Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You decide to invest in 329 day Certificate of Deposit issued by JP Morgan. Your broker quotes you a rate of 6.07% on $6,000,000.00.

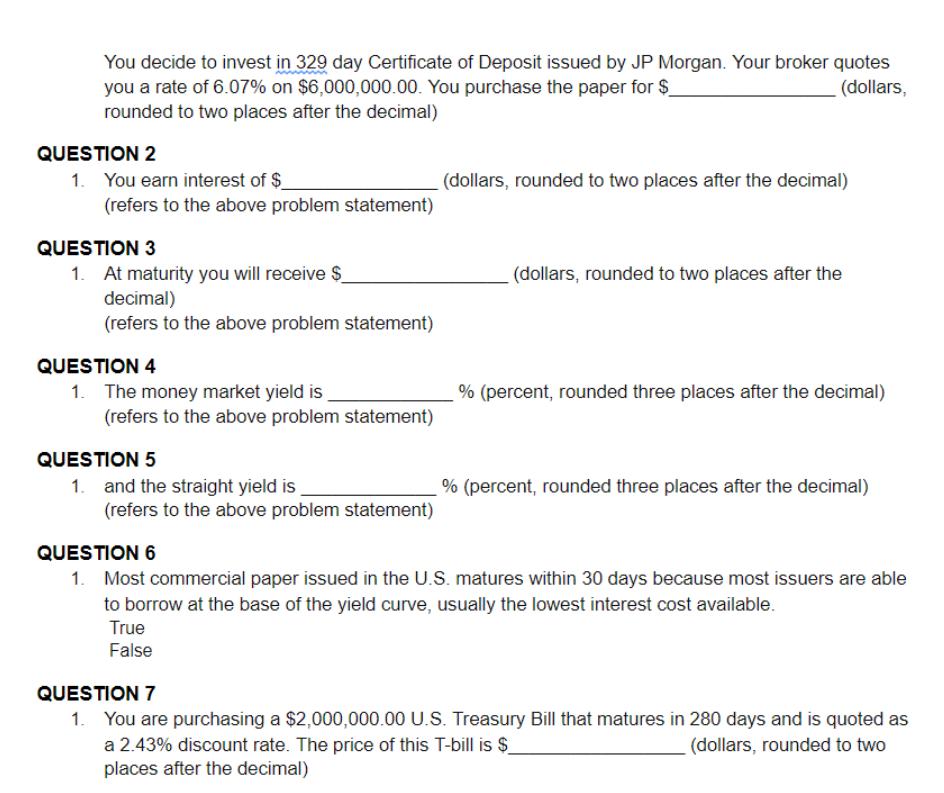

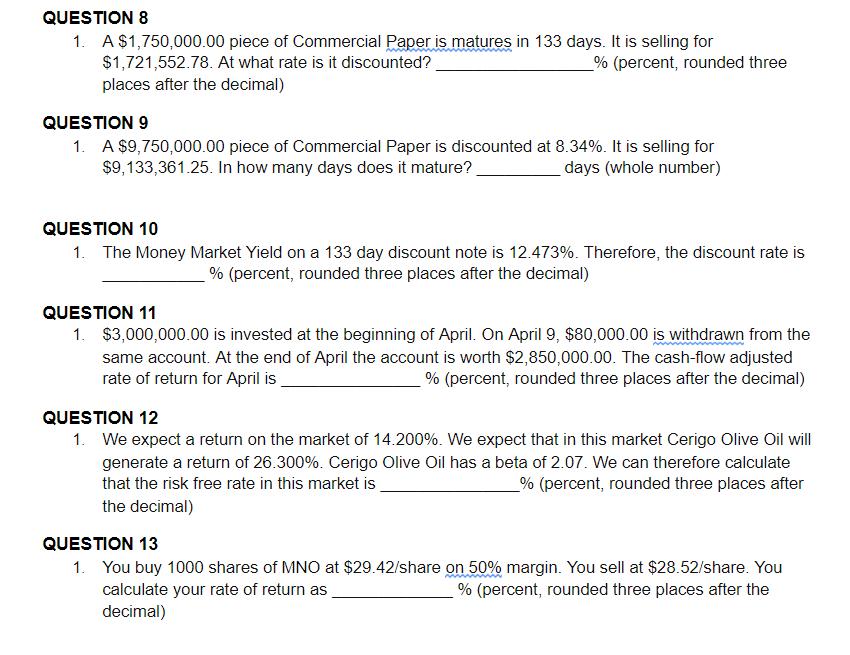

You decide to invest in 329 day Certificate of Deposit issued by JP Morgan. Your broker quotes you a rate of 6.07% on $6,000,000.00. You purchase the paper for $ (dollars, rounded to two places after the decimal) QUESTION 2 1. You earn interest of $ (refers to the above problem statement) QUESTION 3 1. At maturity you will receive $ decimal) (refers to the above problem statement) QUESTION 4 1. The money market yield is (refers to the above problem statement) QUESTION 5 1. and the straight yield is (refers to the above problem statement) (dollars, rounded to two places after the decimal) (dollars, rounded to two places after the % (percent, rounded three places after the decimal) % (percent, rounded three places after the decimal) QUESTION 6 1. Most commercial paper issued in the U.S. matures within 30 days because most issuers are able to borrow at the base of the yield curve, usually the lowest interest cost available. True False QUESTION 7 1. You are purchasing a $2,000,000.00 U.S. Treasury Bill that matures in 280 days and is quoted as a 2.43% discount rate. The price of this T-bill is $ (dollars, rounded to two places after the decimal) QUESTION 8 1. A $1,750,000.00 piece of Commercial Paper is matures in 133 days. It is selling for $1,721,552.78. At what rate is it discounted? % (percent, rounded three places after the decimal) QUESTION 9 1. A $9,750,000.00 piece of Commercial Paper is discounted at 8.34%. It is selling for $9,133,361.25. In how many days does it mature? days (whole number) QUESTION 10 1. The Money Market Yield on a 133 day discount note is 12.473%. Therefore, the discount rate is % (percent, rounded three places after the decimal) QUESTION 11 1. $3,000,000.00 is invested at the beginning of April. On April 9, $80,000.00 is withdrawn from the same account. At the end of April the account is worth $2,850,000.00. The cash-flow adjusted rate of return for April is % (percent, rounded three places after the decimal) QUESTION 12 1. We expect a return on the market of 14.200%. We expect that in this market Cerigo Olive Oil will generate a return of 26.300%. Cerigo Olive Oil has a beta of 2.07. We can therefore calculate that the risk free rate in this market is % (percent, rounded three places after the decimal) QUESTION 13 1. You buy 1000 shares of MNO at $29.42/share on 50% margin. You sell at $28.52/share. You calculate your rate of return as % (percent, rounded three places after the decimal)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started