Question

You currently hold a portfolio that has SPY, MSFT, AAPL, and WFC in it. You are considering adding BA stock to it. Table below summarizes

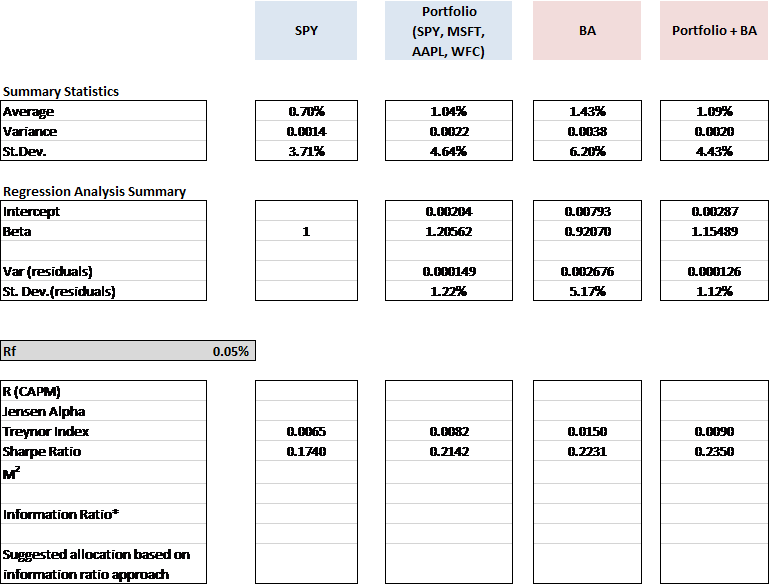

You currently hold a portfolio that has SPY, MSFT, AAPL, and WFC in it. You are considering adding BA stock to it. Table below summarizes historical data analysis for (1) SPY, (2) Portfolio of (SPY, MSFT, AAPL, and WFC), (3) BA stock, and (4) New Portfolio that is based on the old portfolio with BA stock added to it.

Use this table to answer all the questions:

1. Based on the analysis of Treynor and Sharpe Indexes for the 4 investment options, what can you conclude:

BA stock must have a lot of firm specific risk compared to other investments

BA stock must have a lot of market risk compared to other investments

BA stock must have very little firm specific risk compared to other investments

BA stock must have very little of market risk compared to other investments

2. Calculate Jehnsen Alpha for BA and (Portfolio + BA)

0.64% and 0.80%

0.26% and 0.21%

1.50% and 0.90%

0.79% and 0.30%

3. Calculate M2 for BA and (Portfolio + BA), use SPY as a proxy for the Market Portfolio.

0.223% and 0.235%

0.18% and 0.23%

0.14% and 0.11%

0.56% and 0.47%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started