You decide to follow your finance professor's advice and reduce your exposure to Hannah. Now Hannah represents 11.696% of your risky portfolio, with the rest in the Natasha fund. Recalculate the required return on Hannah stock.(Round all intermediate values to five decimal places as needed.)

The required return of Hannah stock is %.

(Round to one decimal place.)

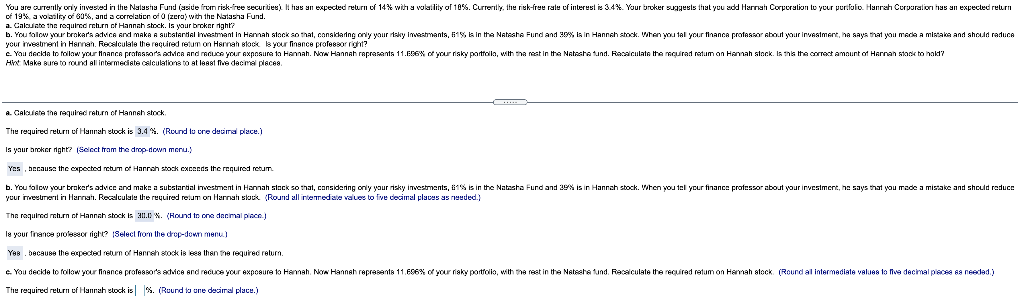

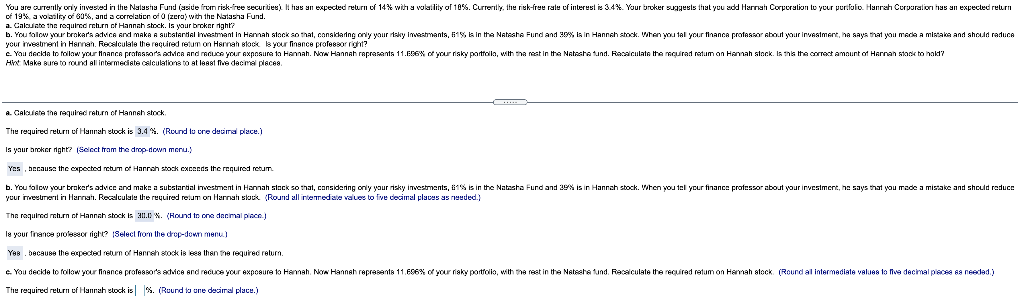

You are currently only invested in the Nest Fund (asive from risk-ree vecurities. Hi has an expected return of 14% with a volaility of 1 of 19% av bolicy of 80%, and a correlation of 0 (zero) with the Natasha Fu Currently, the risk-free rate of interesti: 3.44. Your broker suggests that you add Harrat Corporation to your puriful Hanrah Corporation has an expected return Fund. a. Calculate the requined churn of Hannah stock. Is your broker night? b. You flow your brakar'a actuca and MAKA A substantial wastant in Hannah stock so that considering only your taky Investments, %, a in the Natasha Fund and 90% lain Hannah stock. When you tal your finance professor About your investment, he says that you made a mistake and should reduce your meebrent in Harran Recalculate the required return on Hannah Block Is your finance professor right? c. You decide to follow your finance pratessor's actice and aduce your exposure to Hannah. Nora Hannah representa 11.606% of your risky partallo, with the rest in the Natesha tund. Racalculate the mourad retum an Hamah stock. Is this the correct amount of Harran stars to hald? Hint Make sure to round all intermediate calculations to at least the decimal places A. Calcule the required return of Hannah stock The required return of Hannah stock is 3.4. Round to cre decinsi place. Is your broker right? Select from the drop-down menu. Yes, because the expected return of Hannah stock cxceeds required return b. You folow your braker's strice and make a sutstarbal investment in Hannah slack so that considering only your risky investments, 67' is in the Natasha Furd and 20% is in Hannah stock. when you tell your finance professor about your investment, he says that you made a mistake and should reduce your mener in Harna. Recalculate the required retur on Harrali stock {Round all intenredate values to five decimal places suded. The required churn of Hannah stock is 0%. (Hound to one decimal place) la your france profesor right? Select from the drop-down menu.) Ye. because the expected return of Herreh stock is Be then the required return. c. You decide to follow your finance professor's advice and recure your exposure to Hannah. Now Hannah representa 11.696% of your risky portfolio, with the rest in the Nateshe und Resiculate the required retum on Hernah alock (Round al intermediate values to five decimal places needed) The required return of Hannah clock is S. (Ruurd to une decimal place.) You are currently only invested in the Nest Fund (asive from risk-ree vecurities. Hi has an expected return of 14% with a volaility of 1 of 19% av bolicy of 80%, and a correlation of 0 (zero) with the Natasha Fu Currently, the risk-free rate of interesti: 3.44. Your broker suggests that you add Harrat Corporation to your puriful Hanrah Corporation has an expected return Fund. a. Calculate the requined churn of Hannah stock. Is your broker night? b. You flow your brakar'a actuca and MAKA A substantial wastant in Hannah stock so that considering only your taky Investments, %, a in the Natasha Fund and 90% lain Hannah stock. When you tal your finance professor About your investment, he says that you made a mistake and should reduce your meebrent in Harran Recalculate the required return on Hannah Block Is your finance professor right? c. You decide to follow your finance pratessor's actice and aduce your exposure to Hannah. Nora Hannah representa 11.606% of your risky partallo, with the rest in the Natesha tund. Racalculate the mourad retum an Hamah stock. Is this the correct amount of Harran stars to hald? Hint Make sure to round all intermediate calculations to at least the decimal places A. Calcule the required return of Hannah stock The required return of Hannah stock is 3.4. Round to cre decinsi place. Is your broker right? Select from the drop-down menu. Yes, because the expected return of Hannah stock cxceeds required return b. You folow your braker's strice and make a sutstarbal investment in Hannah slack so that considering only your risky investments, 67' is in the Natasha Furd and 20% is in Hannah stock. when you tell your finance professor about your investment, he says that you made a mistake and should reduce your mener in Harna. Recalculate the required retur on Harrali stock {Round all intenredate values to five decimal places suded. The required churn of Hannah stock is 0%. (Hound to one decimal place) la your france profesor right? Select from the drop-down menu.) Ye. because the expected return of Herreh stock is Be then the required return. c. You decide to follow your finance professor's advice and recure your exposure to Hannah. Now Hannah representa 11.696% of your risky portfolio, with the rest in the Nateshe und Resiculate the required retum on Hernah alock (Round al intermediate values to five decimal places needed) The required return of Hannah clock is S. (Ruurd to une decimal place.)