Question

You decide to use annual volatility of 27.27%. You want an at the money option. Since exchange-traded options are standardized, the closest one you could

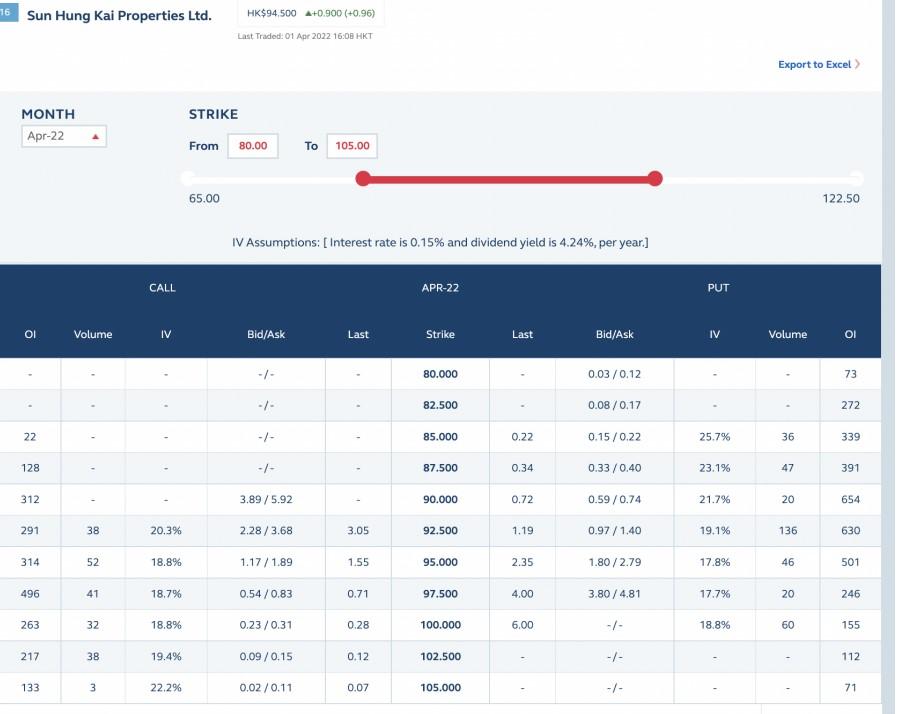

You decide to use annual volatility of 27.27%. You want an at the money option. Since exchange-traded options are standardized, the closest one you could find has a strike price of 95. You try to price 95-strike European call option that expires at the end of April. The last trading day would be on 28 Apr. Let h = 27/365. The stock will not pay dividends over this period. The continuously compounded risk-free rate is 0.66% p.a.. You construct a 1-step binomial tree.

What is the option price

What is the price of the call option of Sun Hung Kai Properties Ltd based on Black-Scholes formula? Recall S=94.5, = 0.2727, h=27/365, K = 95, r = 0.66% p.a. continuously compounded, = 0.

Compare the option price youve obtained and the option price traded on April 1 in SHK.pdf. What is the last traded price?

16 Sun Hung Kai Properties Ltd. HK$94,500 A+0.900 (+0.96) Last Traded: 01 Apr 2022 16:08 HKT Export to Excel STRIKE MONTH Apr-22 From 80.00 To 105.00 65.00 122.50 IV Assumptions: [ Interest rate is 0.15% and dividend yield is 4.24%, per year.) CALL APR-22 PUT OI Volume IV Bid/Ask Last Strike Last Bid/Ask IV Volume OI -- 80.000 0.03/0.12 73 . 82.500 0.08/0.17 272 22 -- 85.000 0.22 0.15 / 0.22 25.7% 36 339 128 87.500 0.34 0.33/0.40 23.1% 47 391 312 3.89/5.92 90.000 0.72 0.59 / 0.74 21.7% 20 654 291 38 20.3% 2.28/3.68 3.05 92.500 1.19 0.97/1.40 19.1% 136 630 314 52 18.8% 1.17 /1.89 1.55 95.000 2.35 1.80/2.79 17.8% 46 501 496 41 18.7% 0.54 / 0.83 0.71 97.500 4.00 3.80/4.81 17.7% 20 246 263 32 18.8% 0.23 / 0.31 0.28 100.000 6.00 -- 18.8% 60 155 217 38 19.4% 0.09/0.15 0.12 102.500 -- 112 133 3 3 22.2% 0.02/0.11 0.07 105.000 -- 71 ! 16 Sun Hung Kai Properties Ltd. HK$94,500 A+0.900 (+0.96) Last Traded: 01 Apr 2022 16:08 HKT Export to Excel STRIKE MONTH Apr-22 From 80.00 To 105.00 65.00 122.50 IV Assumptions: [ Interest rate is 0.15% and dividend yield is 4.24%, per year.) CALL APR-22 PUT OI Volume IV Bid/Ask Last Strike Last Bid/Ask IV Volume OI -- 80.000 0.03/0.12 73 . 82.500 0.08/0.17 272 22 -- 85.000 0.22 0.15 / 0.22 25.7% 36 339 128 87.500 0.34 0.33/0.40 23.1% 47 391 312 3.89/5.92 90.000 0.72 0.59 / 0.74 21.7% 20 654 291 38 20.3% 2.28/3.68 3.05 92.500 1.19 0.97/1.40 19.1% 136 630 314 52 18.8% 1.17 /1.89 1.55 95.000 2.35 1.80/2.79 17.8% 46 501 496 41 18.7% 0.54 / 0.83 0.71 97.500 4.00 3.80/4.81 17.7% 20 246 263 32 18.8% 0.23 / 0.31 0.28 100.000 6.00 -- 18.8% 60 155 217 38 19.4% 0.09/0.15 0.12 102.500 -- 112 133 3 3 22.2% 0.02/0.11 0.07 105.000 -- 71Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started