix II), as well as other information needed to calculate the taxes payable amount (Appendix III).

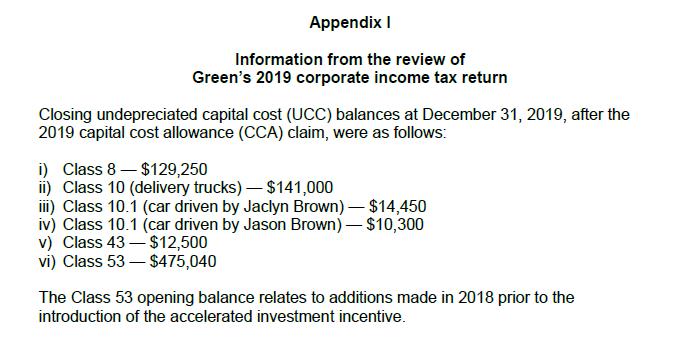

Appendix I Information from the review of Green's 2019 corporate income tax return Closing undepreciated capital cost (UCC) balances at December 31, 2019, after the 2019 capital cost allowance (CCA) claim, were as follows: i) Class 8-$129,250 Class 10 (delivery trucks) - $141,000 iii) Class 10.1 (car driven by Jaclyn Brown) - $14,450 iv) Class 10.1 (car driven by Jason Brown) - $10,300 v) Class 43 vi) Class 53 $12,500 $475,040 The Class 53 opening balance relates to additions made in 2018 prior to the introduction of the accelerated investment incentive.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Detailed Answer Question 1 Estimate of Taxes Payable Net Income per Financial Statements Net earnings before income taxes 897500 Adjustments to Determ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started